VinFast market capitalization surpasses Ford

Last night, in the US market, the Vietnamese car brand VinFast made history when it successfully listed on the US stock market. A series of major US newspapers published information about this "debut" session.

VinFast shares opened at $22, more than double the $10 a share agreed with Black Spade Acquisition, VinFast's SPAC partner (BSAQ.A), which valued VinFast at $23 billion, Reuters reported.

VinFast shares rose further during the session, ending at $37.06 and valuing the yet-to-be-profitable electric vehicle maker at $85 billion, more than Ford's (FN) market capitalization at $48 billion and General Motors' (GM.N) $46 billion stock.

About $185 million of the company's shares were traded, according to Refinitiv data.

Immediately after its shares were listed on the US stock exchange, VinFast's market capitalization surpassed Ford's.

The merger with a special purpose acquisition company (SPAC) has given VinFast a listing on a market where founder Pham Nhat Vuong hopes to usurp industry leader Tesla (TSLA.O) with a $4 billion factory under construction, Reuters reported.

Meanwhile, shares of Vietnamese electric vehicle maker VinFast began trading on the Nasdaq on Tuesday, after completing its merger with U.S.-listed special purpose acquisition company Black Spade Acquisition, CNBC reported.

VinFast’s new U.S. shares opened at $22 on Tuesday and surged to close the day at $37.06, up more than 68%. Black Spade Acquisition’s shares closed at $10.45 on Monday.

The deal with Black Spade values VinFast at approximately $23 billion, according to a June filing with the U.S. Securities and Exchange Commission.

