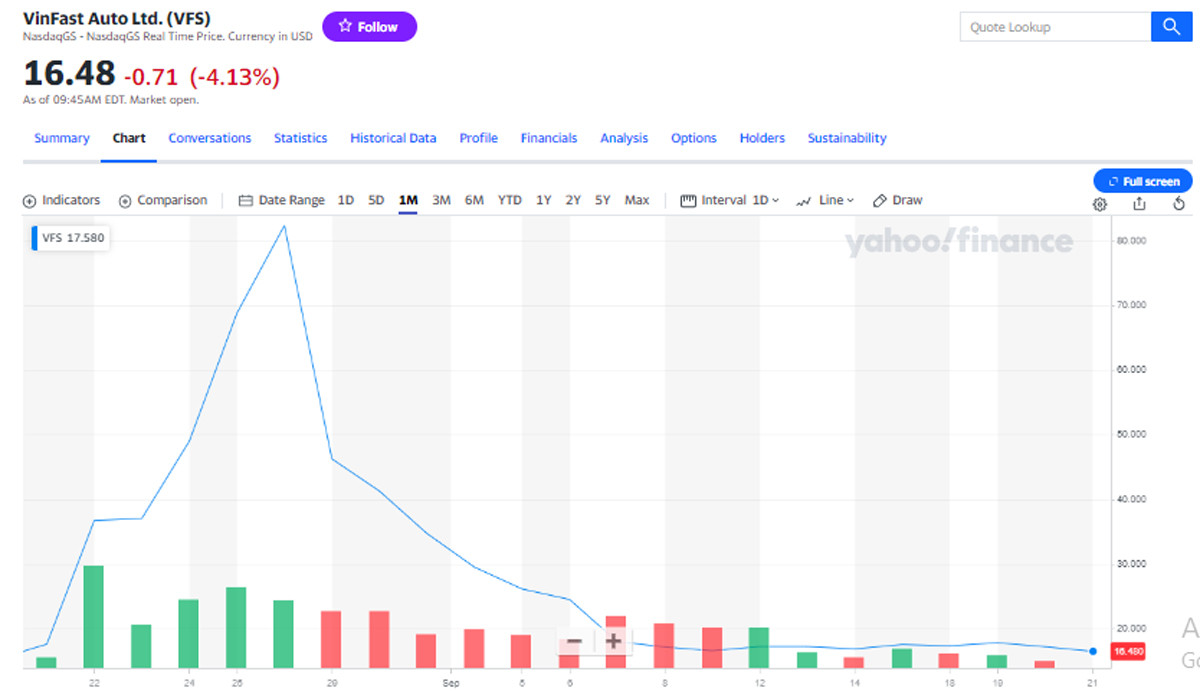

Opening the official trading session on September 21 on the US Nasdaq stock exchange (September 21 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong fell sharply for the second consecutive session.

Specifically, as of 8:50 p.m. on September 21 (Vietnam time), VFS shares decreased by 4.25% compared to the previous session to 16.46 USD/share.

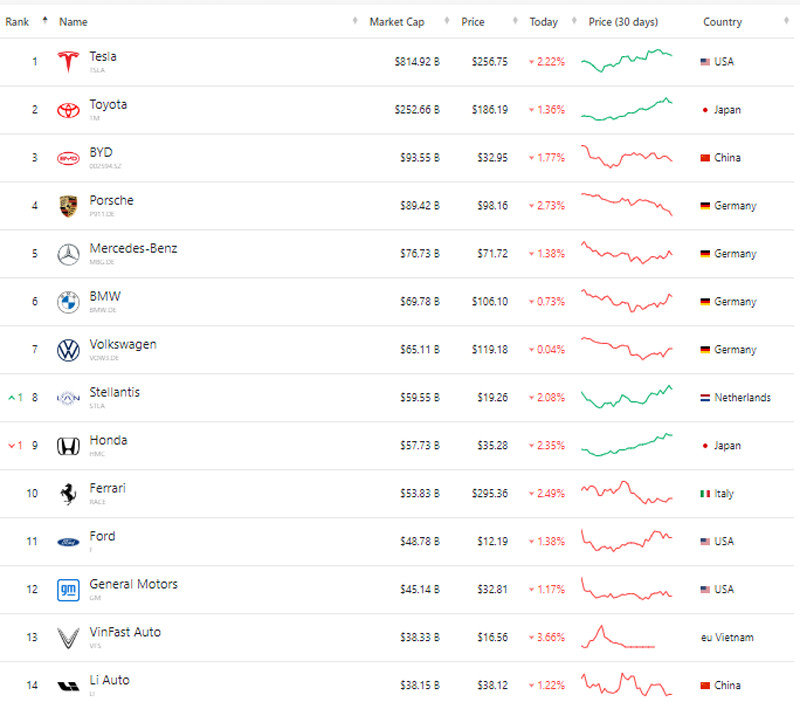

Despite the sharp decline in price and capitalization, many other electric car companies also recorded a decline in stock prices. Therefore, VinFast ranked above Chinese car company Li Auto and ranked 13th in the world car industry.

Billionaire Elon Musk's Tesla, the world's largest electric car company, saw its market capitalization drop by more than $30 billion compared to the same time the previous session to $815 billion. China's largest electric car company BYD also fell by about $3 billion to $96 billion.

VinFast's capitalization is ranked above another Chinese electric car company, Li Auto (capitalization of 38.1 billion USD).

This is still the lowest price since VinFast shares were listed on August 15 with the first closing price of 37 USD/share. Previously, in the session on August 28, VinFast shares reached 93 USD/share. VinFast's capitalization at that time reached nearly 210 billion USD.

At the current price, the capitalization of VinFast Auto (VFS) of billionaire Pham Nhat Vuong stands at 38.3 billion USD.

In the past 10 sessions, VinFast shares have fluctuated between 16-18 USD/share. Liquidity has decreased, from 10-20 million units/session in the bustling days at the end of August to now only 2-3 million units per session.

In the session on September 20, VinFast recorded only 1.38 million units transferred.

On September 21, VinFast announced its business results for the first time after listing on the US stock exchange. Accordingly, the Vietnamese electric car company's revenue in the second quarter of 2023 increased by 131% over the same period to more than 337 million USD thanks to the delivery of 9,535 electric cars during the period. Total assets reached 4.9 billion USD.

VinFast's gross loss was 114 million USD, up 7.5% year-on-year and down 28.7% compared to the first quarter of 2023.

Despite many difficulties ahead, as CEO Le Thi Thu Thuy admitted, in recent times, VinFast has made some progress such as: breaking ground on a factory in North Carolina (USA); announcing its expansion strategy to markets in Indonesia, Malaysia, India and Middle Eastern countries...

According to Reuters, VinFast will export about 3,000 cars to Europe in the fourth quarter of 2023, as regional authorities take a tougher look at Chinese electric car companies. The European Union is considering imposing import tariffs on Chinese competitors.

VinFast was founded in 2017 and will officially switch to electric vehicles from 2022. VinFast plans to sell 50,000 electric cars in 2023.

Source

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)