In the context of the whole market's demand deposit (CASA) source declining and not having much room for growth, the scale of CASA at VietinBank is still in the top group of the market and gradually improving in proportion to the capital mobilized from customers.

This contributes to improving NIM (profit margin) and enhancing the bank's operational efficiency.

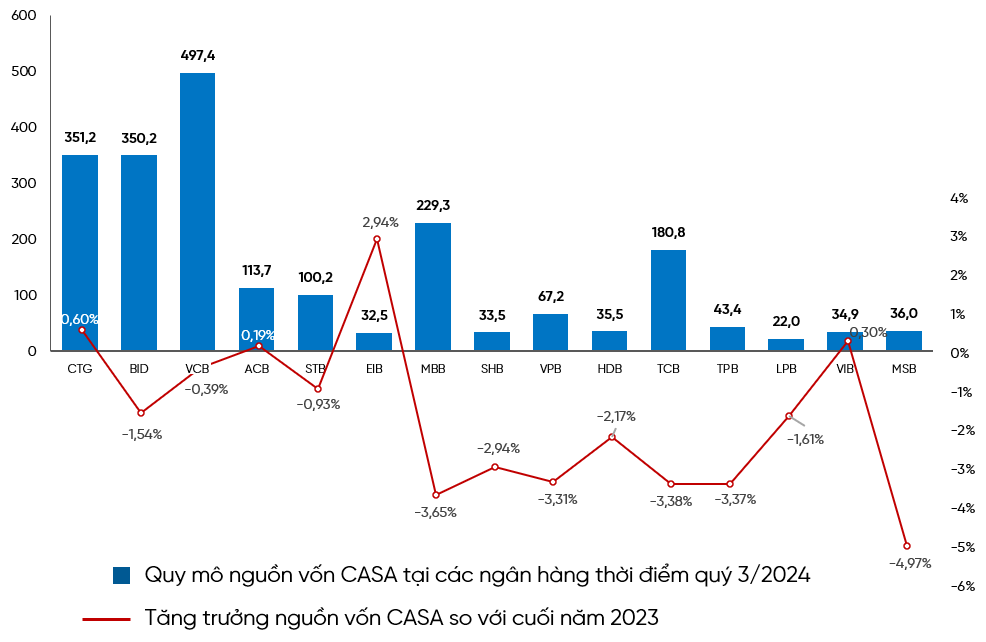

According to the Consolidated Financial Report for the third quarter of 2024 recently announced by banks listed on the stock market, the entire market has seen a decline in the scale and proportion of CASA in mobilized capital. Meanwhile, there are still some banks that go against the general decline of the market, becoming a bright spot in CASA growth with both growth in scale and improvement in the proportion of CASA in mobilized capital such as: CTG,ACB , EIB, VIB.

ON THE SCALE AND GROWTH OF CASA RATIO IN THE CAPITAL MOBILIZATION OF BANKS LISTED ON THE MARKET

According to published data, as of the third quarter of 2024, VietinBank's CASA capital scale reached VND 351 trillion, a net increase of VND 33 trillion, a growth of 10.4% compared to the end of 2023; the proportion of CASA in total mobilized capital reached 23.2%, an increase of 0.6% compared to the end of 2023. With the above results, VietinBank became the bank with the highest increase in CASA balance in the banking industry (VietinBank's increased CASA capital was still higher than the total of the 5 adjacent banks combined), continuing to be in the group of banks with the highest CASA scale and improvement in CASA ratio in the market. This is an advantage of VietinBank compared to other banks, showing the ability to maintain and grow CASA capital in the context of a decline in CASA deposits in the whole market, helping VietinBank reduce COF ratio, increase NIM and improve overall operating efficiency.

