The index fluctuated around 1,270 points, VN-Index recorded modest liquidity when it only reached nearly 11,000 billion VND in the first trading session of the new year.

The first session of 2025 (January 2) saw the stock market increase slightly by nearly 3 points (0.23%), approaching the 1,270 point mark, closing the session at 1,269.7 points.

Liquidity was modest, reaching nearly VND 11,000 billion, equivalent to the liquidity level of sessions at the end of 2024. At the end of the session, on the HOSE floor, there were 239 stocks increasing (5 stocks hitting the ceiling), 164 stocks decreasing (14 stocks hitting the floor) and 74 stocks going sideways.

Opening the morning session positively, the market quickly sank into red, lasting until mid-afternoon, the index recovered as the blue-chips group narrowed the decline.

However, this pulling force was only enough to help VN-Index return to a score almost equal to the last session of the year. The reason is believed to be that the three sectors with the largest capitalization on the stock exchange, including real estate, banking and securities, all had not had much breakthrough performance.

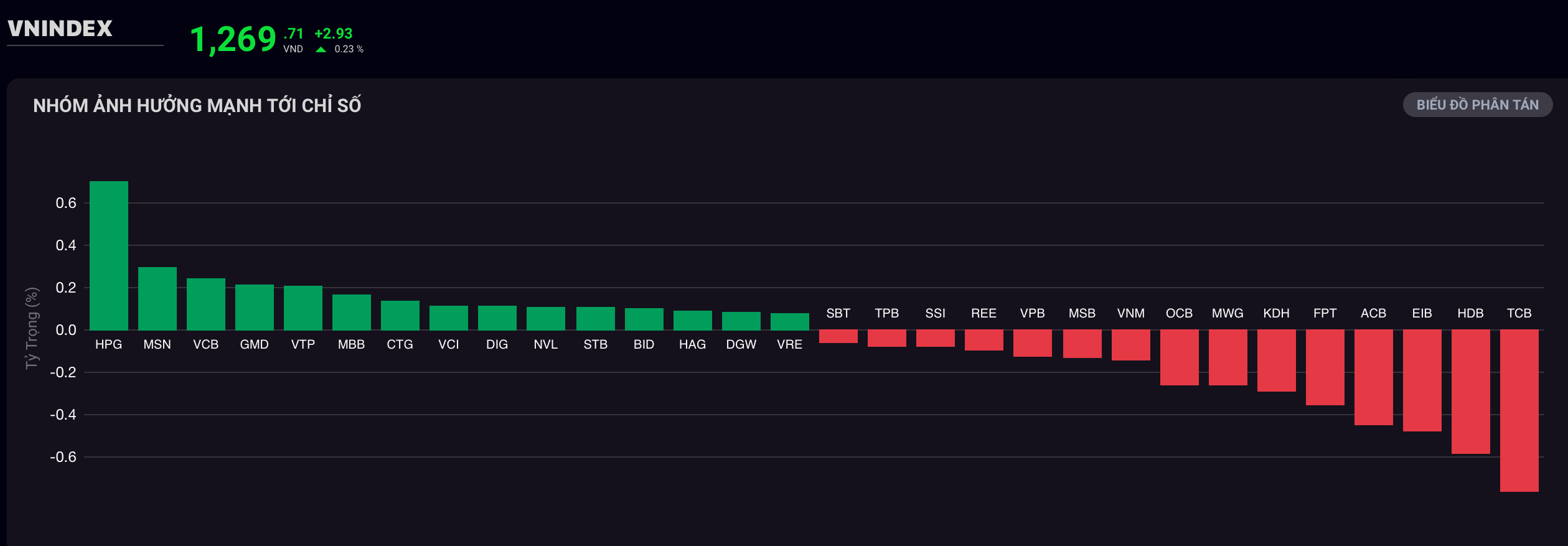

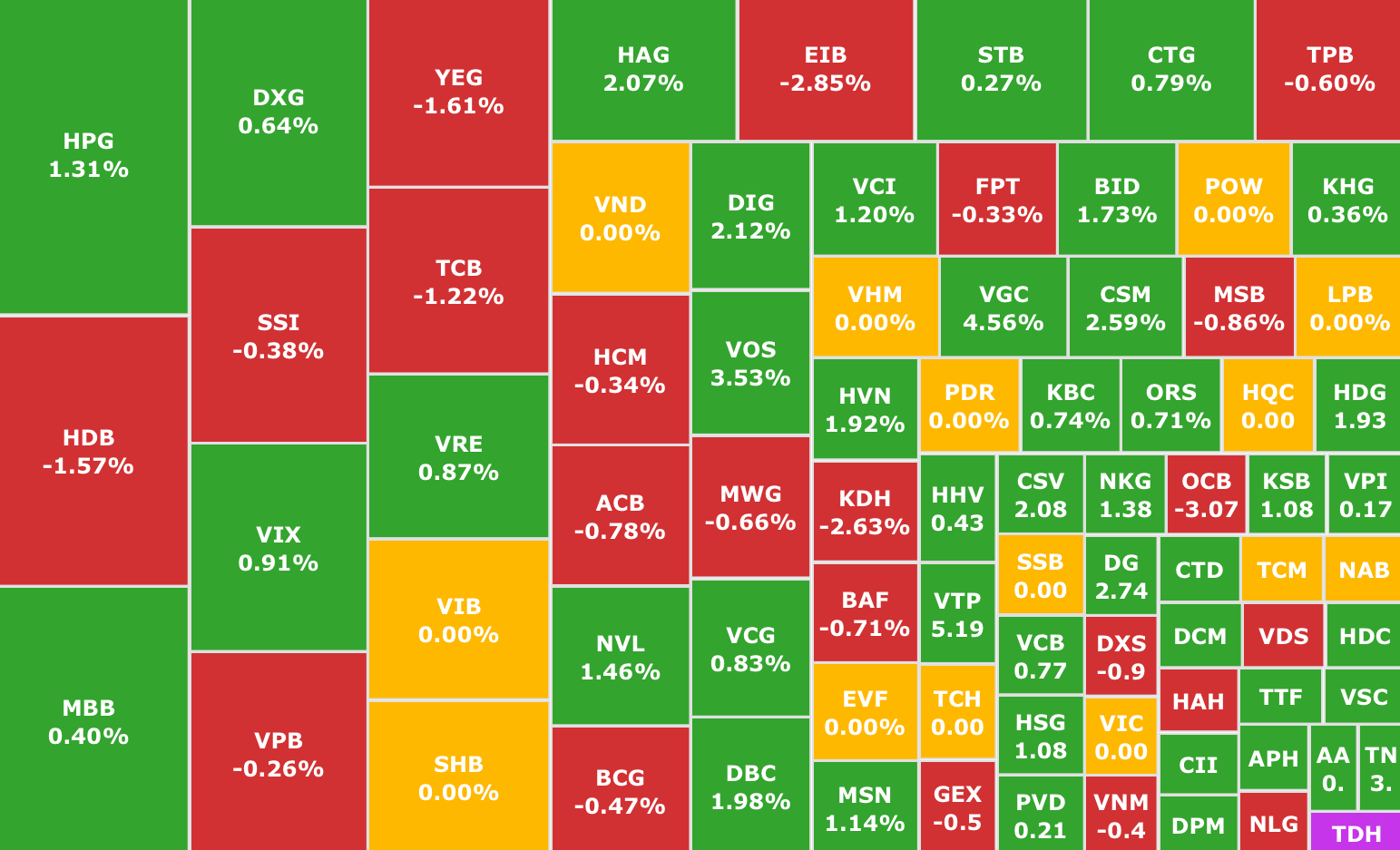

Some codes played a pivotal role in helping the index return to “green”, including: HPG (Hoa Phat Steel, HOSE) increased by 1.31%; MSN (Masan, HOSE) increased by 1.14%; VCB (Vietcombank, HOSE) increased by 0.77%; GMD (Gemadept, HOSE) increased by 1.53%;…

Group of stocks strongly affecting the index session 1/2/2025

Source: SSI iBoard

In addition, other industry groups such as transportation, construction, steel, and livestock maintained positive growth with VTP (Viettel Post, HOSE), DBC (Dabaco, HOSE), HAG (Hoang Anh Gia Lai, HOSE),...

The VN30 basket had a strong differentiation when the general index decreased by more than 1.5 points with 12 stocks increasing, 11 stocks decreasing and 7 stocks remaining unchanged. At the beginning of the session, the general VN30 index even decreased by 9 points when selling pressure appeared, focusing on banking stocks: HDB (HDBank, HOSE), ACB (ACB, HOSE), VPB (VPBank, HOSE).

