According to lawyers, coffee garden assignment contracts are similar to labor contracts and businesses are obligated to pay social insurance for employees.

Coffee company's collection of insurance premiums from workers in products causes outrage - Photo: TAN LUC

In the contract at Ia Sao 1 Coffee Company, it is shown that the company pays social insurance for employees and then collects it in coffee products.

The company pays insurance and collects it with products.

Regarding the social insurance collection scandal between employees and some member companies of Vietnam Coffee Corporation in Gia Lai, reporters have accessed the content of the contract between the parties.

According to the contract between Ia Sao 1 Coffee Company and workers, the sharing of benefits and benefits when receiving contracts is regulated quite specifically.

The company and the contracted workers jointly invest and divide the products according to the investment ratio in the contract plan approved by Vietnam Coffee Corporation.

The contract stipulates that the company shall pay social insurance for employees (23.5%) and provide labor protection, hazardous waste compensation and periodic health check-ups according to regulations and collect by product.

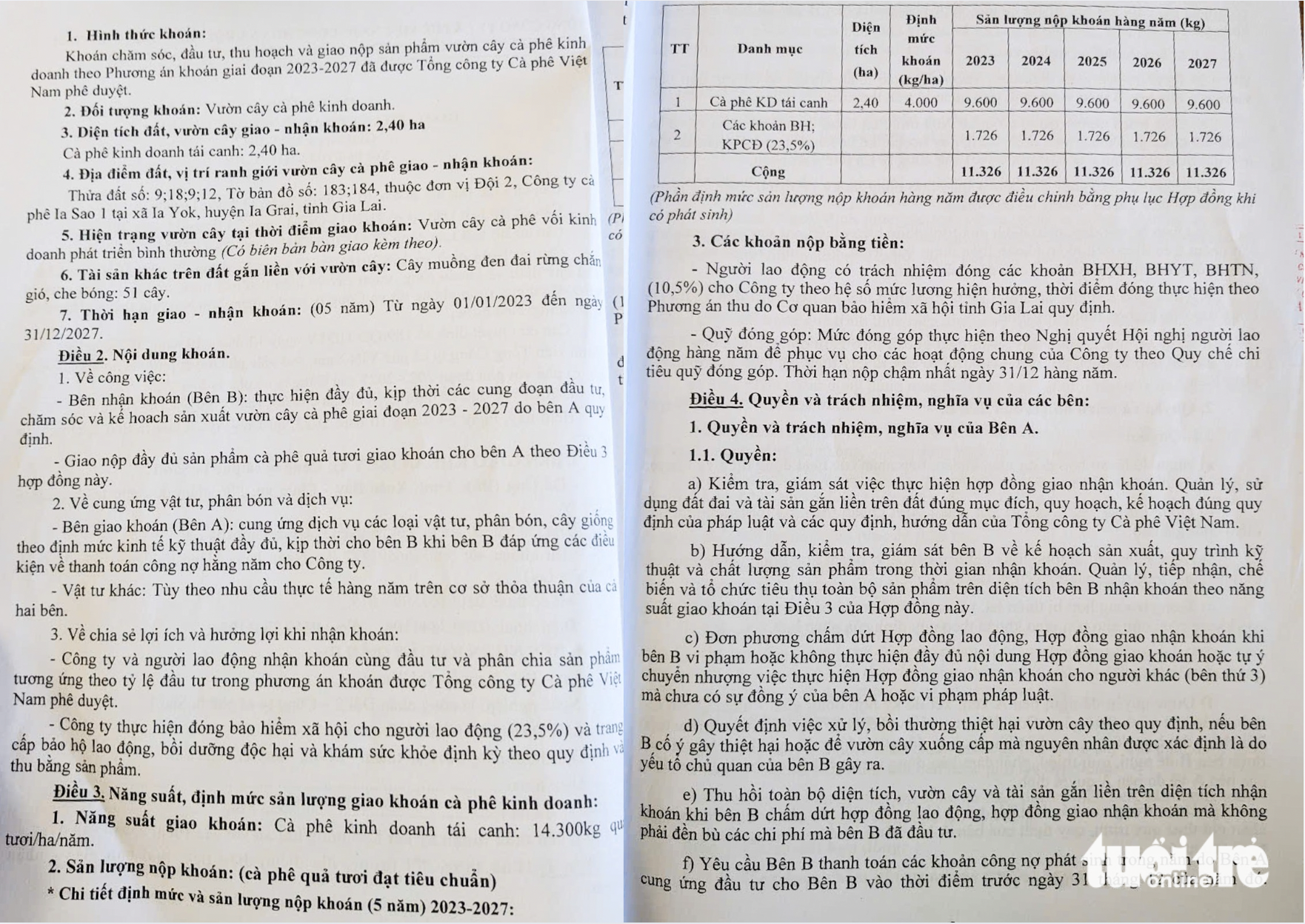

The quota and the contracted output are shown in two items that workers must pay: coffee for replanting (contracted quota of 4,000 kg/ha) and insurance and union fees (23.5%) equivalent to 1,726 kg/worker.

In addition, employees must pay cash contributions of 10.5% of their salary for insurance and fund contributions as prescribed by the company.

With this contract, the employee understands that they are paying 23.5% of the social insurance premium in products and 10.5% in cash (total 32%).

Talking to reporters, the officer in charge of developing the company's contract plan initially said that after paying insurance for employees, the difference from the remaining product revenue would be included in the company's revenue.

But then Mr. Trinh Xuan Bay - the company's director - said that this difference was included in the company's expenses. The company said that the workers were misunderstanding that the company collected coffee to pay for insurance for the workers.

The contract between the workers and Ia Sao 1 Coffee Company shows that the company pays 23.5% of the insurance premium and collects it in products - Photo: TAN LUC

Lawyer: Submitting output to pay insurance is not in accordance with regulations

