The VN-Index officially fell below the 1,260-point threshold due to strong selling pressure concentrated on pillar stocks in today's session (October 24). Investors are advised to avoid panic and seize the opportunity to collect potential stocks.

Selling stocks heavily this afternoon, Ms. Linh Nga (47 years old, Thanh Xuan district, Hanoi) said: "The market has been under pressure for many weeks. After the negative developments in the morning session, I decided to reduce the proportion of STB code in the afternoon session to preserve assets as well as look for other potential stocks at reasonable prices while the whole market is going down."

Negative sentiment increased sharply in the afternoon session, causing the VN-Index to plummet to below 1,260 points.

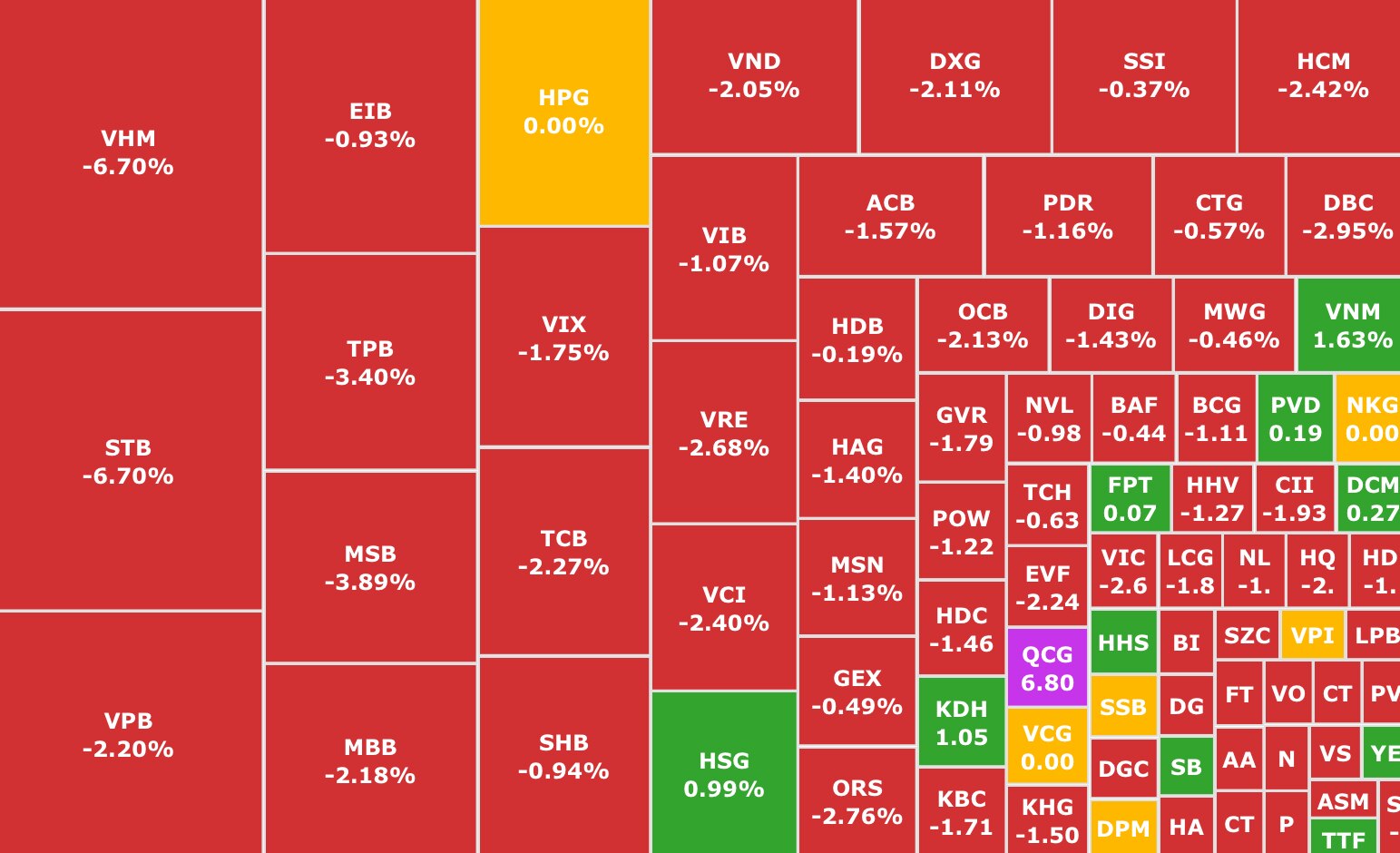

Ms. Nga's move is also the general trend of investors in today's session, VN-Index is under strong selling pressure, concentrated in pillar stocks, VN30 group.

The negative developments that appeared in the morning session had a significant impact on investor sentiment, continued and increased into the afternoon session. The index closed at 1,257.4 points, down 13.5 points (equivalent to 1.06%), marking the sharpest decline in the past two and a half months (since the session on August 5).

Liquidity was boosted at the end of the session but was still quite modest, reaching only VND16,000 billion (equivalent to 673 million trading units), leaning heavily towards the selling side. Red dominated the market with 434 stocks down and 264 stocks up. This was the 15th consecutive session that the stock market recorded low cash flow.

VN30 group decreased sharply by 20.1 points, 22/30 codes decreased, 7 codes increased and 1 code remained unchanged.

