On October 3, Vietcombank reduced the interest rate for deposits of 3 months or more by 0.2 percentage points. The online interest rate for 3-5 month terms dropped to 3.3%/year. The 6-11 month term dropped to 4.3%/year and the 12-24 month term dropped to 5.3%/year. This is the lowest interest rate for this bank.

Vietcombank keeps the interest rate for 1-2 month term at 3%/year.

The remaining three banks in the “Big 4” group remain “inactive”. At 8am on October 4, the interest rates of these banks remained unchanged. In fact, the mobilization interest rates of the group of state-owned commercial banks are much lower than the general banking interest rate level.

The online deposit interest rate for a 1-2 month term at BIDV is currently 3.2%/year, while the same term at VietinBank and Agribank is 3.4%/year.

Interest rate for 3-5 month term deposits at BIDV is 3.7%/year, while at Agribank and VietinBank it is 3.85%/year.

Interest rate for 6-11 month term deposits at BIDV is 4.6%/year while at Agribank and VietinBank it is 4.7%/year.

For deposits with terms from 12-36 months, all three banks are applying the same interest rate of 5.5%/year.

Today, Vietnam Thuong Tin Commercial Joint Stock Bank (VietBank) reduced 0.2 percentage points of interest rates for 1-5 month deposits and 0.3 percentage points for 6-13 month deposits.

Specifically, the 1-5 month term at VietBank is 4.55%/year, the 6-8 month term is 5.7%/year, the 9-11 month term is only 5.8%/year, while the 12-13 month term is 6 and 6.1%/year respectively.

The term from 15-36 months remains at 6.8%/year, this is the highest interest rate currently of this bank.

Dong A Commercial Joint Stock Bank (Dong A Bank) also sharply reduced deposit interest rates today by 0.5 percentage points for deposits with terms from 6-13 months and by 0.7 percentage points for deposits with terms from 18-36 months.

Interest rates for 6-8 month terms have dropped to 5.7%/year, 9-11 month terms to 5.8%/year, 12 month terms to 6.05%/year. 13 month terms are now 6.3%/year and are also the deposit terms with the highest interest rates at Dong A Bank.

Meanwhile, the 18-36 month term, after a 0.7 percentage point reduction, is now 6.05%/year. The interest rate for the 1-5 month terms remains at 4.5%/year.

Notably, GPBank unexpectedly increased the interest rate for deposits with terms from 6 to 36 months. The 1-5 month term remains at 4.25%/year. However, the 6 month term increased by 0.3 percentage points compared to yesterday.

GPBank also adjusted the interest rates for the remaining terms up by 0.3 percentage points. The 7-8 month term increased to 5.5%/year, the 9 month term increased to 5.55%/year, the 12 month term increased to 5.65%/year, and the 13-36 month term increased to 5.75%/year.

Despite the increase, GPBank is still among the banks applying the lowest interest rates in the market today when all terms are under 6%/year.

Thus, since the beginning of October, 8 banks have reduced deposit interest rates including: VietBank, Dong A Bank, Vietcombank, LPBank, Nam A Bank, CBBank, ACB and Bac A Bank.

Meanwhile, only one bank has increased interest rates, GPBank.

| HIGHEST DEPOSITS INTEREST RATE TABLE ON OCTOBER 4 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| VIETCOMBANK | 3 | 3.3 | 4.3 | 4.3 | 5.3 | 5.3 |

