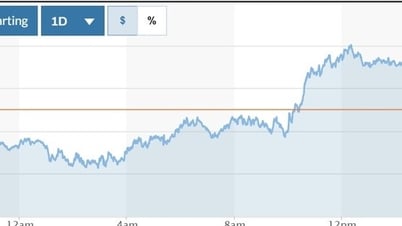

At the close of the session on April 3, VN-Index dropped nearly 88 points - the strongest level in the trading history of nearly 25 years. This index fell to nearly 1,230 points, wiping out all the accumulated achievements since mid-January. In terms of relative scores, VN-Index lost 6.68% - close to the maximum fluctuation range of 7% according to the trading regulations of the market management agency.

517 stocks decreased in price, equivalent to more than 96% of the codes on the HoSE. More than half of these lost all their amplitude and had no buyers, while the remaining volume of some codes sold amounted to tens of millions of shares. Not only the export group, the selling pressure also spread to less affected industries such as electricity and water, public investment...

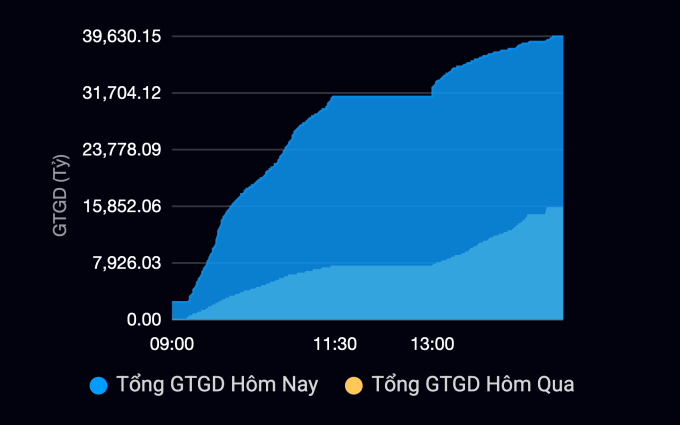

The only positive point is that the absorption force is very strong, thanks to which the market liquidity also reached a record high, with 1.76 billion shares successfully transferred on the Ho Chi Minh City Stock Exchange. The transaction value accordingly reached 39,630 billion VND (more than 1.5 billion USD), double that of April 2.

Mr. Tran Minh Hoang, Director of Analysis and Research at Vietcombank Securities (VCBS), said that the cash flow was clearly differentiated. In the morning, liquidity reached more than VND31,000 billion and there were not too many stocks left to sell at the floor price. This is a positive development, showing that the "bottom-fishing" cash flow actively went hand in hand with the selling force.

However, in the afternoon session, the market sentiment worsened as liquidity increased and the index decreased. Even stocks with low impact from US reciprocal tax fell to their lowest levels, showing that the negative side had the advantage. The selling pressure brought to the floor was greater than the buying power of the active "bottom-fishing" cash flow.

"This is an overreaction of the market because clearly, we do not have any more specific information and there is still time to negotiate with the US before the reciprocal tax takes effect. I believe that Vietnam still has a chance," Mr. Hoang commented, adding that the market "should be calm to have a more moderate reaction."

Without commenting on whether the market is overreacting or not, Mr. Pham Hoang An, Head of Analysis Department of Thanh Cong Securities (TCSC), said that the mass sell-off by investors is an "understandable reaction" when the US's 46% reciprocal tax rate exceeds the predictions of many analysts.

The reason why industries are less affected by tariff policies is not only due to the importance of exports in the economy , but also due to margin call pressure.

Mr. An gave an example of an investor holding a group of seafood and banking stocks in his portfolio and being subject to margin calls. When the seafood stocks hit the floor and lost liquidity, the securities company was forced to sell the bank stocks to recover the debt. This created a cross-influence that spread throughout the market.

According to independent analyst Huynh Hoang Phuong, in a market panic session due to bad news, investors do not have time to analyze which codes or groups are affected. The general trend is still a series of declines.

Regarding Mr. Trump's tariff policy, Mr. Phuong said that this is bad news that affects the whole economy, but it is difficult for investors to quantify the level of impact. At that time, the general mentality will be to prioritize defense by diversifying asset classes, instead of taking refuge in one asset class. That is part of the reason why many people choose to sell stocks to find a safer channel to preserve cash flow.

1.76 billion shares were sold, meaning that the same number of stocks were bought. Strong demand appeared in the morning, helping liquidity reach more than 31,000 billion VND and not recording too many stocks left to sell at the floor price. Many investors see today's decline as a good opportunity to "buy cheap goods".

Mr. Nhat Huy (Thu Duc City, Ho Chi Minh City) bought "a fair amount" of VNM and SAB, but did not disclose the specific amount. This investor believes that the stock prices of Vinamilk and Sabeco are "too cheap" compared to their history. VNM closed the session at VND56,500, while SAB was at VND45,850.

Meanwhile, Ms. Bich Huong (Binh Thanh District, Ho Chi Minh City) chose to buy HPG from Hoa Phat and VCB from Vietcombank at the prices of VND25,350 and VND60,300, respectively. This investor explained that Hoa Phat exports steel, an item in the old 25% tariff group of the US, so it will not be too affected in the future.

As for Vietcombank, her investment experience shows that the probability of bank stocks leading the recovery wave after each "crash" is very high, suitable for holding and waiting for the market to accumulate again.

"In my experience, the group buying stocks at this time is not organizations, most likely it is individual investors who have good faith in the market and the prospects of the stocks they buy," said Mr. Tran Minh Hoang.

In fact, for the whole session, foreign investors net sold nearly VND3,700 billion on the HoSE, while securities companies' self-trading net bought more than VND812 billion. This figure only corresponded to nearly 22% of foreign investors' net selling. The above level was also lower than some previous sessions, most recently on March 19 when self-trading net bought more than VND1,124 billion.

Looking at the overall perspective, Mr. Huynh Hoang Phuong said that the liquidity explosion is a common phenomenon every time the market falls into a panic session. This has been seen in sharp declines in 2022 or most recently in the third quarter of 2023.

"Currently, many investors believe that there is still time to negotiate after the US imposes reciprocal tariffs. This will be the group ready to 'buy the bottom'," the expert said.

However, Mr. Phuong said that it is not reasonable to consider this as the bottom to "catch" when the probability of further decline is still there because when the market panics, the decline cannot stop in just one session. Market history shows that stocks need a certain period to absorb all the stocks sold due to panic.

"Today's session is nothing compared to previous sessions. The market's P/E needs to decrease by at least 5-7% to show signs of absorbing enough stocks sold off due to bad news, unless there is a change in the US's reciprocal tax rate," Mr. Phuong predicted.

In the current situation, experts and analysts of many securities companies all advise investors to stay calm, stay out of the market and observe further, and avoid opening positions when all fluctuations are still unpredictable.

For those who still want to participate in "bottom fishing", Mr. Nguyen Trong Dinh Tam, Deputy Director of Investment Strategy, Analysis Center of Thien Viet Securities (TVS), advises to monitor the important short-term event on April 9 - the expected time of official tax imposition.

This expert added that in the scenario of lower tariffs or the US considering extending the tax deadline for Vietnam, and the stock market being in a balanced state with low volume, disbursing to buy stocks will be less risky for investors.

The areas to watch will be those with business activities mainly concentrated in the domestic market (securities, real estate), while banks can consider but should prioritize representatives without significant outstanding debt from the export sector.

VN (according to VnExpress)Source: https://baohaiduong.vn/vi-sao-thanh-khoan-dot-bien-trong-phien-chung-khoan-giam-88-diem-408692.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)