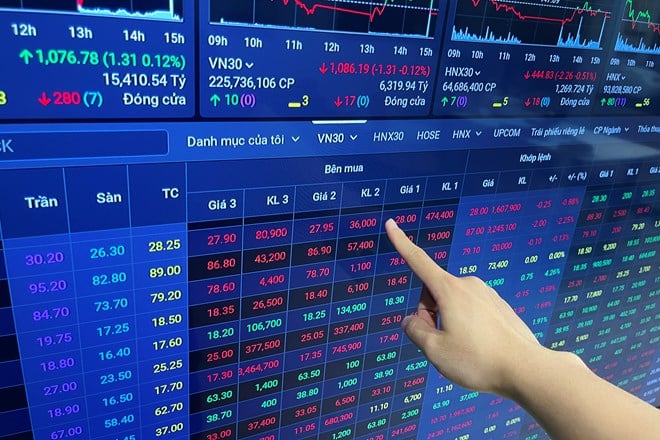

The stock market ended a volatile trading week (November 13-17) with the VN-Index closing at 1,101.2 points, a slight decrease of 0.1% compared to the end of last week. The HNX-Index recorded a decrease of 0.1% to 226.54 points and the UPCOM-Index lost 0.01% to close at 86.02 points.

This week, 3 stocks of Vingroup had the strongest impact on the general index with VHM (-7.9%), VIC (-6.1%), VRE (-4.8%) taking away a total of 7 points from the VN-Index. On the contrary, large-cap stocks such as BID (+1.7%), MSN (+3.9%), MWG (+5.1%) and GVR (+2.3%) supported and restrained the market's decline.

The positive signal last week came from liquidity when the average trading value on all three exchanges continued to increase slightly by 4.6% compared to the previous week, reaching VND21,243 billion/session. Foreign investors continued to sell off when the VN-Index was above the 1,110-point price range. They were net sellers on HOSE with a value of VND1,346 billion this week, up 11% compared to the previous week. The net buying trend on HNX and UPCOM reversed this week after foreign investors recorded net selling values of VND118 billion and VND86 billion, respectively.

According to the assessment of Mr. Dinh Quang Hinh - Head of Macro and Market Strategy Department, VNDIRECT Securities Company, the recovery trend of stock indices has not been violated after the sharp decline last weekend. Besides, the macro is showing a quite positive improvement trend.

"Domestic exchange rate pressure has cooled down significantly in the context of the market believing that the FED will stop raising the operating interest rate. The cooling exchange rate has allowed for a more "relaxed" monetary policy. In the last 6 auctions, the State Bank has completely stopped issuing treasury bills and pumped back into the market thanks to the amount of old treasury bills that have matured. Since the beginning of November, the State Bank has pumped back more than 108,000 billion VND and reduced the amount of treasury bills in circulation to nearly 100,400 billion VND. This move has helped to increase liquidity in the banking system, causing the interbank interest rate to drop sharply again.

Therefore, concerns about the risk of a reversal of domestic monetary policy have been removed and this will help improve investor sentiment and cash flow in the stock market in the last trading weeks of the year," Mr. Hinh told reporters of Lao Dong Newspaper.

In addition to the exchange rate and monetary policy issues, Mr. Hinh also said that many indicators show that Vietnam's growth recovery momentum is showing signs of improvement. In the past two consecutive months, exports have recorded positive growth again with each month's growth rate higher than the previous month. At the same time, other indicators related to industry and FDI capital flows also show positive improvement trends.

"In that context, I expect the fourth quarter business results of listed companies to recover positively and be a driving force for the stock market from now until the Lunar New Year. Investors can take advantage of the corrections in the upward trend of the market to increase the proportion of stocks, prioritizing industry groups with prospects of positive business results improvement in the fourth quarter such as export groups (steel, wood products, furniture, etc.), public investment, industrial park real estate and securities" - Mr. Hinh commented.

Source

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)