| BIDV | 3.2 | 3.7 | 4.6 | 4.6 | 5.5 | 5.5 |

| VIETINBANK | 3.4 | 3.85 | 4.7 | 4.7 | 5.5 | 5.5 |

| AGRIBANK | 3.4 | 3.85 | 4.7 | 4.7 | 5.5 | 5.5 |

| ABBANK | 3.7 | 3.9 | 4.9 | 4.9 | 4.7 | 4.4 |

| ACB | 3.5 | 3.7 | 5 | 5.1 | 5.5 | |

| TPBANK | 3.8 | 4 | 5 | 5 | 5.55 | 6 |

| MSB | 3.8 | 3.8 | 5 | 5.4 | 5.5 | 5.5 |

| TECHCOMBANK | 3.65 | 3.85 | 5.15 | 5.2 | 5.45 | 5.45 |

| VPBANK | 4.1 | 4.15 | 5.2 | 5.2 | 5.5 | 5.1 |

| MB | 3.6 | 3.8 | 5.2 | 5.3 | 5.6 | 6.3 |

| SEABANK | 4.5 | 4.5 | 5.2 | 5.35 | 5.5 | 5.5 |

| EXIMBANK | 4 | 4 | 5.2 | 5.5 | 5.6 | 5.8 |

| NAMA BANK | 4.65 | 4.65 | 5.2 | 5.3 | 5.8 | 6.4 |

| LPBANK | 4.15 | 4.35 | 5.3 | 5.4 | 6.1 | 6.8 |

| OCB | 4.1 | 4.25 | 5.3 | 5.4 | 5.5 | 5.9 |

| KIENLONGBANK | 4.75 | 4.75 | 5.4 | 5.6 | 5.7 | 6.4 |

| GPBANK | 4.25 | 4.25 | 5.45 | 5.35 | 5.65 | 5.75 |

| SACOMBANK | 3.7 | 3.7 | 5.5 | 5.8 | 6.2 | 6.4 |

| VIB | 4.75 | 4.75 | 5.6 | 5.6 | 6.2 | |

| PG BANK | 4 | 4 | 5.6 | 5.6 | 5.7 | 6.4 |

| SHB | 4 | 4.3 | 5.7 | 5.8 | 6.1 | 6.4 |

| SAIGONBANK | 3.6 | 4 | 5.7 | 5.7 | 5.9 | 5.9 |

| VIETBANK | 4.55 | 4.55 | 5.7 | 5.8 | 6 | 6.8 |

| DONG A BANK | 4.5 | 4.5 | 5.7 | 5.8 | 6.05 | 6.05 |

| SCB | 4.75 | 4.75 | 5.75 | 5.85 | 6.05 | 6.05 |

| BVBANK | 4.4 | 4.7 | 5.75 | 5.9 | 6.05 | 6.15 |

| OCEANBANK | 4.6 | 4.6 | 5.8 | 5.9 | 6.1 | 6.5 |

| BAC A BANK | 4.75 | 4.75 | 5.9 | 6 | 6.1 | 6.25 |

| CBBANK | 4.2 | 4.3 | 6 | 6.1 | 6.3 | 6.4 |

| HDBANK | 4.45 | 4.45 | 6.1 | 6.1 | 6.3 | 6.5 |

| VIET A BANK | 4.6 | 4.6 | 6.1 | 6.2 | 6.5 | 6.6 |

| BAOVIETBANK | 4.4 | 4.75 | 6.1 | 6.3 | 6.5 | 6.5 |

| NCB | 4.75 | 4.75 | 6.3 | 6.35 | 6.4 | 6.4 |

| PVCOMBANK | 4.25 | 4.25 | 6.4 | 6.4 | 6.5 | 6.8 |

Source

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

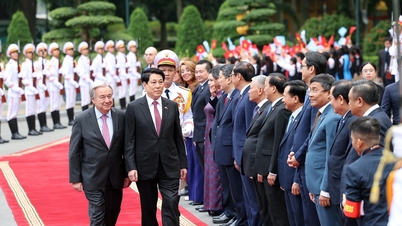

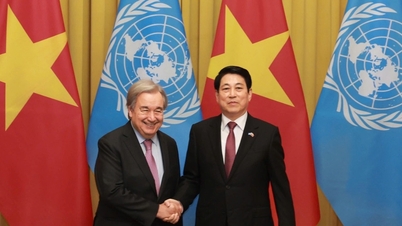

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

Comment (0)