Controlling shareholder 'dumps' nearly 3.5 million shares of VNG Corporation (VNZ)

VNG Corporation's stock code VNZ once attracted the attention of investors when it increased rapidly many times, reaching a peak price of 1.35 million VND/share and becoming the most expensive stock code in the history of Vietnam.

Currently, the VNZ code has 'stabilized' again. In the trading session on July 22, 2023, the VNZ code was priced at VND 736,600/share, with trading volume only around a few thousand shares per session. However, the largest shareholder of VNG Corporation recently registered to sell a large amount of VNZ shares to reduce ownership ratio.

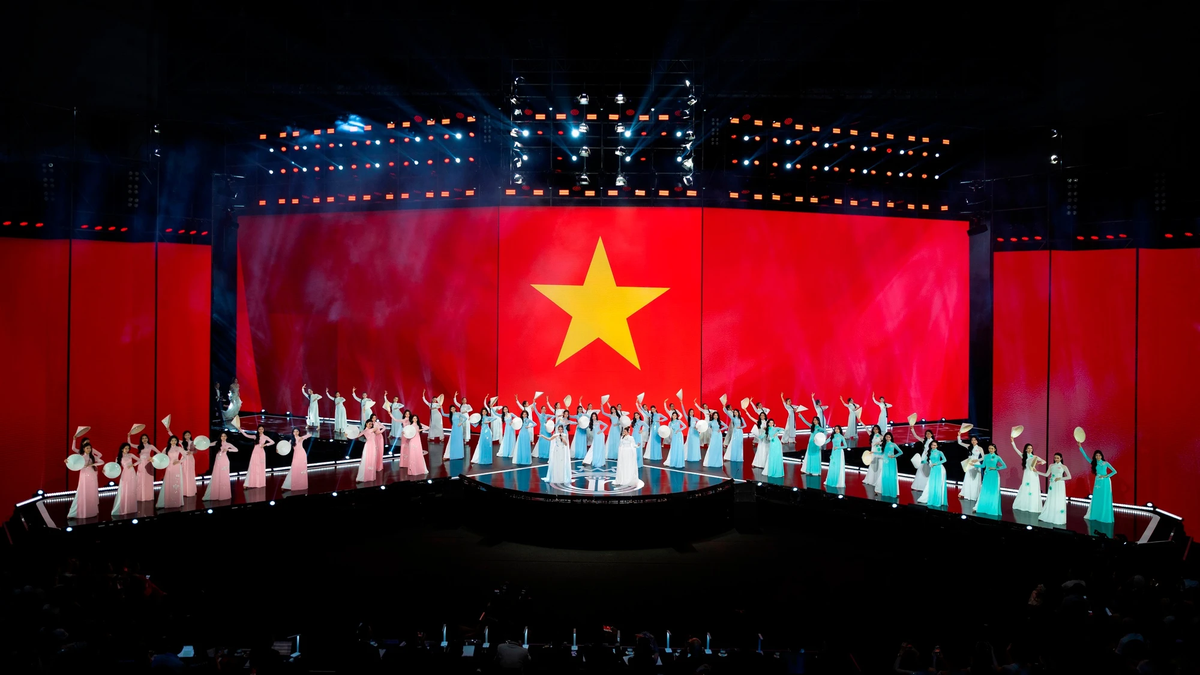

VNG's controlling shareholder (VNZ) is about to 'dump' nearly 3.5 million shares onto the market (Photo TL)

Specifically, VNG Limited, a legal entity that owns up to 61.12% of shares in VNG Corporation, has registered to sell 3,483,048 VNZ shares. The transaction is expected to take place from July 25, 2023 to August 15, 2023.

If the transaction is successful, VNG Limited is expected to reduce its ownership ratio from 61.12% to 49%. With an ownership ratio below 51%, VNG will no longer be a subsidiary of VNG Limited, and the relationship will be converted into an affiliated company.

After reaching its peak at VND 1.35 million/share on February 15, 2023, VNZ stock price has continuously decreased sharply, by the trading session on July 22, 2023, it was only trading around VND 736,600/share. With a trading volume of only a few thousand shares per session, the large amount of VNZ shares that VNG Limited is about to 'dump' into the market will be able to impact this code to decrease in price more strongly than before.

Losing trillions in 2022, VNG is having to plan to reduce losses

In the adjusted document of the 2023 Annual General Meeting of Shareholders, VNG's Board of Directors had to change the business target for 2023 with the revenue target being only VND 9,281 billion. The revenue target increased by 19% compared to the implementation in 2022.

However, the company's 2023 profit plan is only to reduce the parent company's loss from VND1,077 billion to only VND378 billion. In addition, the company's board of directors also plans not to pay dividends in 2022 to keep cash resources for investment in other business activities including developing e-wallets, payment gateways, video game copyrights, AI development, etc.

Finally, the Board of Directors also presented to shareholders a change in the handling plan for 7.1 million treasury shares. In particular, the Board of Directors presented to shareholders to stop the plan to sell 7.1 million treasury shares to BigV Technology JSC.

Regarding VNG's business situation, in 2022, the company achieved revenue of VND 7,801 billion, a slight increase compared to 2021. However, this was also the year that VNG had to record a huge consolidated loss of up to VND 1,534 billion. This loss was 21.3 times higher than the previous year.

Entering 2023, although VNG expects revenue growth, the company only dares to set a target of reducing losses at the parent company to VND 378 billion and consolidated losses to VND 572 billion.

In fact, in the first quarter, VNG recorded revenue of 1,852 billion VND, with a loss after tax of 90 billion VND. Basically, it can be seen that VNG's first quarter business results were "less than expected".

In terms of asset structure, by the end of the first quarter of 2023, VNZ's total assets decreased from VND 9,092.1 billion to VND 8,975.7 billion. Of which, equity decreased from VND 5,333.7 billion to VND 5,022 billion, and liabilities increased from VND 3,758.4 billion to VND 3,953.7 billion.

Source

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)