Being in the TOP of countries subject to the highest reciprocal tax rates from the US, KBSV Vietnam believes that FDI disbursement in Vietnam will tend to decrease in the next 1-2 years. However, after this period, FDI disbursement may recover and be offset by FDI enterprises targeting export markets outside the US...

April 2, 2025 – “Liberation Day”, the US President Donald Trump’s administration announced import tariffs on more than 180 economies. Of which, Vietnam is among the TOP countries with the highest reciprocal tariffs. Donald Trump himself has also seen negative impacts on the US economy. However, from Donald Trump’s perspective, this is positive to achieve the goal of “America First” and increase competitiveness with China in the long term.

In addition, in Tradewar 1.0, American businesses faced higher import costs when tariffs were imposed, but the goods they received were still sourced from China (due to the evasion of origin to other countries), Donald Trump considered this negative. Therefore, with the current moves, the Analysis Department of KB Securities Vietnam Company (KBSV Research) believes that Donald Trump will adopt a tougher stance in Tradewar 2.0, especially towards trading partners with a large proportion of Chinese goods "disguised" as exports to the US, including Canada, Mexico, Vietnam, etc.

Accordingly, KBSV Research forecasts that FDI enterprises will tend to temporarily suspend disbursement for previously registered new factory investment projects. At the same time, they will cut production in industries that are susceptible to short-term impacts.

Industries such as garments, furniture, seafood, and steel will be immediately negatively impacted. It is estimated that this group of products accounts for 10% of Vietnam's total export turnover. This means that if these export orders are affected, Vietnam's total export turnover could decrease by up to 10% because it may only take 3-6 months to shift orders to partners with lower tax rates than Vietnam and the risk of a global recession increases, reducing consumer demand.

For the electronic components, electrical equipment, and high-tech industries, the impact is still moderate (accounting for about 17% of Vietnam's total export turnover) because the transfer of orders to other countries faces more obstacles in terms of factories, investment costs, and labor resources. In addition, these are products that play an auxiliary role for industrial and high-tech production activities in the US, so there is a basis to expect that Vietnam can negotiate and negotiate for D. Trump to consider reducing the tax rate applied to these products. In addition, under Tradewar 1.0, these products are also excluded from the list of US import taxes on China.

In the long term, Vietnam will lose its competitive advantage in attracting FDI enterprises to export to the US when the 46% reciprocal tax rate that Vietnam has to pay is significantly higher than that of other competing countries such as India, Indonesia, the Philippines and Malaysia... This creates a big disadvantage for Vietnam in attracting FDI enterprises targeting the US export market.

Although Vietnam has the ability to negotiate tax reductions, FDI enterprises have somewhat recognized the escalation trend and D. Trump's direction in Tradewar 2.0. This has caused new FDI enterprises to temporarily stop disbursing capital to Vietnam, worrying about the costs and risks of investing in factories in Vietnam.

Meanwhile, FDI enterprises operating in Vietnam may cut capacity. The production capacity for export to the US market – estimated at about 30% – is likely to be gradually reduced in Vietnam. Instead, enterprises tend to shift this capacity to other countries with lower tariffs.

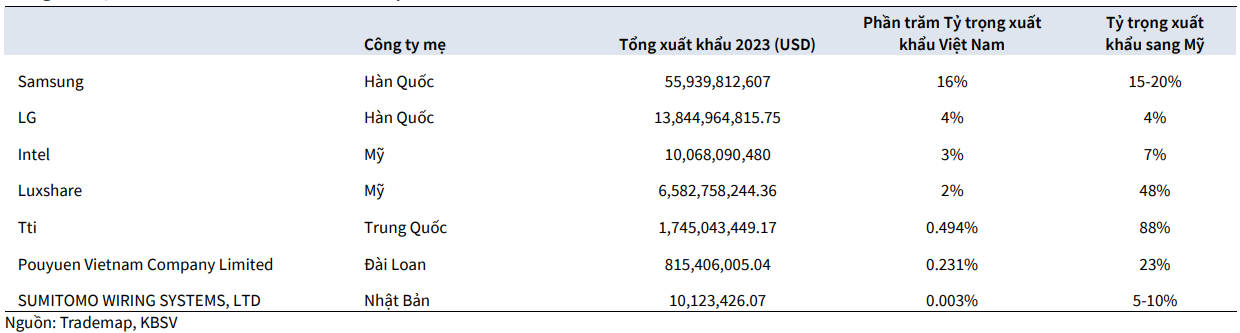

However, experts at KBSV expect that the disbursed FDI capital flow can recover and be offset by FDI enterprises with export markets outside the US, thanks to Vietnam still maintaining advantages in terms of cheap labor force, favorable location for trade, policies to attract FDI capital, etc. Some FDI enterprises with relatively large export markets outside the US in Vietnam such as Samsung, LG, Intel. However, in the short term (next 1-2 years), these enterprises may temporarily stop expanding investment in Vietnam, due to excess capacity from the output serving the US market and needing more time to shift orders to other markets.

Vietnam still has a chance to negotiate a reduction in tariffs. April 9 is the deadline for the US to impose reciprocal tariffs. Based on Donald Trump's previous actions, KBSV believes that Vietnam's negotiation efforts can help reduce reciprocal tariffs to a lower level. At the same time, Vietnam can also take advantage of this opportunity to convince the US to reduce tariffs on important raw materials and auxiliary products for the US manufacturing industry, including electronic components, electrical and electronic equipment, and products supporting the production of semiconductor chips. This will continue to attract FDI in this industry in the long term.

Source: https://baodaknong.vn/viet-nam-co-the-mat-loi-the-canh-tranh-trong-viec-thu-hut-doanh-nghiep-fdi-xuat-khau-den-my-248620.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)