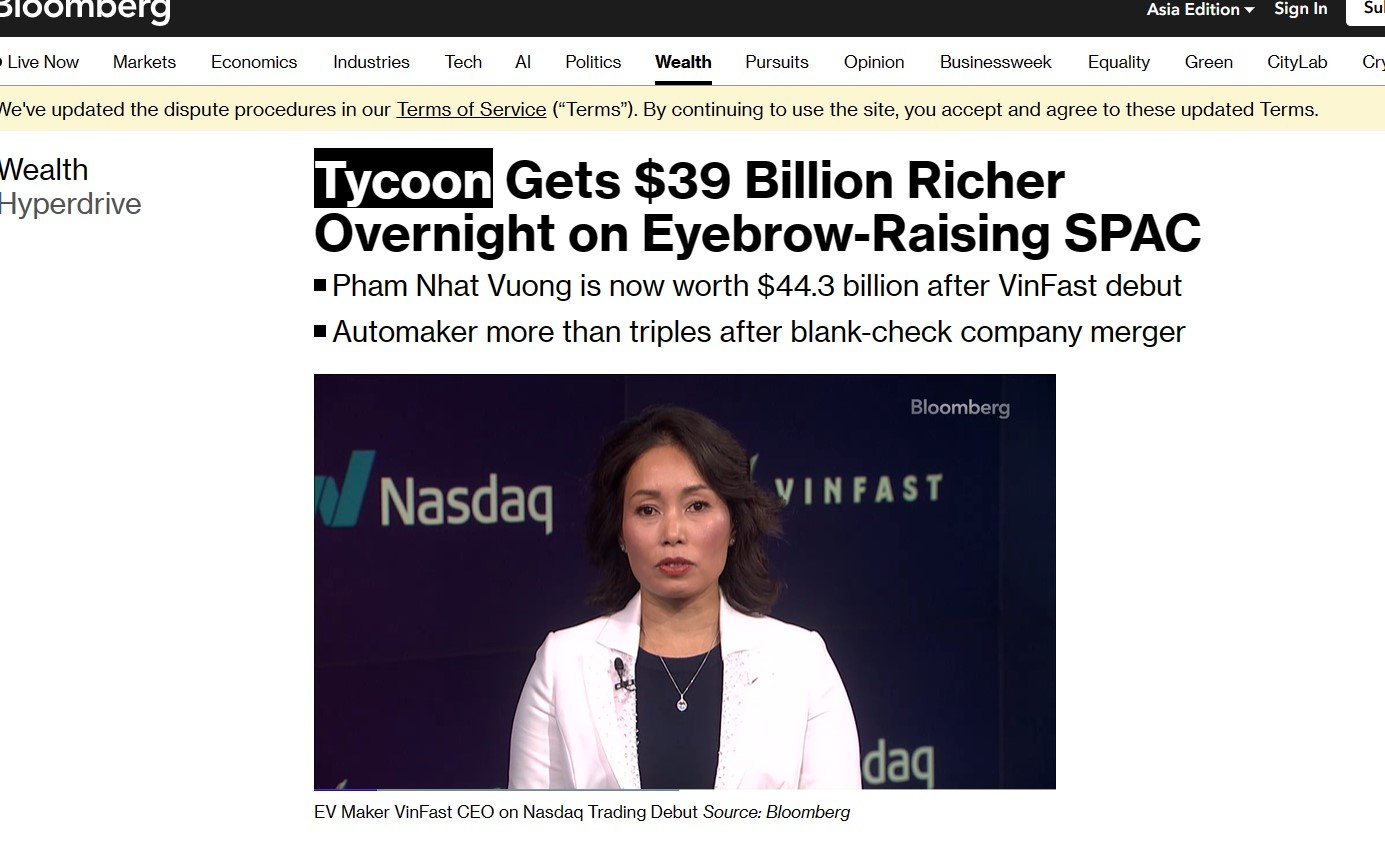

“The listing in the US is an important milestone for us. The listing will open up access to capital markets for us in the future,” VinFast CEO Le Thi Thu Thuy, who uses the English name Madame Thuy, told CNBC.

VinFast, the automotive arm of Vietnamese conglomerate Vingroup , was founded in 2017. So far, the company has imported about 2,100 of its electric vehicles from Vietnam to the U.S. and brought nearly 800 more to Canada.

The company made its first deliveries in the US in March.

Investors compete to buy VIC, Vingroup has an additional 3.3 billion dollars in capitalization

VinFast’s successful debut on the night of August 15 in the US market helped VIC shares surge in the morning of August 16 in the Vietnamese market. Right from the beginning of the session, demand for VIC at the ceiling price increased sharply.

According to Bloomberg, after VinFast was listed, Mr. Pham Nhat Vuong's assets skyrocketed to 44.3 billion USD. Source: Bloomberg

VIC is trading at VND75,600/share, up VND4,900/share compared to yesterday. Thanks to that, Vingroup's market capitalization has increased by VND18,688 billion. Compared to the end of July, the market capitalization of the largest real estate company on the Vietnamese stock exchange has increased by VND78,186 billion (about USD3.3 billion).

Not only did Vingroup's market capitalization increase sharply, the assets of Mr. Pham Nhat Vuong, Chairman of Vingroup's Board of Directors, also made great strides.

In a newly published article, Bloomberg said that billionaire Pham Nhat Vuong's assets have increased by 39 billion USD, reaching 44.3 billion USD. With this breakthrough, Mr. Pham Nhat Vuong will enter the top 30 on Bloomberg's billionaire list.

VinFast not only helps Vingroup's assets increase rapidly but also contributes to boosting the VN-Index.

After surpassing many important milestones, VN-Index fell into a period of strong fluctuations and corrections. At that difficult time, VIC hit the ceiling, thereby spreading positive signals to many other blue-chips, thereby helping VN-Index maintain its green color.

Thanks to VIC, two other “VIN family” stocks, VHM and VRE, increased quite strongly. VHM increased by VND1,100/share, equivalent to 1.8% to VND62,800/share. VRE increased by VND350/share, equivalent to 1.1% to VND31,650/share.

VIC's role is even greater when VN-Index is green but the number of stocks decreasing in price (227 stocks) is higher than the number of stocks increasing in price (193 stocks). Currently, VN-Index is up 8.24 points, equivalent to 0.67% to 1,242.35 points; VN30-Index is up 12.27 points, equivalent to 0.99% to 1,253.44 points.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)