Notably, the Vin group of stocks was unexpectedly pushed to the lowest market price of the session, VHM (Vinhomes, HOSE) approached the floor price when it decreased by 6.7%, to 43,850 VND/share (the floor price is 43,750 VND/share), VIC (Vingroup, HOSE) and VRE (Vincom Retail, HOSE) both decreased by 2.7%.

It is worth mentioning that the development of Vingroup shares comes at a time when Vinhomes is carrying out a deal to buy millions of treasury shares.

According to the latest update from the Ho Chi Minh City Stock Exchange (HOSE), Vinhomes has purchased a total of more than 19.1 million treasury shares, accounting for 5.17% of the total registered number. According to the plan, Vinhomes will buy back a maximum of 370 million treasury shares (accounting for 8.5% of the total outstanding shares) by order matching and/or negotiation from October 23 to November 21, 2024.

Therefore, the current market developments show that the move to buy treasury stocks is unlikely to withstand profit-taking pressure from investors on VHM when this stock is at its peak price in over a year.

Other real estate codes are also under strong selling pressure such as DXG (Dat Xanh, HOSE), PDR (Phat Dat, HOSE), DIG (DIC Group, HOSE), KBC (Kinh Bac, HOSE).

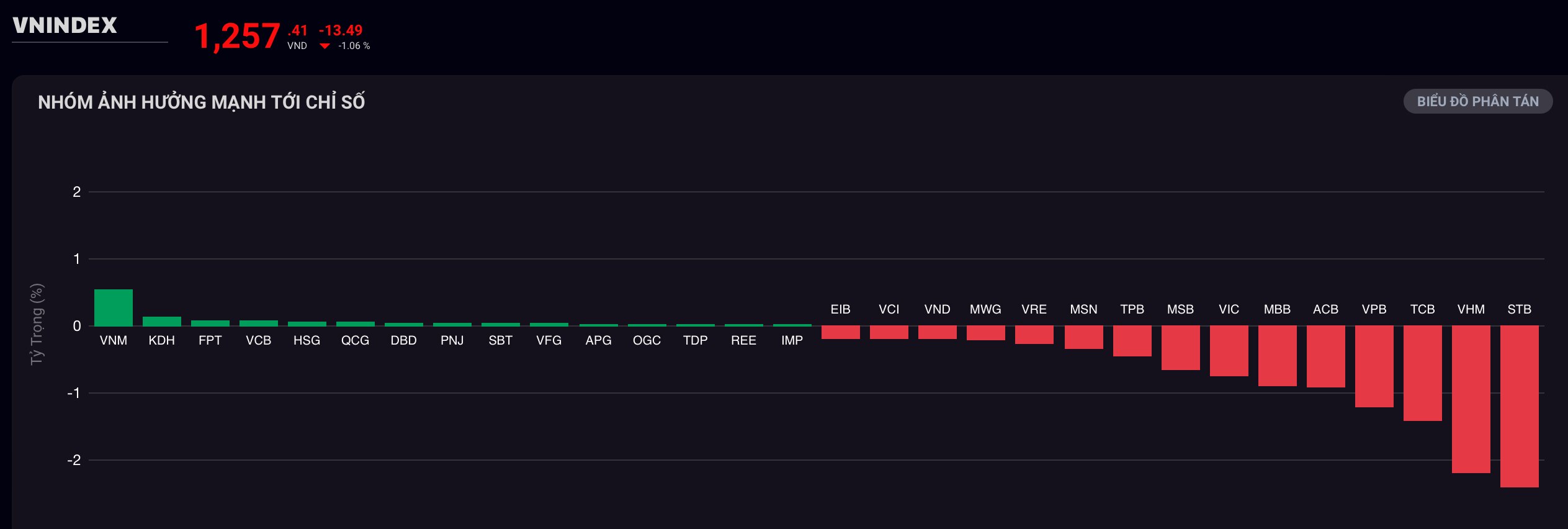

Group of stocks strongly affecting the index

Banking and securities stocks, Vin stocks create major resistance to the market's growth (Source: SSI iBoard)

Besides, the selling focus today also belongs to a banking stock - STB (Sacombank, HOSE), which was unexpectedly sold heavily at the end of the session.

After remaining flat in the morning session, by 2:00 p.m., selling pressure appeared at STB, the stock fell sharply by 6.7%, reaching the threshold of the floor price - VND 33,400/share. Liquidity was only behind VHM with more than VND 1,108 billion.

Also in the banking group, many other stocks joined the negative group with a decrease of over 2%, including: TPB (TPBank, HOSE), VPB (VPBank, HOSE), TCB (Techcombank, HOSE) decreased by over 2%.

Foreign investors net sold 257 billion VND, with HPG (Hoa Phat Steel, HOSE), STB (Sacombank, HOSE), VRE (Vincom Retail, HOSE) leading the list. On the contrary, this group aggressively bought VPB (VPBank, HOSE), FPT (FPT, HOSE), VNM (Vinamilk, HOSE).

Going against the market trend, QCG stock (Quoc Cuong Gia Lai, HOSE) "hit the ceiling" to 11,000 VND/share.

According to experts , investors should not panic, avoid chasing sell, chase buy, keep calm and carefully study the business story of the stocks held and the target stocks. This can also be an opportunity to collect potential stocks when the price is at a low threshold.

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru visit the National Museum of History](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/93ae477e0cce4a02b620539fb7e8aa22)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

Comment (0)