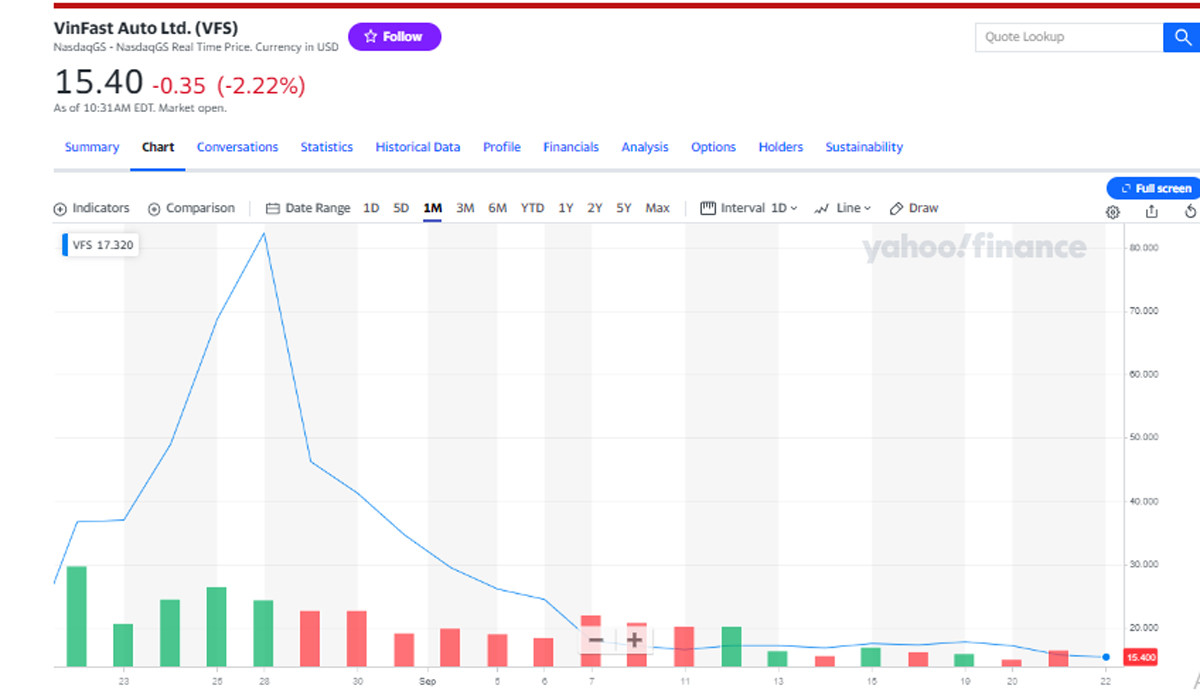

Opening the official trading session on September 22 on the US Nasdaq stock exchange (September 22 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong decreased for the third consecutive session.

Specifically, as of 9:30 p.m. on September 22 (Vietnam time), VFS shares decreased by 2.9% compared to the previous session to 15.3 USD/share.

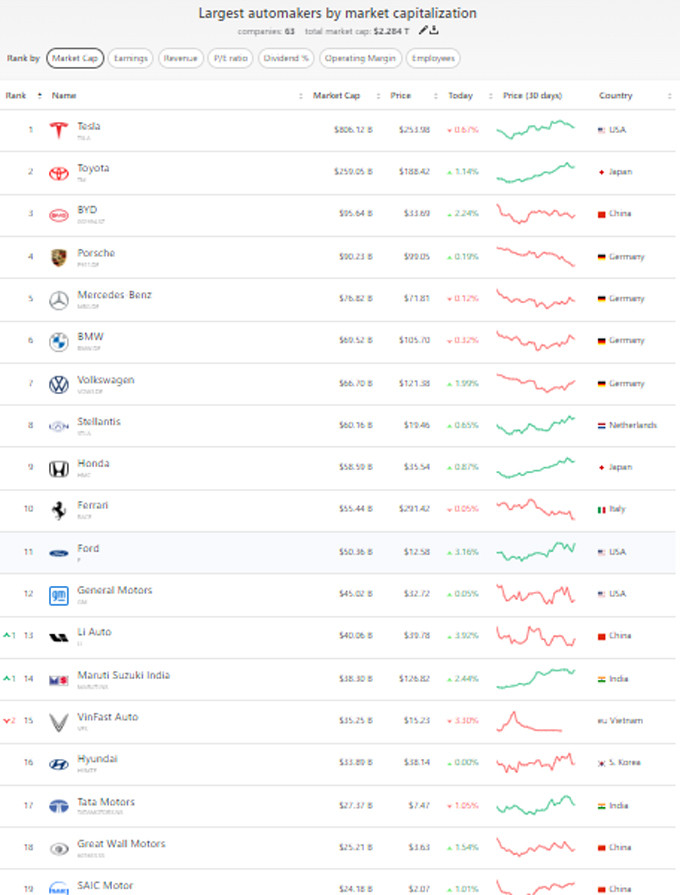

With the current price of 15.3 USD/share, the capitalization of VinFast Auto (VFS) of billionaire Pham Nhat Vuong stands at 35.2 billion USD.

In the past 11 sessions, VinFast shares have fluctuated between 15-18 USD/share. Liquidity remains low.

In the session on September 21, VinFast recorded only 3.28 million units transferred.

With the stock price falling sharply for 3 sessions, VinFast's capitalization has plummeted. The scale of billionaire Pham Nhat Vuong's electric car company ranks 15th in the world , behind China's Li Auto and Maruti Suzuki India.

Billionaire Elon Musk's Tesla, the world's largest electric car company, also fell sharply. After losing more than $30 billion at the same time last session, Tesla fell another $10 billion to $806 billion.

China's largest electric car maker BYD also fell and is now worth $95.6 billion.

On September 21, VinFast announced its business results for the first 6 months of 2023 to the US Securities and Exchange Commission, stating that its total assets reached 4.9 billion USD.

Investors are now waiting to see how many electric cars VinFast will sell in the American and European markets in 2023.

Source

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)