Accordingly, products subject to tax include flat-rolled carbon steel in coil and uncoil form, with a carbon content of less than 0.6% by mass, coated, plated or covered with corrosion-resistant metals such as zinc, aluminum or iron-based alloys, regardless of thickness and width.

Some products not subject to the tax include: Steel coated, plated or coated with chromium or chromium oxide; galvanized steel, zinc-aluminium alloy or zinc-aluminium alloy if additionally coated with chromium or chromium oxide; steel coated, plated or coated with zinc by electrolysis; and stainless steel.

The tax rate applied to Chinese enterprises and organizations is up to more than 37.1%, specifically including a number of enterprises such as Baoshan Iron & Steel, Shanghai Meishan Iron, Baosteel Zhanjiang Iron, Wuhan Iron...

For Korean companies, Hyundai Steel Company is subject to a 13.7% tax rate, and other manufacturers and exporters from Korea are subject to a 15.6% tax rate.

The Ministry of Industry and Trade may amend and supplement the list of HS codes of goods subject to temporary anti-dumping tax to conform to the description of investigated goods and other changes.

Previously, on February 21, the Ministry of Industry and Trade also issued a decision to impose temporary anti-dumping tax on some hot-rolled steel (HRC) products from China, with an application period of 120 days, starting from March 8, 2025. The tax rate in this period ranges from 19.3 - 27.8%. This move puts pressure on domestic HRC prices - an important input material for galvanized steel production, thereby affecting the costs and competitiveness of domestic steel enterprises.

The Vietnam Steel Association (VSA) and steel industry enterprises have sent a petition to the Ministry of Industry and Trade, requesting an early conclusion on the anti-dumping investigation into galvanized steel (AD19 case).

VSA said that after the anti-dumping measure on galvanized steel (AD02 case) expired in 2022, the amount of galvanized steel imported from China increased dramatically, accounting for more than 60% of the total import volume in 2023. This is the main factor putting pressure on the domestic steel industry, creating an urgent need to re-establish trade defense tools to protect domestic production.

(According to TPO)

Source: https://baoyenbai.com.vn/12/348104/Viet-Nam-ap-thue-chong-ban-pha-gia-thep-ma-Trung-Quoc-Han-Quoc.aspx

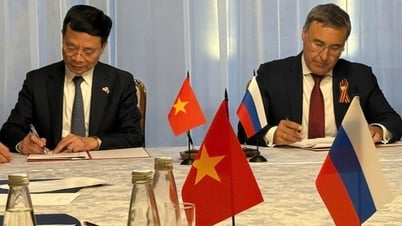

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)