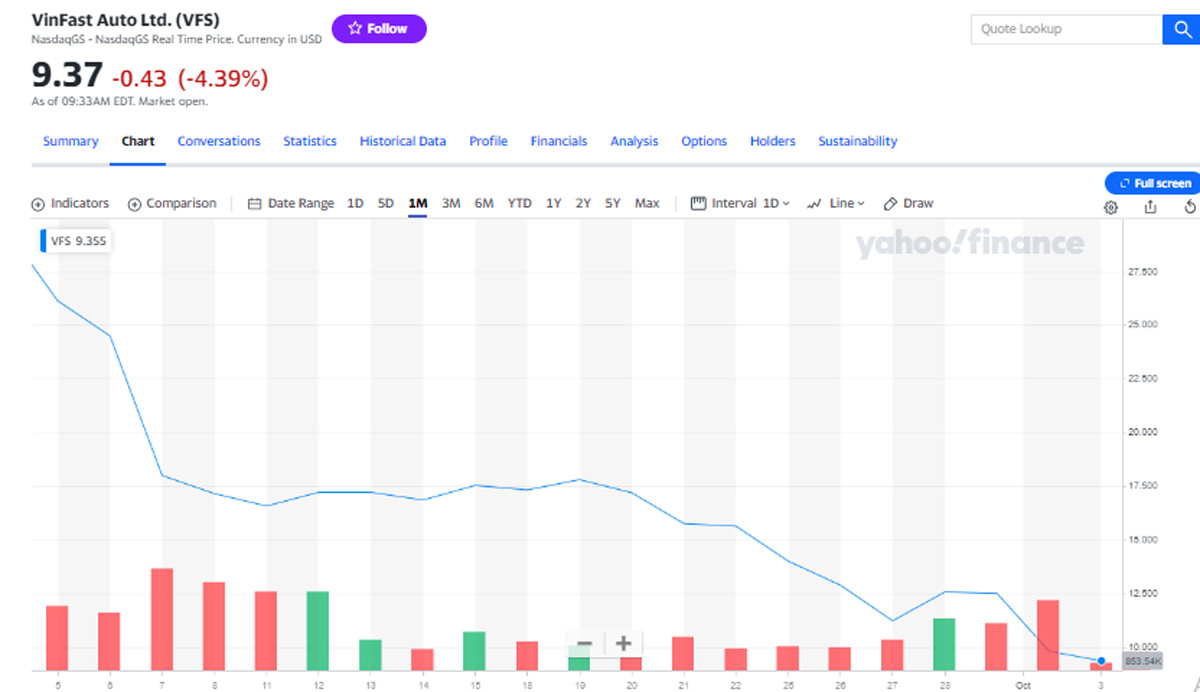

Opening the official trading session on October 3 on the US Nasdaq stock exchange (October 3 evening Vietnam time), VinFast Auto shares (VFS) of billionaire Pham Nhat Vuong decreased for the third consecutive session, down to below 10 USD/share, the lowest level since being listed on the US Nasdaq exchange on August 15.

Specifically, as of 8:30 p.m. on October 3 (Vietnam time), VFS shares decreased nearly 4% compared to the previous session, down to 9.5 USD/share.

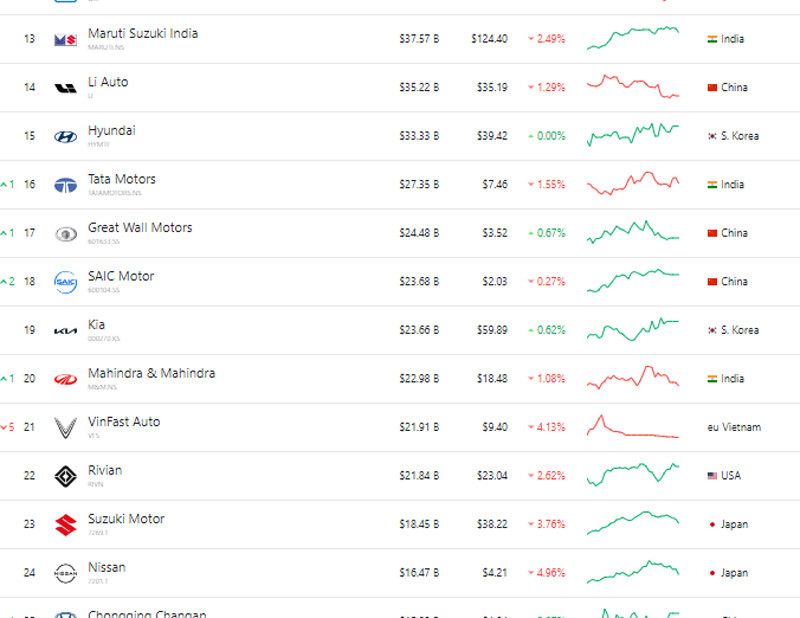

At the current price, VinFast Auto’s (VFS) market capitalization has fallen below the $22 billion threshold, lower than the initial valuation when merging with Black Spade ($23 billion). This market capitalization has decreased by nearly 90% compared to the peak at the end of August.

