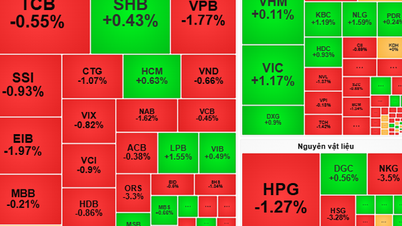

Cash flow focused on large-cap stocks such as HPG, VNM, and MWG, helping the index representing the Ho Chi Minh City Stock Exchange accumulate more than 9 points, thereby extending the second session's increase and regaining the 1,260 point mark.

The cautious sentiment of domestic investors has been somewhat relieved after the strong increase last weekend. Today (August 19), VN-Index at one point increased by more than 11 points compared to the reference after the opening hour, reaching 1,263 points. The green color was maintained in the following minutes although the increase amplitude gradually narrowed.

Strong demand helped the index widen its increase range after the lunch break and finally closed the trading session on August 19 at 1,261.62 points, up 9.39 points compared to the reference. This is the highest price range in the past 1 month.

The Ho Chi Minh City Stock Exchange recorded 267 stocks closing in green, outnumbering the 152 stocks that fell. Among the stocks that increased, 6 hit the ceiling and most of them closed with no sellers. The VN30 basket had 18 stocks increasing and 4 stocks falling below the reference.

VNM accumulated 2.98% compared to the reference, up to 76,000 VND, becoming the main driving force for the market and leading the increase in the VN30 basket. SAB of this group also increased 2.66% to 57,800 VND, thereby appearing in the list of codes that have the most impact on the VN-Index.

The growth momentum also came from pillar stocks of many other industry groups such as banking , steel, oil and gas... Specifically, in the banking stock group, VCB increased by 0.79% to VND88,800, TCB increased by 2.1% to VND21,900, BID increased by 0.84% to VND47,900, LPB increased by 2.11% to VND31,500 and EIB increased by 2.96% to VND19,100.

Steel stocks also recorded a significant improvement when most closed in the green. Specifically, NKG increased by 2.4% to VND21,150, TLH increased by 1.7% to VND5,920, HSG increased by 1.5% to VND20,650 and HPG increased by 1% to VND25,850.

On the other hand, red dominated the aviation group when many codes closed below the reference. Of which, HVN decreased by 1.4% to 21,100 VND and became the main factor holding back the market's increase in today's session.

The securities group also recorded a lack of excitement when there were 3 representatives in the list of codes that had the most negative impact on the VN-Index. Specifically, SSI lost 0.92% to 32,400 VND, VCI lost 1.07% to 46,250 VND and DSE lost 2.14% to 25,100 VND.

The trading volume for the entire session on August 19 reached more than 698 million shares, down 267 million units compared to the session at the end of last week. The trading value accordingly decreased by VND6,233 billion, down to VND16,781 billion.

HPG ranked first in terms of order matching value with over VND635 billion (equivalent to 24.4 million shares). The next positions in the liquidity rankings were VNM with approximately VND597 billion (equivalent to 7.9 million shares), PNJ with over VND515 billion (equivalent to 4.9 million shares) and MWG with nearly VND443 billion (equivalent to 6.4 million shares).

The market was trading enthusiastically, but foreign investors continued to net sell for the second consecutive session. Specifically, this group sold more than 46.3 million shares, equivalent to a trading value of more than VND1,487 billion, while only disbursing nearly VND1,176 billion to buy more than 33 million shares. The net selling value accordingly reached VND311 billion, more than four times higher than the previous session.

Foreign investors sold VHM shares heavily with a net value of about VND78 billion. Next were HPG with more than VND72 billion, TCB with more than VND50 billion and HSG with more than VND42 billion. Meanwhile, foreign investors' cash flow focused on disbursing into VNM shares with a net value of more than VND137 billion. CTG and GAS ranked next in terms of attracting foreign cash flow when the net purchase value of these stocks was approximately VND37 billion.

Source: https://baodautu.vn/vn-index-tang-hon-9-diem-phien-dau-tuan-vuot-moc-1260-diem-d222779.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)