Vingroup Vice President Le Thi Thu Thuy said that a successful listing in the US will open up opportunities for VinFast to access international capital sources, attract technology and engineering investment, and contribute to realizing the strategy of making VinFast a global brand. Lao Dong newspaper reporters had a conversation with Mr. Phan Linh - Professional Director of Take Profit Investment Holdings JSC about the story of Vietnamese enterprises "bringing bells to strike foreign lands".

VFS listing on NASDAQ is an inspirational story for Vietnamese businesses. Photo: VIN

What do you think about the story of VFS listing on the NASDAQ?

This is an inspiring story for Vietnamese businesses when VinFast became the pioneer to list on the NASDAQ - an exchange with many strict standards.

Raising capital from the domestic stock market was previously something that few Vietnamese businesses thought of, but now there are businesses that have successfully raised capital on the US stock exchange.

This not only brings VinFast's brand to the world but also brings the name of Vietnamese enterprises to international friends.

This also helps VinFast in its financial relationships with financial institutions. It is easier to raise capital to continue developing the electric vehicle segment. It is even possible to divest part of the capital if the US market is favorable in the context of lower interest rates when the FED changes direction in the near future.

Mr. Phan Linh - Professional Director of Take Profit Investment Holdings JSC. Photo: NVCC

An expert said that the US is one of the most difficult capital markets in the world. VinFast must meet the strict requirements of the US Securities and Exchange Commission (SEC). VinFast's listing on the US stock exchange also strengthens the confidence of Vietnamese businesses, even opening up opportunities for other businesses. What is your assessment of this?

VinFast shows that nothing is impossible when we have the desire and careful preparation, extraordinary goals can be achieved. This is a model for other Vietnamese businesses to look at and follow if they want to reach out to the big sea.

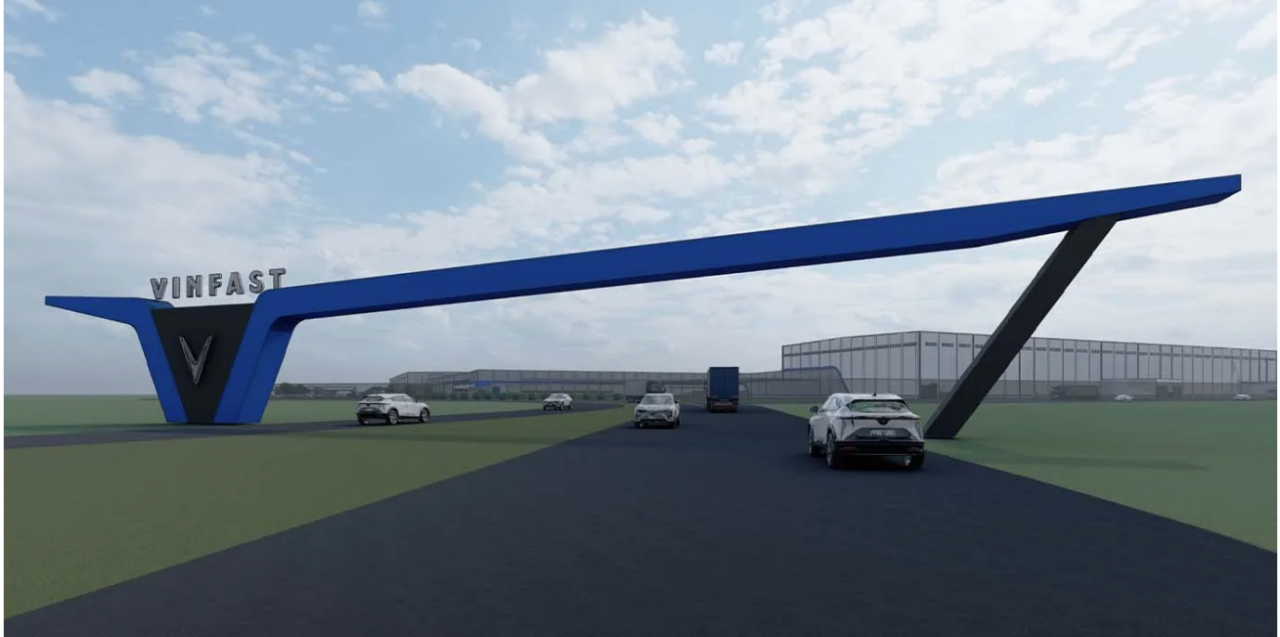

Drawing of VinFast's upcoming electric vehicle manufacturing facility in North Carolina (USA). Photo: VinFast

According to you, is the effect from VFS shares strong enough to grow in the long term?

The US stock market is very fierce because they have many diverse financial products, including short selling.

The cost of this game is quite expensive, even up to tens of millions of USD. Even the cost of custody if the stock price is high is also expensive because custody fees in the US are calculated based on market price.

If VinFast's strength is not strong enough, it is also very possible that in a short time, the company's stock will be revalued by the market. Therefore, this is a long-term game. If comparing revenue, profit and market share of VinFast's electric vehicle segment, it is still much lower than other competitors.

So behind the halo, we should also look at the realities. Of course, I and many other Vietnamese people are proud of VinFast.

Thank you!

laodong.vn

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)