The market has strong differentiation in large-cap stocks.

As for foreign investors, they continued to net sell and dump stocks at the beginning of the year, but at a moderate level, about 99 billion VND, with the focus on technology stock FPT (FPT, HOSE).

The correction has been predicted by many experts, mainly stemming from investors' "holding money" mentality before and after the Lunar New Year holiday, so this trend is likely to last from now until after the Lunar New Year. However, this is also an opportunity for investors to capture stocks with long-term growth stories and potential in the coming year, focusing on groups such as: technology, retail, banking, etc.

In another development, today (January 2), at the opening ceremony of the first stock trading session in 2025, the leaders of the State Securities Commission received 6 important instructions from Minister of Finance Nguyen Van Thang.

Accordingly, the Minister requested to continue to improve the legal framework and documents related to the Securities Law. In particular, units need to soon deploy the new information technology system (KRX) to ensure consistency in transactions. At the same time, the Minister emphasized the need to strengthen inspection and strictly handle violations in the stock market, thereby helping to limit the negative psychological impact of rumors and unofficial information, narrowing the gap between the Vietnamese stock market and the world.

All of that contributes to helping Vietnam shorten the time on the journey to upgrade the stock market, creating money to grow the Vietnamese stock market to become more attractive, attracting foreign capital flows.

Source: https://pnvnweb.dev.cnnd.vn/vn-index-am-dam-phien-giao-dich-dau-nam-20250102174424813.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)