According to lawyer Thao Nguyen (Ho Chi Minh City Bar Association), a contract is a civil agreement between the contracting party and the contracting party. Contracts that determine the nature of the work performed by the worker and payment by the coffee output according to the harvest are currently considered to have the same nature as labor contracts.

Therefore, the law requires social insurance payment. The obligation to pay social insurance of employees and employers in this case is stipulated by law as follows:

Based on the employee's salary, the compulsory social insurance contribution rate is 32%. Of which, the employee contributes 10.5%, the employer contributes 21.5% and 2% is union funds.

According to the reflection of the workers and based on the content of the contract, the contracted output (ie paid in coffee) of the workers includes: coffee for replanting business and insurance and union fees (23.5%).

Therefore, the employer's request that employees pay back a portion of their output equivalent to 23.5% to pay insurance, union fees, and collect additional money depending on the salary level for social insurance is not in accordance with the law.

Because the obligation to pay 21.5% to social insurance funds and 2% to union funds is the company's obligation. Meanwhile, employees only have to pay 10.5% of their salary to the social insurance fund.

The company can collect 10.5% of the employee's salary to pay into social insurance funds on behalf of the employee. As for the 23.5% of insurance and union fees, the company is not allowed to collect from the employee and must pay from its own funds.

"The contribution rate has been clearly stipulated by law, so businesses and employees need to fulfill their obligations in accordance with the law," said lawyer Thao Nguyen.

Recommend businesses to dialogue with workers

On February 21, the leader of the Gia Lai Provincial Labor Federation informed that after receiving press reports, the agency sent officials to the enterprise to grasp the situation.

At the same time, it is recommended that businesses and unions soon organize dialogue conferences with workers to discuss issues, explain information and listen to workers' thoughts and aspirations to find solutions and ensure workers' rights.

Representatives of Gia Lai Provincial Labor Federation will send officials to attend this conference.

Source: https://tuoitre.vn/vu-dong-bao-hiem-xa-hoi-bang-ca-phe-luat-su-phan-tich-20250221164230365.htm

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)