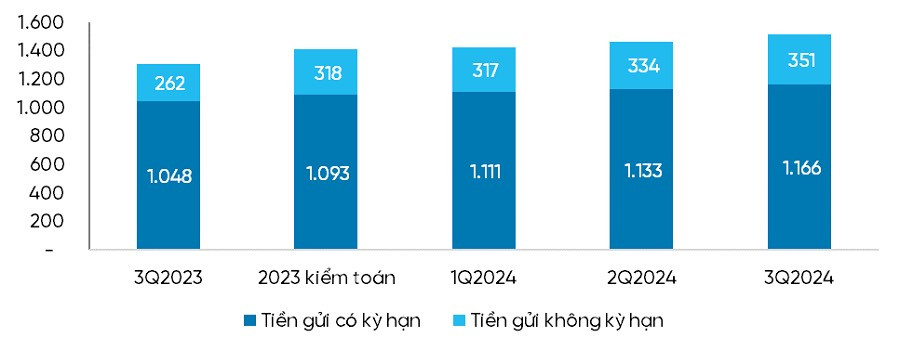

GROWTH OF VIETINBANK'S CASA CAPITAL

VietinBank's growth in scale and improvement in CASA ratio comes from the drastic implementation of many comprehensive, fundamental, and breakthrough solutions:

VietinBank focuses on CASA growth in all segments with comprehensive financial solution packages suitable to each customer's needs.

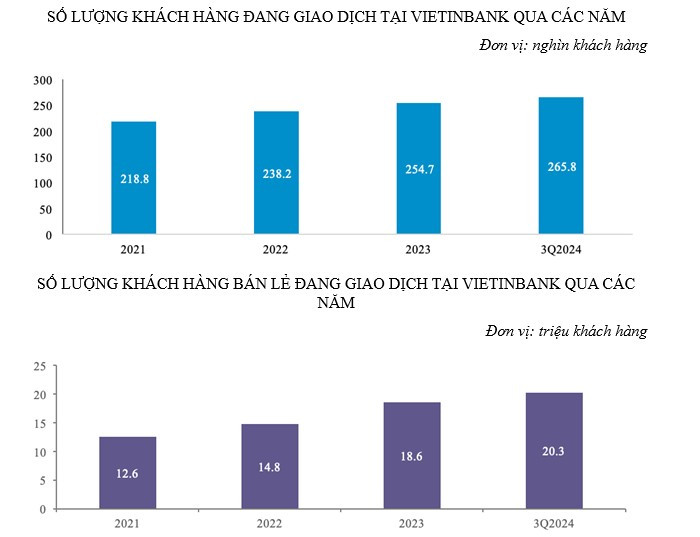

Currently, VietinBank is managing customers according to different segments and sub-segments. Based on listening and empathizing with the needs and stories of each customer, VietinBank has built comprehensive financial solution packages suitable for each segment: large corporate customers, small and medium-sized corporate customers, FDI corporate customers, retail customers... and according to the different business characteristics of each customer.

Along with the comprehensive financial solution package, VietinBank has implemented many more preferential programs on account services, money transfer and electronic banking for customers; actively shifting customers using traditional channels to digital channels, helping to improve service experience and reduce costs for banks and customers.

Over the years, VietinBank has effectively implemented campaigns to develop new customer files to register for account opening (including registration to open personal accounts through the eKYC application) and use online payment applications such as eFAST, iPAY. Thanks to that, the number of corporate and retail customers has grown over the years with an increase of about 7%/year for the corporate customer segment and 17.5% for the retail customer segment.

Applying advanced banking technologies, connecting diverse ecosystems to serve the diverse needs of customers.

VietinBank constantly innovates, applies modern technologies, connects ERP, connects payments and cash flow management, builds a comprehensive payment ecosystem to serve the diverse needs of all customer segments.

