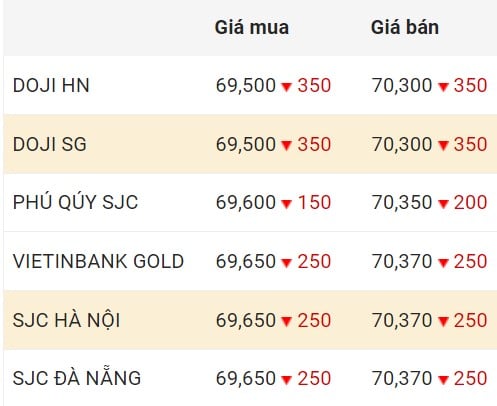

Domestic gold prices

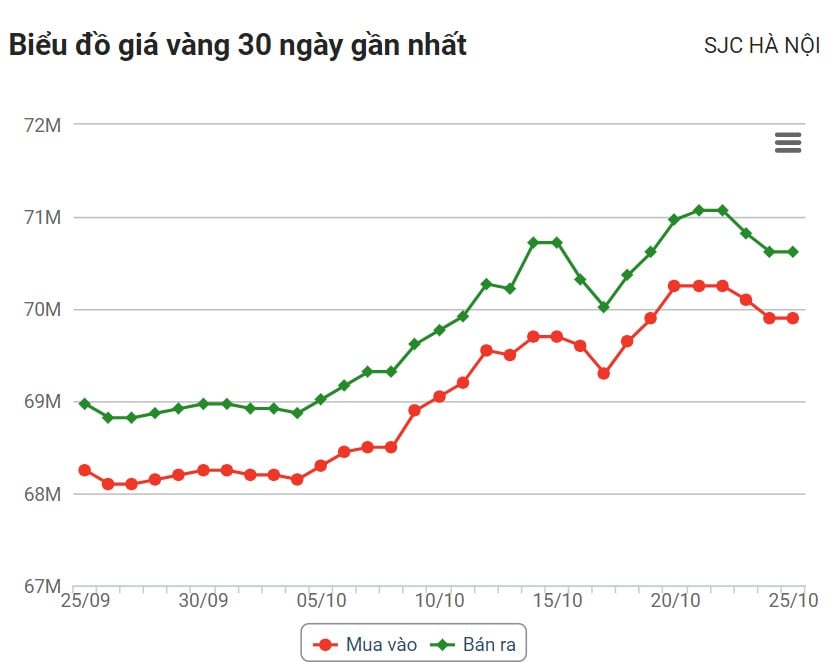

Domestic gold price trends

Trends in world gold prices

Global gold prices rose despite the strengthening US dollar. At 6:35 PM, the US Dollar Index, which measures the dollar's fluctuations against six major currencies, stood at 106.232 points (up 0.14%).

Experts believe gold prices still face several obstacles. The strength of the US dollar has declined from its peak recorded in the second half of 2022, but it still maintains its position. A strong US dollar is bad news for gold because it makes the cost of holding the metal more expensive. The price of the metal is denominated in USD, which can affect foreign demand. As a result, when the dollar strengthens, gold prices tend to fall.

The outlook for the US dollar is considered unpredictable and largely depends on whether the US economy enters a recession, how quickly inflation falls, and the actions of the Federal Reserve (FED).

Interest rates also have an inverse relationship with the price of gold. With interest rates remaining high—and potentially rising—bonds and fixed-income investments are an attractive alternative to gold. If the interest rate hike cycle ends, gold will continue to benefit.

However, recently, Federal Reserve Chairman Jerome Powell expressed concern that global uncertainties would affect the Fed's anti-inflation campaign.

He also left open the possibility of raising interest rates in the near future, as the Federal Open Market Committee's decision depends on the actual situation. If the Fed continues to tighten policy, the gold market will face pressure.

According to the World Gold Council, 2022 was the strongest year for gold consumption in over a decade. This trend reversed in 2023, with gold demand in the first quarter falling 13% year-on-year. The continued buying by central banks around the world was insufficient to offset demand.

Currently, the market is focusing its attention on the US GDP report for the third quarter, which will be released on Thursday (October 26). The Personal Consumption Expenditures (PCE) price index will be published on Friday (October 27), and several other economic reports, particularly speeches by European Central Bank President Lagarde and Federal Reserve Chairman Jerome Powell.

Source

![[Photo] President Luong Cuong receives Speaker of the Jordanian House of Representatives Mazen Turki El Qadi](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F03%2F1770112220330_ndo_br_1-3704-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Philipp Rösler, Chairman of the Switzerland-Vietnam Economic Forum.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F03%2F1770121222295_ndo_br_dsc-8709-jpg.webp&w=3840&q=75)

Comment (0)