Q4/2023 profit is gloomy

According to the consolidated financial report for the fourth quarter of 2023, Van Phu - Invest Investment Joint Stock Company recorded net revenue from sales and service provision in the fourth quarter of 2023 of VND 134.5 billion - a decrease of more than 5 times compared to the same period in 2022 (VND 760.2 billion). Thanks to the cost of goods sold and service provision recorded at a negative VND 14.1 billion, the company's gross profit in the fourth quarter of the enterprise was recorded at VND 148.7 billion, but still decreased compared to the same period in 2022 (VND 381.2 billion).

VPI's net profit from business activities in the last quarter was recorded at only 19.3 billion VND, only about 1/10 of the same period in 2022 (203 billion VND).

At the end of the fourth quarter of 2023, Van Phu - Invest's after-tax profit recorded VND 24.9 billion - only 1/5 compared to the fourth quarter of 2022 (VND 133.2 billion), causing the after-tax profit of non-controlling shareholders to lose a deep loss of VND 15 billion.

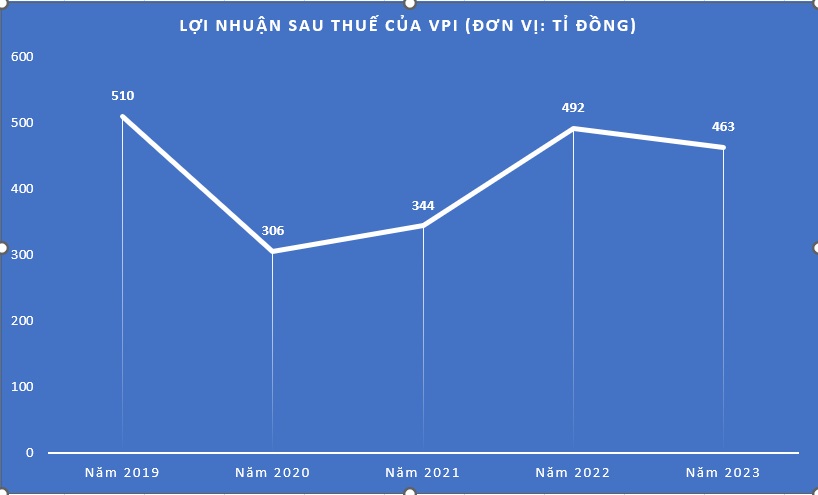

If including the whole year of 2023, VPI's net revenue from sales and service provision is recorded at VND 1,876 billion, down VND 276 billion compared to the previous year. However, thanks to the cost of goods sold decreasing to VND 566 billion, gross profit still reached VND 1,310 billion, higher than in 2022 (VND 1,166 billion). Profit after tax is VND 463 billion, slightly down compared to VND 492 billion in 2022. However, profit after tax of non-controlling shareholders is still negative VND 45.9 billion.

One thing worth noting is that Van Phu Invest's cash flow from business operations recorded a negative VND754 billion in 2023, in contrast to VND344 billion in 2022.

Still owes the Ministry of Health more than 43 billion VND

Van Phu Invest's total assets as of December 31, 2023 are nearly VND 12,532 billion. Of which, short-term assets are recorded at VND 6,130 billion, an increase of VND 1,094 billion compared to the beginning of the year. Cash decreased from VND 488.4 billion to VND 195.6 billion.

In 2023, the company's short-term receivables decreased by VND334 billion to VND2,180 billion. The provision for short-term doubtful receivables increased by VND14 billion, from VND60 billion to VND74 billion.

Notably, Van Phu - Invest's inventory skyrocketed in 2023, from VND1,925 billion at the beginning of the year to VND3,701 billion as of December 31 - accounting for about 30% of total assets.

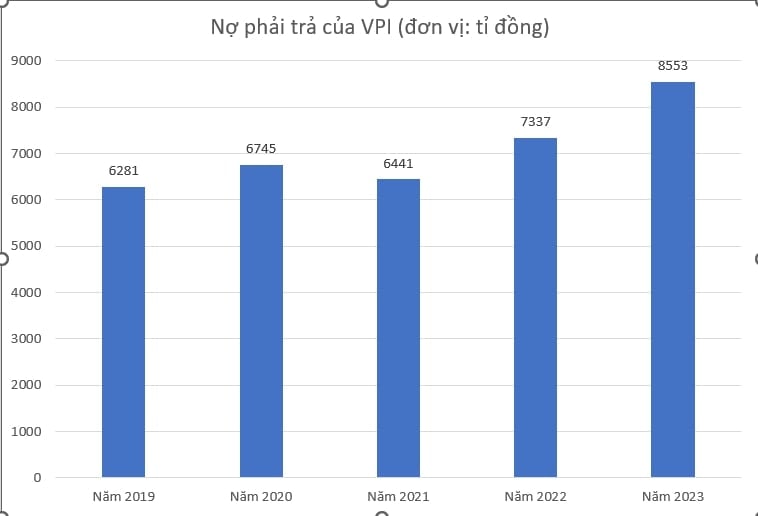

On the other side of the balance sheet, the company's liabilities in 2023 increased by VND 1,216 billion to VND 8,553 billion, bringing the debt/equity ratio to 2.14 times. The reason is that short-term debt increased by VND 1,288 billion to VND 3,924 billion in just 1 year.

One of the elements constituting VPI's short-term liabilities is a debt worth VND 43,098,104,400. This is the amount that the enterprise must pay to the Ministry of Health for the value of assets on land of the University of Public Health related to the Grandeur Palace Giang Vo project (Hanoi).

The amount of more than 43 billion VND appeared in 2019, but by the end of 2023, this debt is still intact.

Source

![[Photo] Prime Minister Pham Minh Chinh and his wife meet the Vietnamese community in Algeria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763510299099_1763510015166-jpg.webp)

![[Photo] The Standing Committee of the Organizing Subcommittee serving the 14th National Party Congress meets on information and propaganda work for the Congress.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763531906775_tieu-ban-phuc-vu-dh-19-11-9302-614-jpg.webp)

![[Photo] General Secretary To Lam receives Slovakian Deputy Prime Minister and Minister of Defense Robert Kalinak](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/18/1763467091441_a1-bnd-8261-6981-jpg.webp)

![[Photo] General Secretary To Lam receives CEO of AP Moller-Maersk Group, Denmark](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/18/1763462288958_a3-bnd-8222-2510-jpg.webp)

Comment (0)