Weak cash flow led to cautious trading from the opening, and as the morning session progressed, selling pressure intensified, pushing the VN-Index significantly below the reference level.

The stock market was dominated by red. For example, in the banking sector, apart from STB, VCB, SSB, MBS, HDB, LPB, and NAB which remained in the green, the rest declined. The securities and technology sectors also saw significant drops.

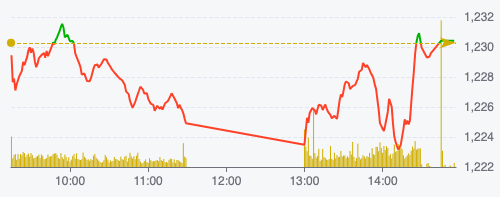

At the close of the morning trading session on August 13th, the VN-Index fell 5.49 points, or 0.45%, to 1,224.79 points. Across the entire exchange, there were 119 gainers and 254 losers.

VN-Index performance on August 13 (Source: FireAnt).

Entering the afternoon session, after half-day selling pressure, buying pressure towards the end of the session helped the index surge, before reversing course to close slightly higher on the VN-Index. However, the HNX and UPCoM exchanges continued to decline.

At the close of trading on August 13th, the VN-Index rose 0.14 points, or 0.01%, to 1,230.42 points. Across the entire exchange, there were 162 gainers, 234 losers, and 88 stocks that remained unchanged.

The HNX-Index fell 0.59 points to 230.18 points. Across the entire exchange, there were 72 gainers, 88 losers, and 58 stocks unchanged. The UPCoM-Index fell 0.21 points to 92.79 points.

VCB was the driving force behind the market's turnaround, contributing over 2.33 points to the VN-Index; closing the session up 1.94% at 89,500 VND/share. In addition, NAB also stood out, closing in positive territory and contributing 0.34 points to the market.

Additionally, HDB, CTG, LPB, ABB, VBB, SGB, and PGB also closed higher. However, TCB, MBB, SSB,ACB , BID, and VIB continued to decline and were among the top 10 stocks negatively impacting the market.

Green dominated the real estate sector as well, with PDR, TCH, DIG, CEO, NVL, VRE, DXG, HDG, TDC, NTL, KHG, and VIC closing higher; notably, DLG and QCG surged to their ceiling prices.

Meanwhile, the securities sector remained negative, with most stocks declining, including VIX, VND, SSI, SHS, VCI, FTS, VDS, CTS, ORS, AGR, BSI, and BVS. Only a few stocks in the sector saw gains, such as HCM, MBS, HBS, APG, DSC, and VIG.

Similarly, red dominated the steel sector. HPG, a major player, led the market decline, losing 0.7 points; closing down 1.74% at 25,400 VND per share. In addition, HSG, NKG, TVN, TLH, HSV, and SBG also closed in the red.

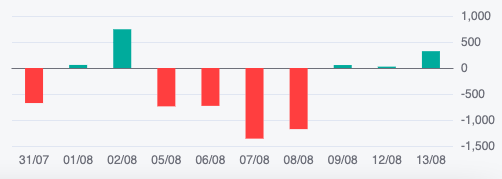

Foreign investor trading activity.

The total value of matched orders in today's session was VND 14,922 billion, a 5% decrease compared to the previous day, of which the value of matched orders on the HoSE reached VND 13,081 billion. In the VN30 group, liquidity reached VND 6,614 billion.

Foreign investors continued to be net buyers with a value of 324 billion VND today, including disbursing 1,905 billion VND and selling 1,581 billion VND.

Stocks that experienced significant selling pressure included HPG (234 billion VND), TCB (75 billion VND), NLG (35 billion VND), VHM (26 billion VND), SSI (21 billion VND), etc. Conversely, stocks that were mainly bought included HDB (380 billion VND), VNM (152 billion VND),FPT (77 billion VND), CTG (53 billion VND), MWG (48 billion VND), etc.

Source: https://www.nguoiduatin.vn/vcb-tro-thanh-cong-than-cuu-vn-index-204240813154150309.htm

Comment (0)