DNVN - Prime Minister Pham Minh Chinh asked leaders of commercial banks to focus on discussing, providing solutions, and answering the question "Why do businesses complain about lack of capital and difficulty in accessing credit capital, while the amount of deposits of economic organizations and residents in the banking system is still very large...?".

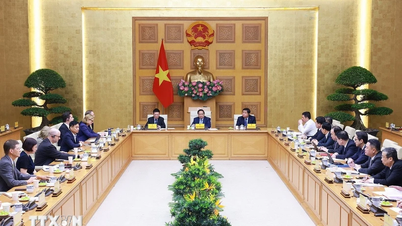

Speaking at the opening ceremony of the conference on implementing monetary policy management tasks in 2024 focusing on removing difficulties for production and business on the morning of March 14 in Hanoi, Prime Minister Pham Minh Chinh assessed that the economy is recovering in all areas.

However, the world economy in 2024 is assessed to still face many difficulties due to many different reasons. Therefore, although Vietnam's economy has improved, progressed, recovered, and is highly appreciated by international organizations, there are still shortcomings, limitations, and it continues to face many difficulties and challenges, and difficulties and challenges can come at any time.

Regarding monetary policy, in recent times, the Government and the Prime Minister have directed drastic, synchronous, specific and practical management. The State Bank has tried to operate proactively, flexibly, appropriately and effectively, businesses have made efforts to restructure their operations to suit the situation, and credit institutions have also shared to have better capital flow.

However, the head of the Government said that it is necessary to frankly acknowledge that credit growth in the first two months of 2024 decreased compared to the end of 2023 while the amount of deposits is still very large (14 million billion VND).

Prime Minister Pham Minh Chinh delivered an opening speech at a conference on implementing monetary policy management tasks in 2024, focusing on removing difficulties for production and business. (Photo: VGP)

Lending interest rates remain high, bad debt tends to increase, and the handling of weak commercial banks is slow. Some credit programs are ineffective.

Accordingly, the Prime Minister asked delegates, especially Chairmen and General Directors of commercial banks, to focus on discussing and providing specific answers and solutions to 6 basic issues.

Firstly, how to manage monetary policy, especially interest rates and exchange rates, to prioritize promoting growth (about 6-6.5%) and maintaining macroeconomic stability, controlling inflation, and ensuring major balances of the economy.

Second, why do businesses complain about lack of capital and difficulty in accessing credit capital, while the amount of deposits from economic organizations and residents in the banking system increases, even though the mobilization interest rate continuously decreases? Where is the bottleneck, what is the cause? Is it due to regulations, management, caution or locality?

Third, is the credit supply situation of the banking system for the economy, each industry and sector good? What are the bottlenecks, causes, and solutions to overcome them, ensuring that capital supply is not blocked, delayed, or untimely? How can credit supply be focused, key, and concentrated for production and business?

Fourth, what solutions are needed to increase access to credit capital for businesses and people? Especially solutions on interest rates, procedures, loan applications, collateral, guarantees, communication and technology measures...?

Fifth, what should commercial banks do to ensure annual credit growth of about 15% as assigned by the State Bank at the beginning of the year? How can we continue to reduce lending interest rates so that the banking system can share the difficulties with people and businesses?

Sixth, what should the Government, the State Bank, ministries, sectors and localities do, what should the business community and people do to stimulate investment and consumption, and increase the capital absorption capacity of people and businesses? What tools are needed? For example, a Credit Guarantee Fund for small and medium enterprises?

The Prime Minister asked delegates to focus on discussion, speak frankly, without embellishment or blackening, clearly pointing out what has been done and what has not been done. Present objective and subjective causes, lessons learned, and key issues that need to be resolved. At the same time, propose and recommend to the Government, the State Bank, ministries, branches, and localities, partially answering the raised questions.

Moonlight

Source

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)