The VN-Index continues to rise above the support level around 1,260 points.

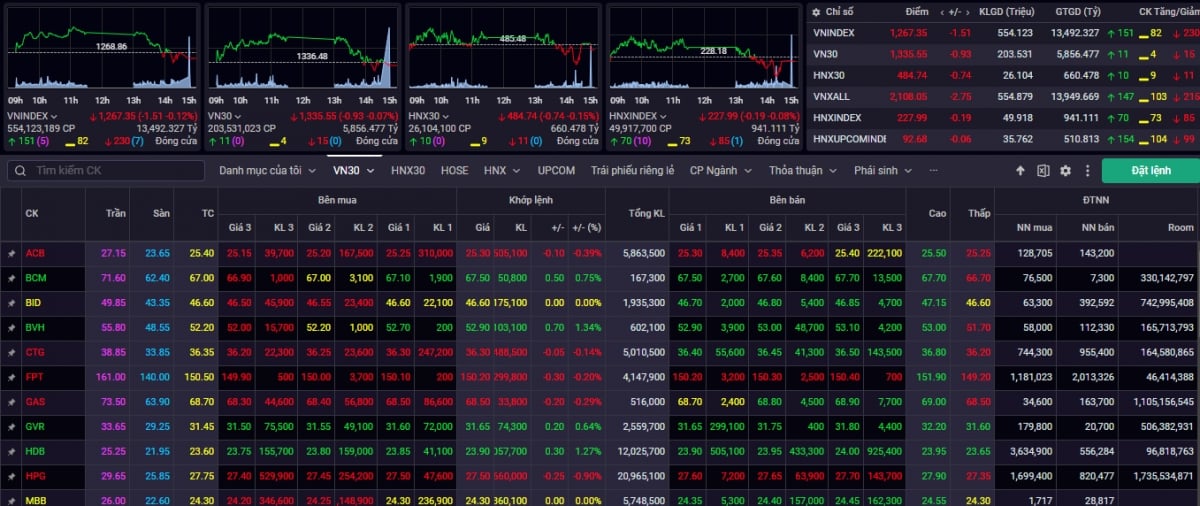

The VN-Index experienced its fifth consecutive session of narrow-range fluctuations between 1,260 and 1,280 points. Selling pressure continued as the index rose towards the resistance level around 1,280 points. At the close of trading on December 12th, the VN-Index fell by -1.51 points (-0.12%) to 1,267.35 points, facing pressure to retest the 200-day moving average around 1,260 points. Trading volume on the HOSE decreased slightly by -2.76% compared to the previous session, approximately 80% of the average. This indicates that the corrective consolidation pressure remains relatively normal across many stocks.

Market breadth leaned towards negative with 182 stocks declining, 117 stocks rising, and 62 stocks remaining unchanged. The market is under pressure from portfolio restructuring and short-term selling after the VN-Index recovered from the 1,200-point level. Foreign investors sold heavily on the HOSE with a net selling value of -295.8 billion VND on December 13th.

According to experts at Saigon - Hanoi Securities Company (SHS), in the short term, the VN-Index continues to grow above the support level around 1,260 points (corresponding to the 200-day moving average), currently facing resistance in the 1,280-1,300 point range. This is a very strong resistance zone, the peak levels of March-July 2024 and September-October 2024 from the beginning of the year to date. To overcome this very strong resistance zone, the market needs strong momentum and support from fundamental factors and outstanding growth prospects. In the medium term, the VN-Index has maintained a wide accumulation channel since the beginning of the year in the 1,200-1,300 point range, with an equilibrium price around 1,250 points.

“In the short term, market quality continues to improve, with many stocks at relatively attractive price levels, opening up many good opportunities. However, the VN-Index is under pressure to correct and consolidate around the support level of 1,260 points, before awaiting new growth drivers such as expectations of Q4/2024 business results and the outlook for 2025. Investors should maintain a reasonable portfolio allocation. Consider selectively investing in fundamentally sound stocks that are expected to continue growing. The investment target should be leading stocks with strong fundamentals,” an expert from SHS stated.

The VN-Index remains in an upward trend.

According to the analysis team at Agribank Securities Company (Agriseco), on the technical chart, increased selling pressure at the end of the day caused the index to reverse and decline slightly. However, the short-term uptrend is still being maintained as the nearest support level around 1,260 points has not been breached. The RSI indicator also shows a similar trend, maintaining an upward peak-trough pattern, indicating that the VN-Index is still in an uptrend. Agriseco Research believes that a sideways consolidation phase is necessary after a period of rapid market growth.

"Bottom-buying demand may gradually increase and regain dominance when the index retreats to near the 1,260-point level in the coming sessions. Investors should continue to hold their portfolios, prioritizing new purchases of banking and real estate stocks when the index retreats to the aforementioned support zone," an expert from Agriseco commented.

Sharing the same view, experts from Yuanta Securities Vietnam (YSVN) believe that the market may soon return to its upward trend in today's session (December 13th), and that the market is still in a correction phase after the previous rally. At the same time, this correction phase is likely to end quickly as the market is still experiencing strong positive fluctuations, especially with reduced liquidity indicating that selling pressure is not yet a significant concern. Furthermore, the sentiment indicator continues to rise slightly, showing that investors remain optimistic about the current market developments.

"The short-term trend of the overall market remains upward. Therefore, investors can continue to take advantage of corrections to increase their stock holdings," a YSVN expert recommended.

► Some stocks to watch on December 13th

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1312-vn-index-van-trong-xu-huong-tang-post1141707.vov

Comment (0)