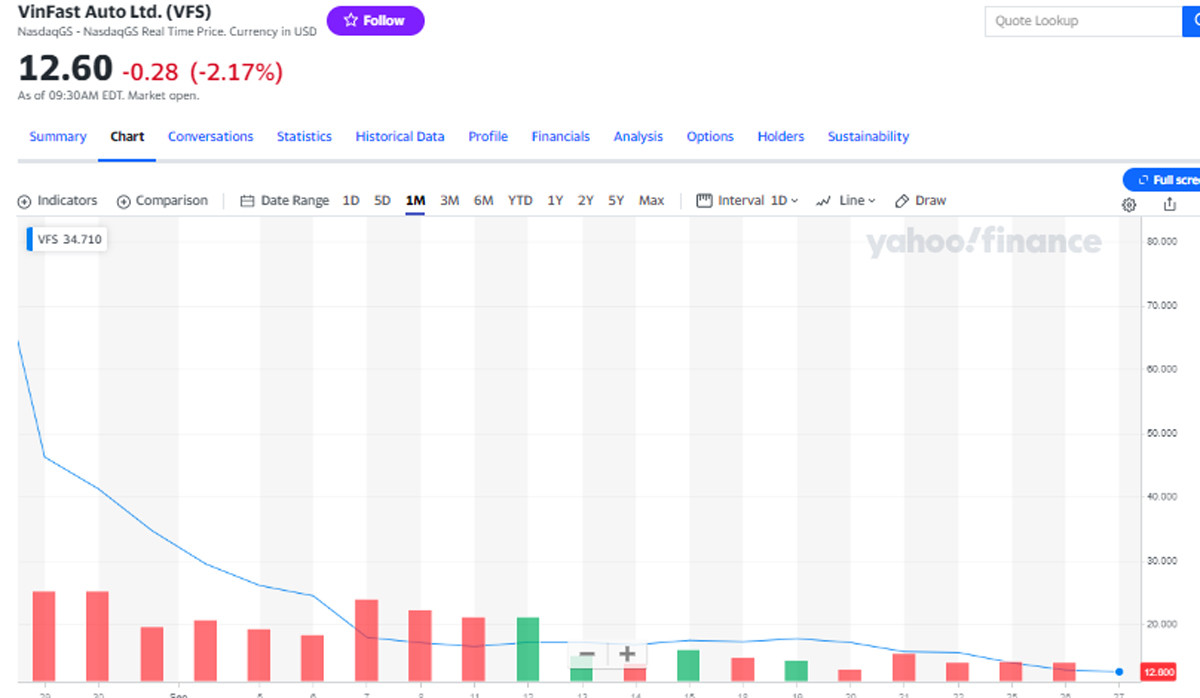

Opening the official trading session on September 27 on the US Nasdaq stock exchange (September 27 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong decreased for the 6th consecutive session.

Specifically, as of 8:30 p.m. on September 27 (Vietnam time), VFS shares decreased nearly 2.2% compared to the previous session to 12.6 USD/share.

At the current price, the capitalization of VinFast Auto (VFS) of billionaire Pham Nhat Vuong stands at 30 billion USD.

In the past 14 sessions, VinFast shares have fluctuated in a downward trend, from 18 USD/share to below the current threshold of 13 USD. Liquidity has decreased to the range of 2-3 million units/session.

In the session on September 26, VinFast recorded 2.27 million units transferred.

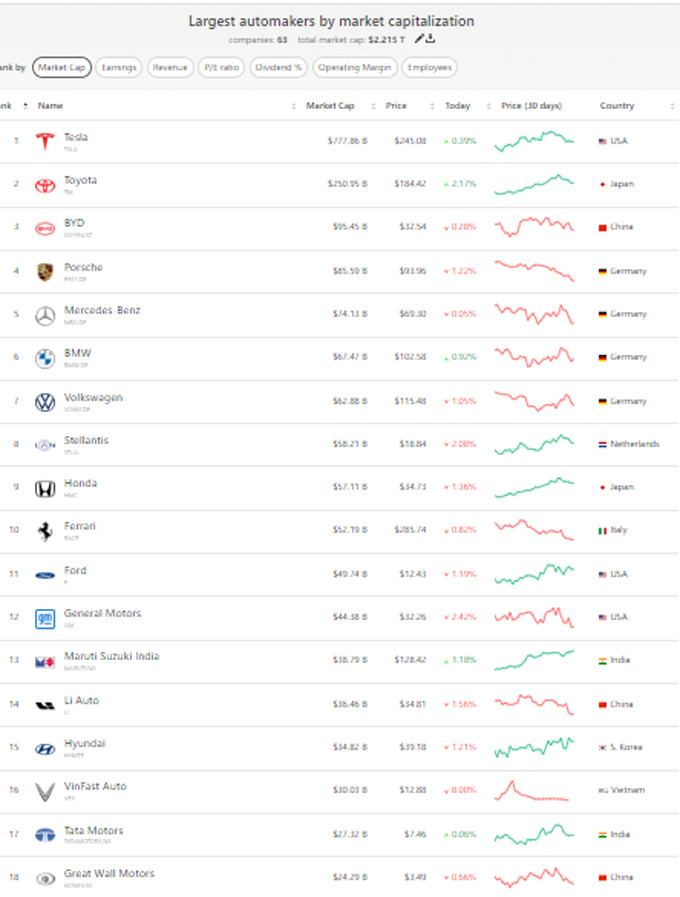

With its stock price falling sharply for 6 sessions, the capitalization of VinFast, the electric car company of billionaire Pham Nhat Vuong, ranked 16th in the world, behind Hyundai of Korea, Li Auto of China and Maruti Suzuki India.

The world's largest electric car company Tesla, owned by billionaire Elon Musk, currently has a capitalization of 778 billion USD. China's largest electric car company BYD has a capitalization of 95 billion USD.

On September 27, VinFast submitted an amended registration for the offering of common shares from a number of shareholders, including Black Spade's sponsors, others related to Black Spade, and key shareholders of VinFast including: Vietnam Investment Group Joint Stock Company (VIG) and Asian Star Trading & Investment (Asian Star).

According to the US Securities and Exchange Commission (SEC), the amendment published on September 27 only corrects typographical errors that appeared in the independent accounting firm's report on the audited financial statements included in the registration statement and in the notes to the consolidated financial statements.

According to the registration, the group will issue more than 75.7 million common shares. This is a number of shares 17 times higher than the 4.5 million listed VFS shares (out of a total of more than 2.3 billion outstanding VFS shares).

Also according to the plan, Mr. Pham Nhat Vuong's two private investment companies, VIG and Asian Star, will bring 46.29 million VinFast shares to the market, equivalent to about 2% of outstanding shares.

The information in this preliminary prospectus is incomplete and subject to change, according to the SEC. These securities may not be sold until the SEC announces they are effective.

Investors are currently waiting to see when VinFast will receive SEC approval for its plan to register to offer more than 75 million VFS shares.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

Comment (0)