This situation is believed to come from the profit-taking trend of investors after a long period of growth of VN-Index.

At the end of the last trading session of the week (April 5), VN-Index closed at 1,255.11 points, continuing to lose more than 13 points, equivalent to 1.04%. This is also the third consecutive session of decline of VN-Index.

The downward trend appeared from the session of April 3, by the end of the week today, April 5, VN-Index lost a total of nearly 32 points. In which, the session of April 3 and session of April 5 saw the market "evaporate" the most points, 15.57 points and 13.14 points respectively.

Liquidity is still maintained at around VND21,000 billion. This shows that money is still flowing into stocks but in a profit-taking trend from investors after a long period of positive growth of VN-Index.

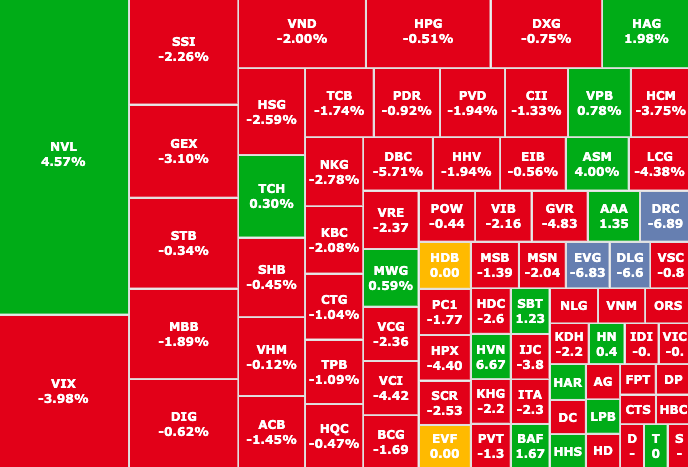

Market breadth was tilted towards the selling side with 381 stocks losing points, of which 157 stocks lost more than 1% in value, the market was in red.

"Red" spreads across the market

Many key industry groups in previous sessions suddenly reversed and plummeted: banking, securities, real estate, retail: TCB (Techcombank, HOSE) decreased by 1.74%, contributing 1.06 points to the decrease;ACB (ACB, HOSE) decreased by 1.45%, contributing 0.81 points to the decrease, MSN (Masan, HOSE) decreased by 2.04%, contributing 0.62 points to the decrease,...

Other industries have increased against the trend in the recent short time: chemicals, rubber, etc.

Group of stocks affecting VN-Index session 4/5

Source: SSI iBoard

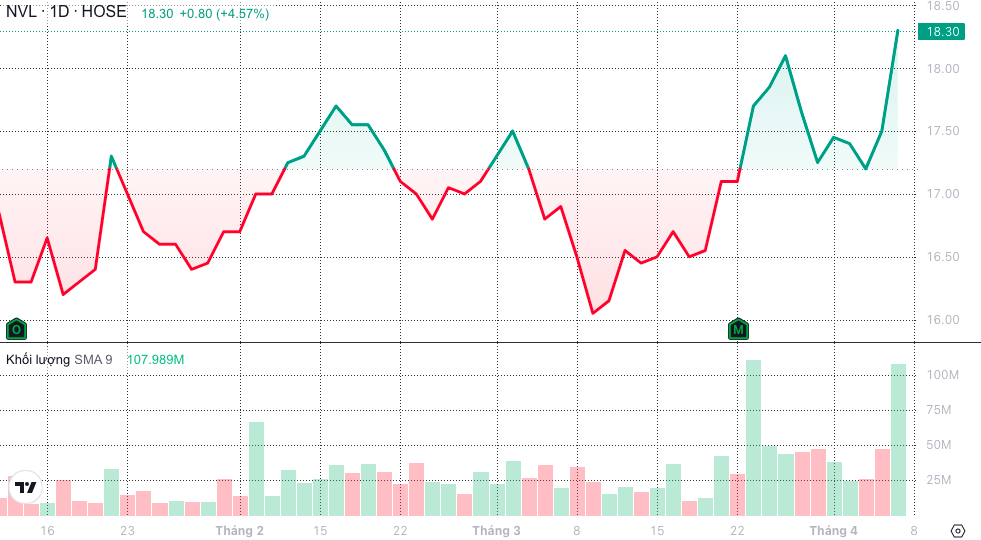

Today's "bright spot" comes from the stock of the real estate "giant", NVL ( Novaland , HOSE) which unexpectedly increased by nearly 5%, reaching a market price of 18,300 VND/share, acting as a pillar, holding back the downward momentum. This is the highest level in the past 6 months.

In particular, NVL's trading volume today reached nearly 108 million shares, equivalent to VND1,955 billion. This figure helped NVL become the stock with the highest trading value on the floor on April 5, and also the third highest liquidity in NVL's listing history.

NVL increased sharply in today's session amid a series of positive news (Source: SSI iBoard)

This status appeared right after the news that Novaland successfully converted 2,346 billion VND of bonds into shares in part of the Aqua City project.

In addition, recently, in the list of securities ineligible for margin in the second quarter of 2024 announced by HOSE on April 3, NVL no longer appeared on this list, because the enterprise announced its consolidated (audited) financial report for 2023 with positive profits.

Regarding the business plan, according to the documents of the 2024 Annual General Meeting of Shareholders, Novaland said that it is expected that revenue will reach VND 32,587 billion, an increase of 585%, and profit after tax will be VND 1,079 billion, an increase of 122% compared to last year.

For foreign investors , net buying has tended to increase, balancing with net selling. In particular, NVL shares (Novaland, HOSE) achieved the highest net buying value - 224 billion VND, followed by MWG (Mobile World , HOSE) with a net buying of 121 billion VND,...

On the other hand, VHM (Vinhomes, HOSE) suffered the strongest net selling pressure with 226 billion VND.

Experts believe that in the near future, VN-Index is entering a "shaking" phase when doubts about the growth momentum increase, because VN-Index has experienced a long period of increase, cash flow will need to be allocated to other industry groups.

FIDT analysis group forecasts that in the medium term, cash flow still has many prospects to flow into the market, risky cash flow will have plans to take refuge, so market developments in April will be volatile and unpredictable.

But in the long term, the market situation is still positive as the economy has recovered more clearly, the market upgrade story and investor confidence continue to be the driving force for the market.

Securities companies recommend that investors should take advantage of the adjustment period to restructure their portfolios appropriately, prioritizing stocks with good fundamentals and profit prospects.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the first meeting of the Central Steering Committee on housing policy and real estate market](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/22/c0f42b88c6284975b4bcfcf5b17656e7)

Comment (0)