VN-Index dropped sharply by nearly 14 points at the end of the week with increasing profit-taking pressure. Foreign investors maintained their 17th consecutive session of net selling.

VN-Index continued to "plummet" at the end of the week (June 28), losing nearly 14 points, down to 1,245 points.

Thus, VN-Index lost 33 points in the last trading week of June, which is also the last week of the second quarter. Previously, in the first session of this week (June 24), the market fell sharply by 28 points. After that, the market tried to improve its points in the following sessions but only returned to the 1,250 point mark. Today, the index turned sharply down by nearly 14 points, slipping below the 1,250 point mark.

The market remained in the green in the early morning session, but before lunchtime, the index began to reverse, turning red and falling sharply in the late afternoon session.

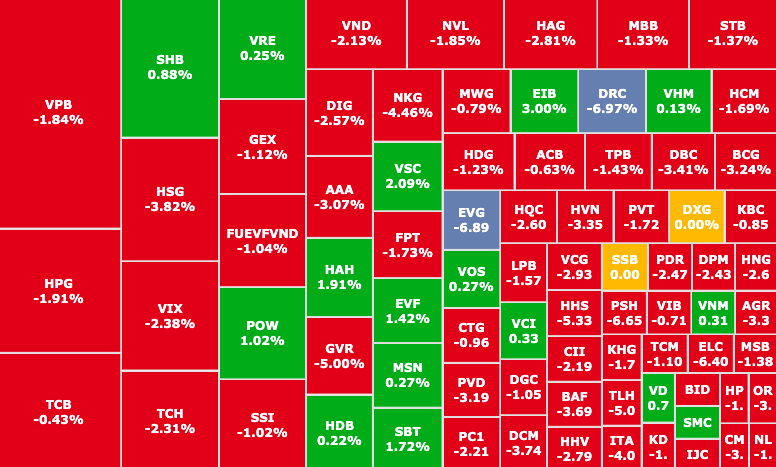

In the whole market, liquidity reached 23,489 billion VND, of which, on HOSE floor reached 20,857 billion VND, an increase of 5,700 billion VND compared to yesterday, mainly due to strong selling trend with 355 codes decreasing, 79 codes increasing.

Nearly 72% of stocks were in the "red", in which the most heavily affected were chemical, oil and gas, and technology stocks.

"Red" spreads across the market at the end of the week

Leading the market's downward trend was technology stockFPT (FPT, HOSE), which fell 1.73% under selling pressure from investors, especially foreign investors, with more than 3,100 successful transactions. This put FPT in the top 5 stocks with the most negative impact on the general index of the stock market.

Next is HPG ( Hoa Phat Steel, HOSE) also decreased sharply by 1.91%.

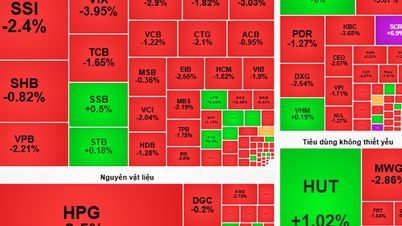

Meanwhile, a series of banking stocks: VPB (VPBank, HOSE), LPB (LPBank, HOSE), MBB (MBBank, HOSE), ACB (ACB, HOSE), SSI (SSI Securities, HOSE)... Contrary to the general trend of the industry, EIB (Eximbank, HOSE) increased sharply by 3% andSHB (SHB, HOSE) increased slightly by 0.88%, contributing positively to the market.

Notably, VND shares (VNDirect, HOSE) continued to fall sharply by 2.13% in market price on the day of the 2024 Annual General Meeting of Shareholders.

Blue-chip stocks "fuel" the market's decline (Photo: SSI iBoard)

Foreign investors continued to maintain a net selling status for the 17th consecutive session. In today's session alone, the net selling value was about 1,170 billion VND.

Faced with this fluctuation, Mr. Tran Quoc Toan, Business Director of Mirae Asset Securities Headquarters , commented that the market is being mainly affected by high profit-taking pressure, in the context that investors are waiting for Q2 business results and quarterly reports. The market will soon be rebalanced, but the gloomy state and cash flow may weaken in the short term within 1-2 weeks.

Securities companies recommend that investors need to prepare mentally and plan in advance for the case that the stock market loses the support level at the 1,235 - 1,250 point zone, by acting quickly and reducing the proportion to a safe level to limit damage.

Source: https://phunuvietnam.vn/vn-index-tiep-tuc-lao-doc-mat-33-diem-trong-tuan-giao-dich-cuoi-quy-2-20240628175534733.htm

![[Photo] General Secretary To Lam attends the 1st Congress of the Central Party Committee of the Fatherland Front and Central Mass Organizations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/2aa63d072cab4105a113d4fc0c68a839)

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Central Steering Committee on housing policy and real estate market](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/22/c0f42b88c6284975b4bcfcf5b17656e7)

Comment (0)