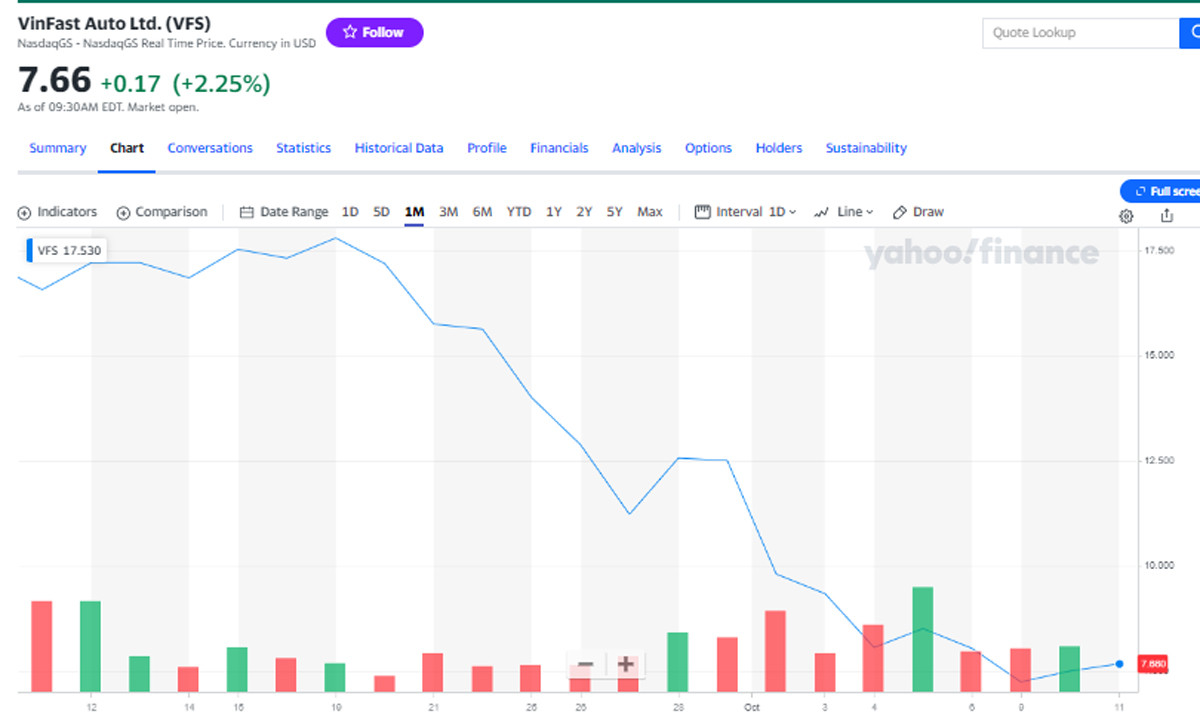

Opening the official trading session on October 11 on the US Nasdaq stock exchange (October 11 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong increased slightly, after the car company announced its intention to acquire VinES Energy Solutions JSC.

Specifically, as of 8:35 p.m. on October 11 (Vietnam time), VFS shares increased by more than 2% compared to the previous session to nearly 7.7 USD/share. VFS's capitalization is at 17.7 billion USD.

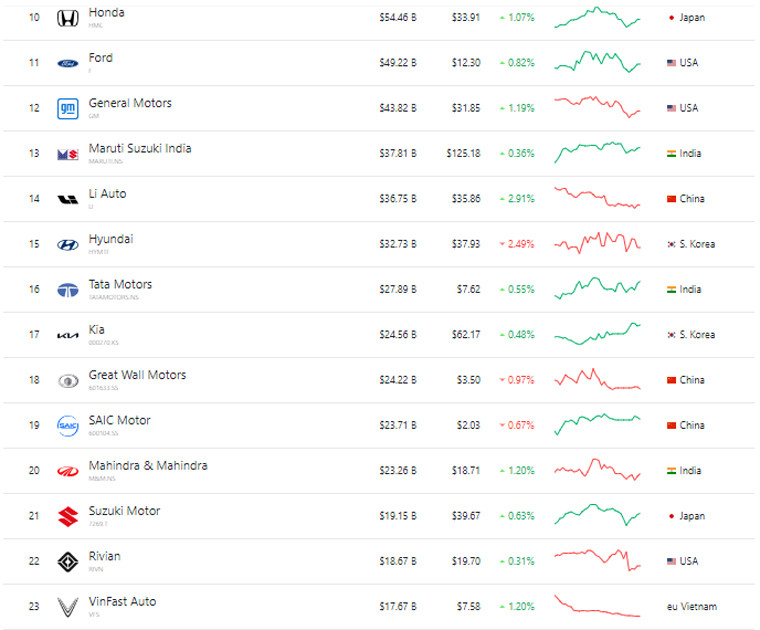

VinFast's current market capitalization is below most of the world's famous car manufacturers and also behind the American pure electric car company Rivian, but also above some other small Chinese and American electric car startups, including NIO, Xpeng, and Lucid.

VinFast rose to 23rd place among car manufacturers in the world. If only counting electric car manufacturers, VinFast ranked 5th after Tesla of billionaire Elon Musk (as of October 11, capitalization was 847 billion USD); BYD of China (92.5 billion USD), Li Auto of China (36.8 billion USD) and Rivian of the US (18.7 billion USD).

Thus, compared to the peak of 210 billion USD recorded on August 28 (when VinFast shares reached 93 USD/share), the capitalization of billionaire Vuong's car company has decreased about 12 times.

In recent sessions, VinFast stock liquidity on the Nasdaq floor has been at 3-4 million units/session even though the number of freely circulating shares has increased sharply.

Currently, VinFast has about more than 80 million shares in free circulation (out of a total of more than 2.3 billion VFS shares in circulation).

According to a recently released financial report update, VinFast had total assets of more than 5.18 billion USD as of the end of September 2023. This car company lost nearly 1.73 billion USD in the first 9 months of 2023.

At the beginning of the session on October 11 (night of October 11 Vietnam time), VinFast announced its intention to acquire 99.8% of VinES Energy Solutions JSC.

After the acquisition, VinFast will be able to master battery technology, an important component of electric vehicles. VinES will be fully integrated into VinFast's production value chain and enhance the competitive advantage of this car company.

The acquisition of VinES will turn VinFast into a fully integrated battery-electric vehicle (BEV) supplier and accelerate its development capabilities across three key pillars: vehicle development, electricity & electronics, and batteries.

VinES is a member company of the Vingroup ecosystem, with capital of VND6,500 billion (USD270 million). This enterprise operates in the field of research, development and production of lithium-ion batteries for electric vehicles, energy storage systems and other commercial applications. As of September 30, VinES had total consolidated assets of about VND17,000 billion (about USD711 million).

In the global electric vehicle market, VinFast is currently facing many difficulties due to fierce competition and difficulty in raising capital. However, this car company also has an advantage in the charging station system in Vietnam with an advertised density of 3.5 km/station in 80 cities (out of 85 cities) across the country.

Listing on an international stock exchange gives VinFast the opportunity to raise international capital. However, the electric car company faces higher disclosure requirements, tighter supervision, and harsh assessments from international experts and media.

The world's electric vehicle industry is still facing many difficulties, especially new car manufacturers. Competition is getting bigger and bigger. Billionaire Elon Musk's Tesla, the world's number 1 electric car company, has recently reduced car prices very sharply, with some models being equal to or even lower than gasoline cars in the same segment.

Currently, VinFast is trying to boost car sales with plans to expand to 50 markets in 2024. In addition, VinFast also plans to open new factories in Indonesia and India.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)