Trading on the market is still volatile due to strong differentiation in many stock sectors. Red dominates but pharmaceutical and insurance stocks are still a notable bright spot.

VN-Index lost the 1,250 point mark, insurance and pharmaceutical groups attracted cash flow

Trading on the market is still volatile due to strong differentiation in many stock sectors. Red dominates but pharmaceutical and insurance stocks are still a notable bright spot.

|

| Bao Viet (BVH) shares increased in price and were a bright spot in the session. |

Closing yesterday's session (December 2) at 1,251.21 points, up 0.06%, with trading volume down 9% compared to the previous session and only 65% of the average, the VN-Index edged slightly above the reference level in a short period of time at the beginning of the session on December 3. After that, the index quickly fell below the reference level and maintained this state until the end of the morning session. Red dominated many stock groups in the morning session. However, the decrease of the main index VN-Index was not too large when it still received support from a few leading stocks.

In the afternoon session, trading was somewhat balanced, causing the VN-Index to fluctuate around the reference level. However, due to relatively strong selling pressure in some pillar stocks as well as many small and medium-cap groups, the VN-Index closed in red. Meanwhile, the HNX-Index also closed below the reference level, although it spent most of the session in green.

At the end of the trading session, VN-Index decreased by 1.38 points (-0.11%) to 1,249.83 points. HNX-Index decreased by 0.03 points (-0.01%) to 225.29 points. UPCoM-Index remained unchanged at 92.44 points.

The three exchanges today recorded 336 stocks increasing while 383 stocks decreased and 858 stocks remained unchanged or not traded. The whole market still recorded 23 stocks increasing to the ceiling while only 9 stocks decreased to the floor.

|

| VCB shares pull VN-Index down deeply. |

The technology group was the focus of the market when prices increased simultaneously. In particular, unlike some previous sessions, CMG was the stock leading the cash flow into the technology industry. This stock jumped strongly from the beginning of the session and at times increased by more than 6%. However, the cash flow then shifted to some other technology stocks, causing CMG to cool down and close up 3.55%. Meanwhile, FPT, after a period of sluggishness at the beginning of the session, bounced back and closed at 145,000 VND/share, up 1.97%. In addition, ELC also increased by 1.3%.

Insurance and pharmaceutical stocks had a very positive trading session. Of which, IMP was pulled up to the ceiling price. BVH increased by more than 6.3%, DHT increased by more than 8.8%, MIG increased by 3.8%, BMI increased by 3.1%, DVN increased by 2.3%.

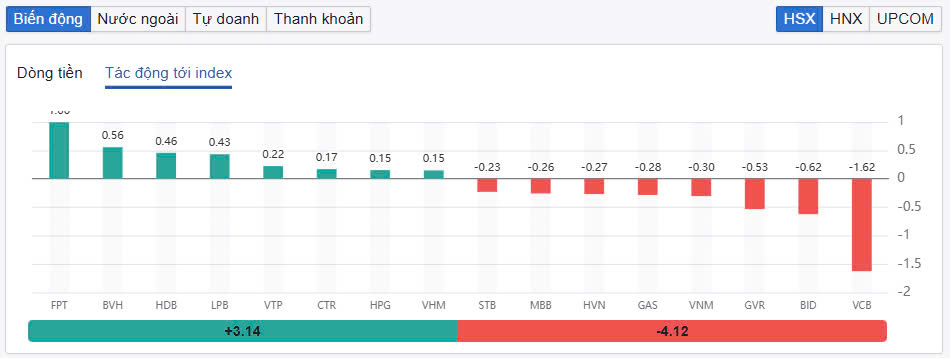

FPT and BVH were the two leading stocks in terms of points contributed to the VN-Index today with 1 point and 0.56 points respectively. In addition, stocks such as HDB, LPB, VTP, CTR... all maintained their positivity and contributed to supporting the general market. HDB increased by 2.56%, LPB increased by 2.11%, VTP increased by 5.6%.

On the other hand, VCB was the main cause of great pressure on the general market. Immediately after opening, VCB decreased in price and put great pressure on VN-Index. VCB alone took 1.62 points from this index. In addition, BID, GVR, VNM, GAS… were all in red and also had a negative impact on VN-Index.

A group of stocks that also attracted attention in today's session was ports and shipping. VTO was the code leading this line when it hit the ceiling early to 14,200 VND/share and maintained this level until the end of the session. Codes such as PHP, VIP, VOS... all increased well.

|

| Foreign investors continue to return to net selling. |

The total trading volume on the HoSE floor reached more than 673 million shares, equivalent to a trading value of VND15,639 billion, up 31% compared to the previous session. Negotiated transactions accounted for nearly VND4,200 billion. The codes with large negotiated transactions on the HoSE floor were EIB (VND930 billion), VHM (VND623 billion) and SSB (VND410 billion). The trading value on the HNX and UPCoM was VND909 billion and VND358 billion, respectively.

FPT topped the list in terms of transaction value with VND734 billion. HPG and CTR traded VND424 billion and VND331 billion respectively.

Foreign investors continued to net sell VND226 billion on HoSE, in which, this capital flow net sold the most VCB code with VND121 billion. MWG and FPT were net sold VND58 billion and VND56 billion respectively. In the opposite direction, MSN was net bought the most with VND80 billion. TCB was behind but the value was only VND28 billion.

Source: https://baodautu.vn/vn-index-mat-moc-1250-diem-nhom-bao-hiem-va-duoc-hut-dong-tien-d231599.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)