Ms. Le Thi Tu was born in 1961 and retired on January 1, 2018 with 20 years of compulsory social insurance (SI).

At the time of retirement, Ms. Tu received a pension equal to 55% of the average salary used as the basis for social insurance contributions. Her pension was lower than the basic salary at that time, so it was adjusted to increase to the basic salary of 1,300,000 million VND.

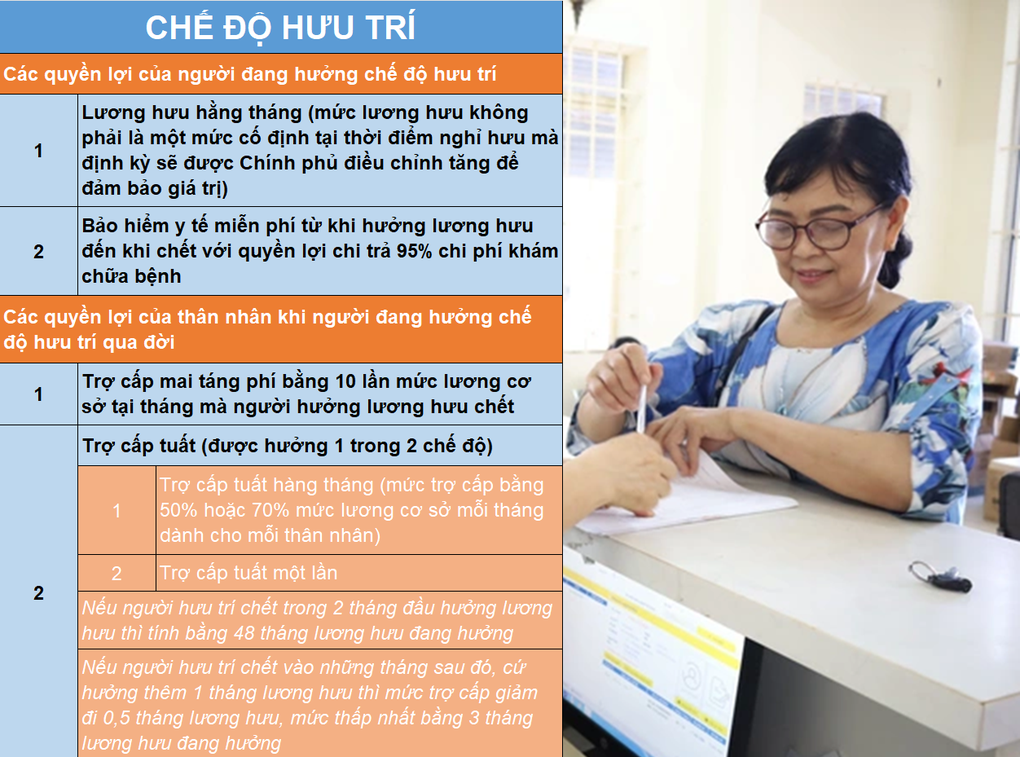

People receiving pensions in Ho Chi Minh City (Photo: Ho Chi Minh City Social Insurance).

Through the process of increasing the basic salary, at the time of June 2024, Ms. Tu will receive a pension of 1,800,000 VND/month.

By July 2024, Ms. Tu's pension will increase by 15% compared to June 2024, to VND 2,070,000/month.

Ms. Tu wondered: "Let me ask, is the development of my pension correct? Why am I not entitled to a pension of 2,340,000 VND/month but only 2,070,000 VND/month?"

According to Ms. Tu, she should have received the lowest salary for a mandatory social insurance participant, which is equal to the basic salary, which is 2,340,000 VND/month according to the provisions of the Social Insurance Law 2014.

According to Vietnam Social Security, Ms. Tu's pension was settled on January 25, 2018, with a total monthly pension of VND 1,300,000. Of which, Ms. Tu's monthly pension is VND 748,266, the compensation level to equal the basic salary is VND 551,734. The pension period is calculated from January 1, 2018.

Ms. Tu's pension at this time is resolved based on two bases: the 2014 Social Insurance Law and Decree No. 153/2018/ND-CP (stipulating pension adjustment policy for female employees who start receiving pension in the period from 2018 to 2021 with a social insurance payment period of 20 years to 29 years and 6 months).

According to Clause 5, Article 56 of the Law on Social Insurance 2014, the lowest monthly pension level of employees participating in compulsory social insurance who are eligible for pension is equal to the basic salary level.

According to Clause 2, Article 3 of Decree No. 153/2018/ND-CP, Ms. Tu's pension adjustment level (compulsory social insurance payment for 20 years, retirement in 2018) is 7.27%. The pension level used as the basis for adjustment is the actual salary (not yet compensated by the basic salary).

Ms. Tu's actual pension as of January 2018 was 748,266 VND/month. After adjustment according to Decree No. 153/2018/ND-CP, Ms. Tu's pension adjustment is calculated by multiplying 748,266 VND/month by 7.27%, equal to 54,399 VND. Thus, the total pension after adjustment is 802,665 VND/month.

The above pension level is lower than the basic salary at the time of January 2018 (1,300,000 VND). Therefore, Ms. Tu's pension is compensated by an additional 497,335 VND/month to equal the basic salary (1,300,000 VND/month) according to the provisions of Clause 5, Article 56 of the Law on Social Insurance 2014.

The most recent salary increase adjustment is from July 1, 2024 according to Decree No. 75/2024/ND-CP. Accordingly, the additional adjustment is 15% on the pension, social insurance benefits and monthly allowances of June 2024.

From January 2018 to June 2024, Ms. Tu's pension was adjusted many times and the benefit level in June 2024 is 1,800,000 VND/month. According to Decree No. 75/2024/ND-CP, her pension from July 2024 will be increased by 15% compared to June 2024, which is 2,070,000 VND/month.

According to Vietnam Social Security, the regulation on calculating the monthly pension benefit level to be compensated to equal the basic salary level only applies at the time Ms. Tu begins to receive pension benefits (ie January 2018).

For subsequent salary increases, it will be based on the Government 's adjustment decision and will not be calculated according to the regulation that the lowest salary must be equal to the basic salary.

Source: https://dantri.com.vn/an-sinh/vi-sao-co-nguoi-nhan-luong-huu-thap-hon-luong-co-so-20240904005251549.htm

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)