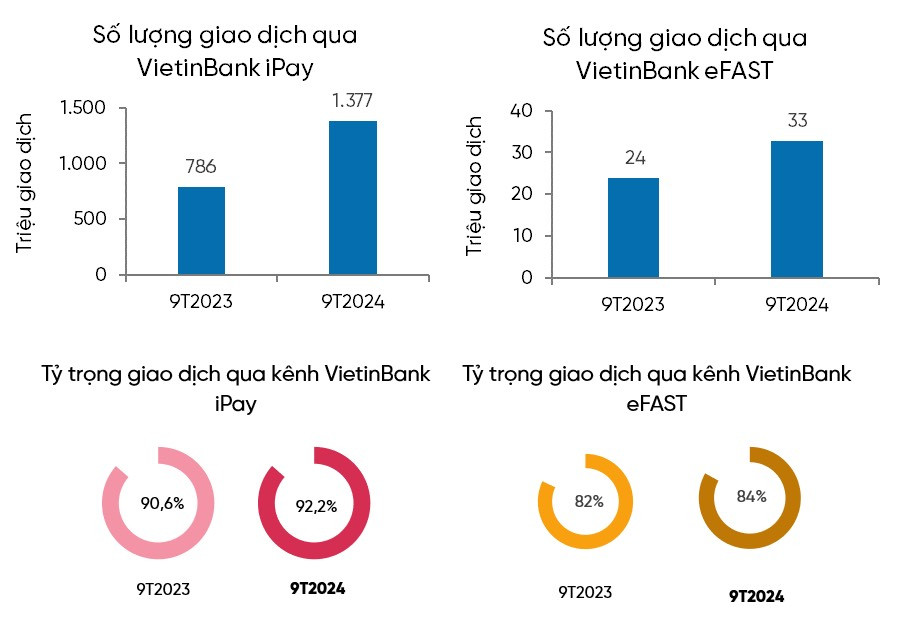

Thanks to efforts to develop digital payment services, the number of transactions via VietinBank's eFAST and iPay in the third quarter of 2024 increased by 37.6% and 75.2% respectively over the same period last year; the proportion of transactions via iPAY of individual customers reached 92.2% and via the eFast channel of corporate customers reached 84%.

VietinBank continues to affirm its leading position in the market with a series of modern, superior payment solutions.

VietinBank has deployed many new payment products and services such as: Account and investment service package for financial institution customers; Electronic payment package in State budget revenue and expenditure activities... applying digital management technology (DSM) to allow customers to conduct transactions remotely, safely and marking a big step forward in the bank's digital transformation process.

Not stopping at the domestic market, VietinBank also pioneered the development of cross-border payment services using QR codes between Vietnam and Thailand - a breakthrough project in the field of international payments. This success continued to expand to the Lao market, helping to facilitate cross-border trade and strengthen the CASA source from international customers.

In parallel with the expansion of the payment ecosystem, VietinBank has established cooperative relationships with major partners such as hospitals, schools, public administrative agencies to develop single payment and tuition fee services; combined with a variety of card payment products with major organizations such as JCB, other payment partners such as: VNPAY , InfoPlus, Vbis...

These strategic solutions have helped VietinBank not only maintain the iconic CASA growth rate but also reduce the cost of capital (COF), improve net profit margin (NIM) and affirm its pioneering position in the field of modern digital payments. In the coming time, VietinBank will continue to apply and develop digital transformation initiatives and solutions to meet the ability to process a large number of transactions in the future, continue to modernize the payment system to create a foundation to promote business activities and bring customer satisfaction and engagement.

Thuy Nga

Source: https://vietnamnet.vn/vietinbank-duy-tri-da-tang-truong-tien-gui-toi-uu-hoa-nguon-von-huy-dong-2344572.html

![[Photo] The Standing Committee of the Organizing Subcommittee serving the 14th National Party Congress meets on information and propaganda work for the Congress.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763531906775_tieu-ban-phuc-vu-dh-19-11-9302-614-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and his wife meet the Vietnamese community in Algeria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763510299099_1763510015166-jpg.webp)

![[Photo] General Secretary To Lam receives Slovakian Deputy Prime Minister and Minister of Defense Robert Kalinak](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/18/1763467091441_a1-bnd-8261-6981-jpg.webp)

Comment (0)