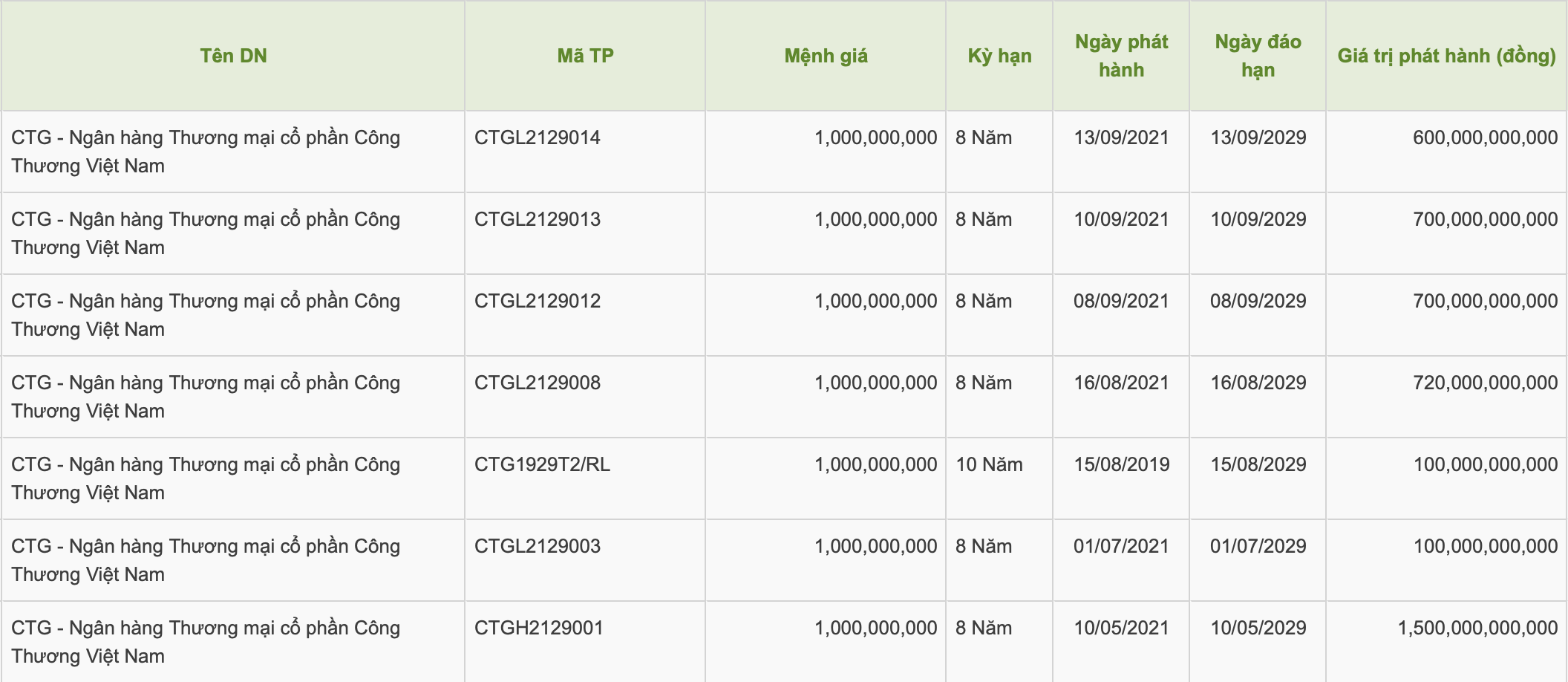

Vietnam Joint Stock Commercial Bank for Industry and Trade ( VietinBank - HoSE: CTG) has just announced information regarding the results of the repurchase of three bond codes: CTGL2129012, CTGL2129013, and CTGL2129014.

Accordingly, the bank repurchased the three bond tranches with a total value of VND 2,000 billion. Specifically, bond tranches CTGL2129012 and CTGL2129013 have a face value of VND 700 billion, while bond tranche CTGL2129014 has a face value of VND 600 billion.

All three tranches of bonds were issued in September 2021, have an 8-year maturity, and are expected to mature in 2029.

Information on VietinBank's early repurchase of bond tranches.

Since the beginning of the year, the bank has repurchased a total of 7 tranches of bonds with a total value of VND 4,420 billion. Of these, the largest tranche repurchased was CTGH2129001, repurchased in May for VND 1,500 billion. This tranche of bonds was issued in May 2021 with an 8-year maturity.

In August 2024, the bank also repurchased 820 billion VND worth of bonds with codes CTG1929T2/RL (100 billion VND) and CTGL2129008 (720 billion VND).

Conversely, this year, VietinBank plans to issue two tranches of bonds to the public, totaling 80 million bonds. Each bond has a face value of 100,000 VND. This is equivalent to a total value of 8,000 billion VND for both bond issuances.

In both issuances, the bank plans to raise funds through two bond issues: XTG2432T2, valued at VND 3,000 billion, with an 8-year term, and CTG2343T2, valued at VND 1,000 billion, with a 10-year term.

All of the above bonds are non-convertible, unsecured bonds and meet the conditions to be included in VietinBank's Tier 2 capital according to current legal regulations.

The interest rate for 8-year bonds will be equal to the benchmark interest rate plus 1.05% per annum, and the interest rate for 10-year bonds will be equal to the benchmark interest rate plus 1.15% per annum.

The proceeds from the 2024 public bond offering, after deducting related fees and expenses, are expected to be used by VietinBank to increase its working capital, increase Tier 2 capital, and ensure compliance with the operational safety ratios stipulated by the State Bank of Vietnam.

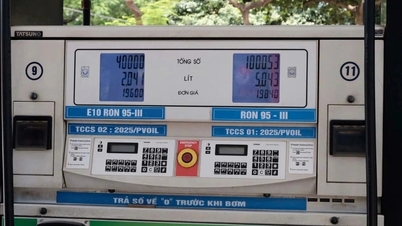

Simultaneously, loans to the economy will be allocated to the gas production and distribution sector totaling VND 4,000 billion, with VND 2,000 billion allocated to the manufacturing industry and VND 2,000 billion to other sectors. The expected disbursement period is Q3/2024 - Q2/2025.

Source: https://www.nguoiduatin.vn/vietinbank-mua-lai-truoc-han-2000-ty-dong-trai-phieu-204240917111929942.htm

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)