In the last session, VinFast shares reached a capitalization of 200 billion USD. VinFast is still attracting the attention of investors interested in the electric vehicle sector.

VinFast had a successful debut on the NASDAQ stock exchange (USA). Photo: VinFast

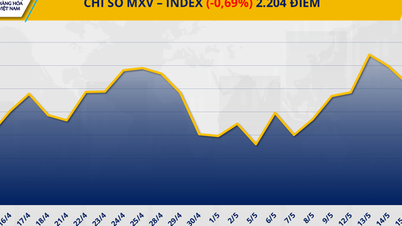

VinFast (NASDAQ:VFS) shares rose 20% to $82.35 per share at the close on Monday, marking a 688% increase since its market debut on August 15.

The total value is now around $190 billion – higher than the $111 billion valuation of banking giant Goldman and $137 billion of Boeing.

The recent growth also makes VinFast's total value higher than half of the companies in the Dow Jones index and about 10 times the size of Walgreens Boots Alliance.

VinFast shares have impressive growth rate. Photo: CNBC

VinFast's hot growth comes as the US stock market has cooled down, showing that investor sentiment is still quite good. VinFast has attracted the attention of investors interested in the electric vehicle sector.

Another notable thing is that when VinFast shares reached the 90 USD/share mark, the Vietnamese electric car company surpassed a number of other giants.

Specifically, VFS took only 10 days to surpass the $200 billion capitalization mark. To do the same, Tesla, the leading electric vehicle company of billionaire Elon Musk, took 3,600 sessions, while Nvidia took more than 7,700 sessions.

As of today, billionaire Pham Nhat Vuong is the 16th richest person in the world with a total asset value of 66 billion USD.

Laodong.vn

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

Comment (0)