Tax experts note that authorizing tax settlement is a 'double-edged sword'. Organizations and businesses need to be careful when authorizing personal income tax settlement on behalf of employees.

Many taxpayers still do not know whether they are authorized to settle personal income tax (PIT) for the company/organization they are working for.

For example, if a taxpayer signs a labor contract with a company for 6 months (applying the progressive tax schedule) and a collaborator contract for 6 months (applying the temporary tax rate - 10%), should he authorize the settlement or settle it himself?

Sharing about this issue at a recent tax settlement workshop, Mr. Trinh Hong Khanh, Director of Ba Mien Accounting - Tax Consulting Company Limited, advised employees with many types of income that if the company/organization paying the income agrees, they should authorize the company/organization to settle the tax on their behalf.

However, from an accounting perspective, Mr. Phan Tuan Nam, co-founder of Webketoan Academy, noted that the company/organization paying income should not authorize the settlement on behalf of the employee in this case because it is quite risky.

The reason is, who knows, that worker may have additional income from many other places, and will certainly be subject to self-determining personal income tax.

“If the accountant does not know clearly whether the employee has a lot of income or not, they should let them settle the tax themselves. In case of having many different sources of income, the employee must proactively calculate whether they can get a tax refund or have to pay more tax, and how much tax will be incurred. Calculating according to the progressive tax table will be much lower than deducting 10%. Some cautious accountants will not authorize tax settlement in this case,” Mr. Nam said.

In the past 3 years, when providing tax consultancy to businesses, Ms. Hoang Thi Tra Huong, Deputy Director of Zbiz Center underFPT IS, often warned that authorizing settlement on behalf of businesses is a "double-edged sword".

According to her, if employees cannot determine their own source of income, they should only be supported to make their own settlement. The enterprise/organization paying the income should not authorize the settlement because the employees themselves may not have collected enough documents to make the personal income tax settlement file.

In fact, many employees work in many places in 1 year (mainly delivery staff, sales staff...), but company accountants subjectively choose to authorize tax settlement while the employee does not authorize, which can easily lead to tax risks.

Experts recommend that accountants should proactively ask employees or post notices and send emails to employees in the company. Only if they are eligible to authorize personal income tax settlement can they accept settlement on behalf of employees.

* Personal income tax settlement dossier for 2024 with income paying organization includes: + Personal income tax finalization declaration: Form 05/QTT-TNCN (in Circular 08/2021/TT-BTC). + Detailed list of individuals subject to tax calculation according to the progressive tax schedule: Form 05-1/BK-QTT-TNCN (in Circular 08/2021/TT-BTC). + Detailed list of individuals subject to tax calculation at full tax rate: Form 05-2/BK-QTT-TNCN (in Circular 08/2021/TT-BTC). + Appendix of detailed list of dependents for family deduction: Form 05-3/BK-QTT-TNCN (in Circular 08/2021/TT-BTC). |

* Personal income tax settlement documents for 2024 for individuals include: + Personal income tax finalization declaration: Form 02/QTT-TNCN (in Circular 08/2021/TT-BTC). + Personal income tax deduction certificate: Form 03/TNCN (in Decree 123/2020/ND-CP). + Income confirmation letter: Form 20/TXN-TNCN - reference form (in Circular 156/2013/TT-BTC). |

Source: https://vietnamnet.vn/uy-quyen-quyet-toan-thue-thu-nhap-ca-nhan-la-con-dao-hai-luoi-2377717.html

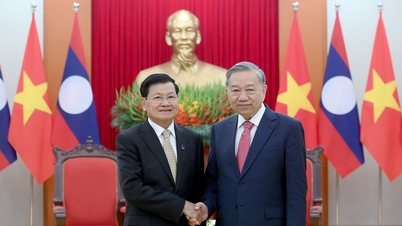

![[Photo] General Secretary To Lam meets with General Secretary and President of Laos Thongloun Sisoulith](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761380913135_a1-bnd-4751-1374-7632-jpg.webp)

![[Photo] President Luong Cuong receives heads of delegations attending the signing ceremony of the Hanoi Convention](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761377309951_ndo_br_1-7006-jpg.webp)

![[Photo] President Luong Cuong and United Nations Secretary-General Antonio Guterres chaired the signing ceremony of the Hanoi Convention.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761370409249_ndo_br_1-1794-jpg.webp)

Comment (0)