According to statistics from data from a number of securities companies, the estimated after-tax profit of listed banks in the fourth quarter of 2023 increased by 25% compared to the same period last year. The profit of banks improved in the last quarter of the year mainly due to banks increasing lending as well as a sharp decrease in capital costs.

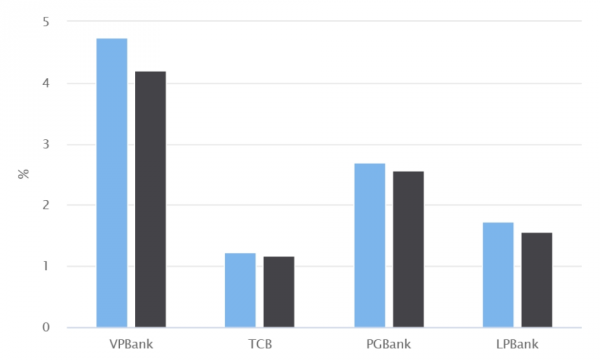

However, asset quality remains a notable point in the 2023 business results picture. The industry-wide bad debt ratio is at 2.2%, up 64 basis points compared to 2022 and the highest level since 2015.

Almost all banks continued to record an increase in bad debt ratio compared to the beginning of the year and previous quarters. On average, state-owned commercial banks had an increase of 0.4% compared to the beginning of the year, while the figure for joint-stock commercial banks was 0.7%. At the same time, the bad debt coverage ratio also decreased to its lowest level since the end of 2020, recording 93.8% (in 2022, this ratio will be 136.9%).

For example, TPBank's Q4/2023 Financial Report shows that although total operating income grew strongly, the Bank's net profit in this quarter decreased by 67.5% compared to the same period in 2022.

The sharp decline in profits in the fourth quarter has caused TPBank's net profit for the whole year of 2023 to decrease by 28.7% compared to 2022, reaching VND4,463 billion.

The reason is that provisioning costs in the fourth quarter of 2023 increased sharply, more than 17 times higher than the same period, pushing provisioning costs for the whole year to VND 3,946 billion, an increase of 114% compared to 2022.

Notably, at the end of the fourth quarter of 2023, TPBank's bad debt ratio was 2.05%, down 0.93 percentage points compared to the previous quarter, but still high compared to 0.84% at the end of 2022.

The provisioning boost in the last quarter of 2023 will bring the bank's bad debt coverage ratio (LLR) to 63.7% by the end of 2023, but it is still much lower than the 135% at the end of 2022, suggesting that asset quality may continue to deteriorate in the coming time.

Despite having the lowest bad debt ratio in the system, accounting for only 1.2% of total outstanding loans at the end of last year, ACB's bad debt figure has reached VND 5,885 billion, an increase of 93% compared to the end of 2022. Credit risk provisioning costs also increased dramatically from VND 70 billion in 2022 to VND 1,804 billion in 2023.

Regarding the bad debt story of the banking industry, financial analyst Dr. Nguyen Duy Phuong, Director of Investment at DG Capital, said that while the shortcomings of 2023 have not been overcome, looking towards 2024, risk factors are present, coming from the slower-than-expected recovery speed of credit demand and continued deterioration in asset quality.

Some contents on handling bad debts and collateral in Resolution 42/2017/QH14 have been officially legalized in Chapter XII, Law on Credit Institutions amended in 2024.

"However, there are still many issues to worry about as the newly issued revised Law on Credit Institutions has removed regulations on seizing secured assets, seizing assets of the party subject to enforcement, returning secured assets as evidence in criminal cases, administrative violations of bad debt; as well as not expanding the subjects participating in buying and selling bad debt, which may make bad debt handling activities more difficult.

From that, it can be seen that the process of handling bad debt will need more time and banks that have good buffers and capital buffers will have more advantages," Dr. Nguyen Duy Phuong stated his opinion.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Video]. Building OCOP products based on local strengths](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/61677e8b3a364110b271e7b15ed91b3f)

Comment (0)