(NLDO) – The last two trading days of VN-Index in 2024 are expected to reach the 1,300 point mark with a positive trend.

The stock market had a positive trading week when the last session of the week on December 27 closed above the 1,275 point mark, along with improved liquidity. Although there was no strong breakthrough or widespread spread, the positive increase of VN-Index came from the active trading of banking stocks, bringing optimism to many investors.

At the end of the week, VN-Index increased by 17.64 points (1.4%), closing at 1,275.14 points; HNX Index increased by 2.06 points, closing at 229.13 points.

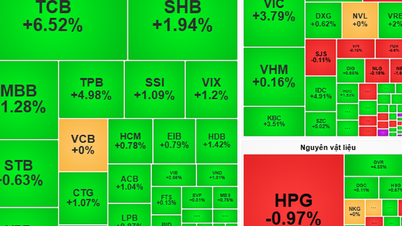

The industry that contributed the most to the increase was banking, with a series of stocks increasing sharply from CTG, LPB, STB, TCB, MBB... Meanwhile, the industry that caused the market to decline was food and beverage, with some stocks falling sharply such as VNM, SAB...

Stock groups affecting VN-Index last week

The total value of matched transactions of VN-Index reached 62,234.87 billion VND, up 18.02% compared to last week. The next bright spot was the net buying momentum of foreign investors, although not much, with a value of more than 274 billion VND focused on SSI, STB, CTG.

Commenting on the trend next week, Mr. Vo Kim Phung, Head of Analysis Department of BETA Securities Company, said that VN-Index is maintaining a positive trend. Next week, the market will have 2 final trading days of the year before entering the holiday season and moving to the new year 2025. It is likely that the last 2 trading days of the year will see strong fluctuations, leaning towards the positive direction, with the probability of re-testing the resistance zone of 1,290 - 1,300 points.

Stocks next week are expected to continue to rise towards the 1,300 point mark to close 2024.

"During this period, investors should observe carefully; avoid chasing stocks that show signs of overheating and have an unstable foundation. Maintain a reasonable cash ratio to take advantage of fluctuations to accumulate stocks of businesses that are expected to have positive business results in the fourth quarter of 2024, with positive prospects in 2025" - Mr. Vo Kim Phung suggested.

Positive trends in the coming days are also given by experts from Pinetree Securities Company.

Accordingly, VN-Index unexpectedly rose with the participation of large cash flows when banking flows surged at the end of the week. The effect of closing transaction account values at the end of the year helped the market expect to increase points, especially cash flows into large-cap stocks. It is likely that the positive trend will be maintained, VN-Index will retest the 1,300 point zone.

"However, the 1,300-point zone is a strong resistance zone as the market has failed 7 times in 2024, so investors should take advantage of the uptrend to close the profit and preserve profits," said an expert from Pinetree Securities.

Vietnam Construction Securities Company (CSI) believes that VN-Index may continue its upward trend towards the resistance level of 1,316 - 1,327 points in the coming weeks, but it cannot avoid strong fluctuations. The support level around 1,267 points is the level where investors can increase their proportion and open new stock buying positions.

Source: https://nld.com.vn/chung-khoan-tuan-toi-tu-30-12-den-3-1-vn-index-se-len-1300-diem-dip-cuoi-nam-196241228195636967.htm

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)