With this capitalization, billionaire Pham Nhat Vuong's electric car company ranks 21st among car companies in the world. If only counting electric car companies, VinFast ranks 4th after billionaire Elon Musk's Tesla (as of October 3, capitalization is 779 billion USD); China's BYD (92.7 billion USD) and China's Li Auto (34.5 billion USD).

VinFast also ranks behind India's Tata Motors, China's SAIC Motor and below South Korea's Kia.

Liquidity of VinFast shares on the Nasdaq exchange has increased sharply in recent sessions, reaching 5-7 million units/day, but is still much lower than the 10-20 million units/session level during the bustling days at the end of August.

In the session on October 2, VinFast recorded liquidity of more than 6.83 million units.

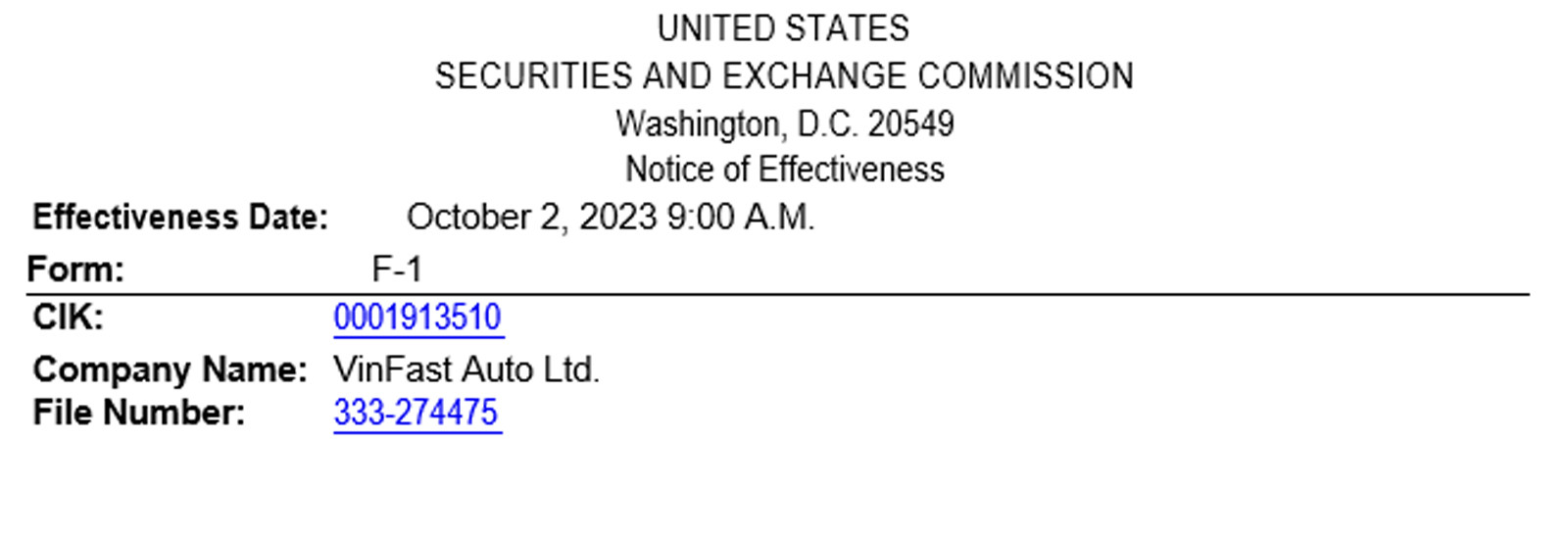

At the beginning of the trading session on October 2 (US time), the US Securities and Exchange Commission (SEC) announced that the public offering of more than 75 million shares by VinFast shareholders was effective.

Specifically, according to the registration, in total, VinFast's shareholder group will issue more than 75.7 million common shares. This is a number of shares 17 times higher than the 4.5 million listed VFS shares (out of a total of more than 2.3 billion VFS shares in circulation).

Also according to the plan, Mr. Pham Nhat Vuong's two private investment companies (VIG and Asian Star) will put 46.29 million VinFast shares on the market, equivalent to about 2% of the outstanding shares. The money will be used to reinvest in VinFast as committed by billionaire Pham Nhat Vuong and Vingroup.

With VFS shares falling to $9, CEO Le Thi Thu Thuy's premonition has come true.

At the press conference after VinFast's listing, Ms. Thu Thuy said that before, when asking investment banks, most of them said that the stock would be red, meaning VFS would fall below 10 USD/share in the first session.

VinFast leaders and associates initially believed that it would reach a capitalization of over 23 billion USD, "but did not expect 85 billion USD" (equivalent to VFS shares at over 37 USD).

The world electric vehicle market is witnessing increasingly fierce competition.

Korean automaker Kia has just launched a new electric car model, the Kia EV9, with a starting price of 54,900 USD (1.34 billion VND) in North America, much lower than the 83,000 USD of the VinFast VF 9.

In the Indian market, according to the Economic Times, VinFast is considering setting up a car factory here. However, this is also the market where Chinese carmaker BYD is expanding its presence. The Chinese carmaker is also leading the Southeast Asian electric vehicle market.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the fourth meeting of the Steering Committee for Eliminating Temporary and Dilapidated Houses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/e64c18fd03984747ba213053c9bf5c5a)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)