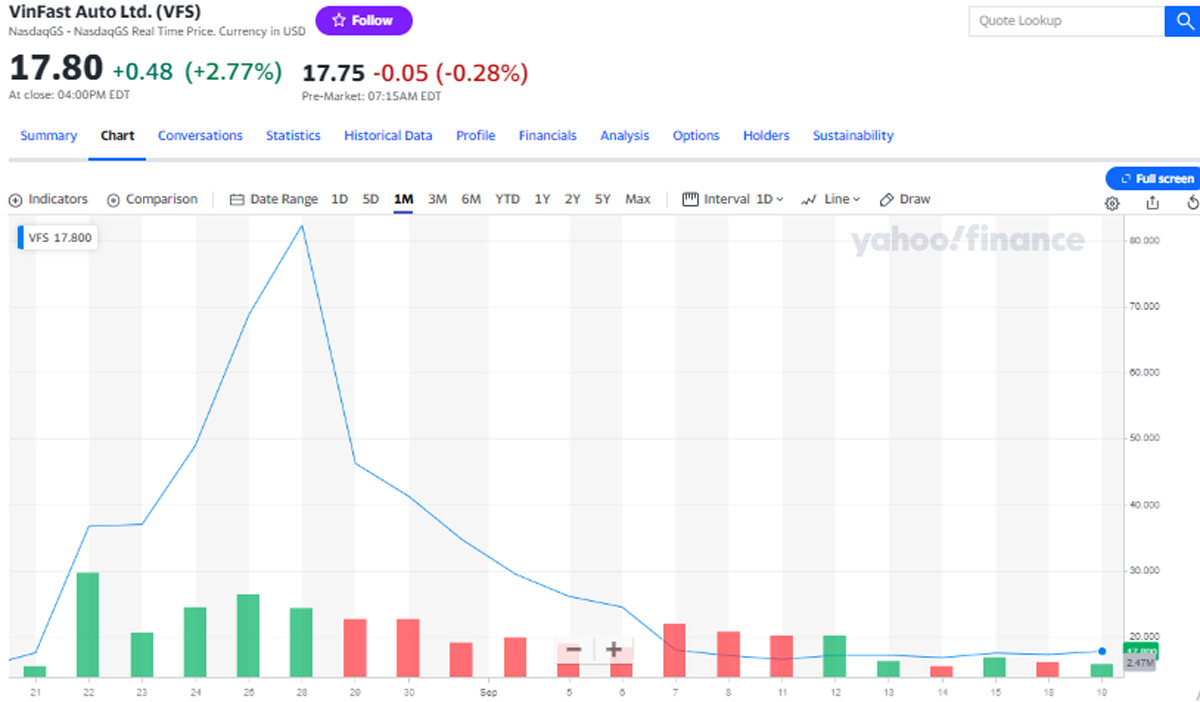

Before the opening of the session on September 20 on the US Nasdaq stock exchange (September 20 evening Vietnam time), VinFast Auto (VFS) shares continued to be quite stable at 17-18 USD/share. After a series of sharp declines, shares of billionaire Pham Nhat Vuong's car company stabilized despite low liquidity.

As of 6:20 p.m. on September 20 (Vietnam time), VFS shares decreased 0.28% to 17.75 USD/share.

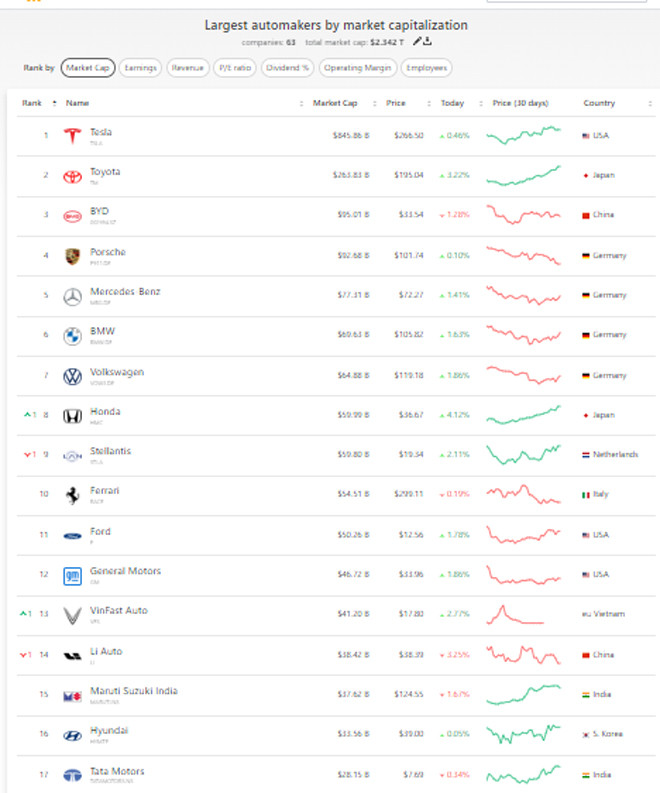

The capitalization of VinFast Auto (VFS) of billionaire Pham Nhat Vuong is still maintained at nearly 41 billion USD.

In the past 9 sessions, VinFast shares have fluctuated between 16-18 USD/share. Liquidity has recently reached only 2-4 million in each recent session, instead of 10-15 million, even more than 19 million units/session in the previous bustling days.

However, this is the lowest price of VinFast shares compared to the unexpected price on the listing day of August 15 with the closing price of the first session of 37 USD/share. Previously, VinFast shares had reached 93 USD/share in the trading session of August 28. VinFast's capitalization at that time reached nearly 210 billion USD.

With a stable capitalization as of recently, VinFast ranks above Chinese car company Li Auto and ranks 13th in the world car industry.

The world's largest electric car company with the largest capitalization is still billionaire Elon Musk's Tesla ($848 billion), followed by China's largest electric car company BYD with a capitalization of $96 billion.

VinFast's capitalization is ranked above another Chinese electric car company, Li Auto (capitalization of 38.6 billion USD).

In recent days, the official commercial version of VinFast VF6 has been revealed and is waiting for its launch date at the end of September.

In a recent introduction by CEO Le Thi Thu Thuy, VinFast is a pure electric car company with a wide range of car products across many segments. And, according to Ms. Thuy, not many companies have such a wide range of products. And VinFast will take advantage of this.

To date, VinFast owns 6 electric car products in different segments. After VFe34, VinFast launched VF8, VF9 and VF5... VF9 is an electric SUV model in segment E - the highest-end segment in VinFast's complete electric car range.

Up to now, the commercial version of VF6 is a B-class SUV version, equivalent to competitors in the same segment such as KIA Seltos and Hyundai Creta.

Investors are currently waiting for information on VinFast’s sales in the first nine months of the year. One piece of information of interest is the number of VF8 and VF9 cars sold in the US and Canada, as well as soon in Europe.

VinFast’s previous business strategy was to use the Vietnamese market as a foundation for development. Sales to the world were done from the US, then find ways to bring products to Europe, ASEAN and the Middle East.

The launch of VF6 and then the “national” version VF3 is expected to be more impressive than the VF5 version. Investors are waiting for the moves from billionaire Pham Nhat Vuong, about new products, technological progress, and sales growth.

VinFast was founded in 2017 and will officially switch to electric vehicles from 2022. VinFast plans to sell 50,000 electric cars in 2023.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference to promote public investment growth momentum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/7d1fac1aef9d4002a09ee8fa7e0fc5c5)

Comment (0)