Sir, how do you evaluate the Government's response to the US decision to impose a 46% tax on goods from Vietnam, especially the Prime Minister's immediate direction to establish a Working Group to enhance cooperation and proactively adapt to the US's economic and trade policy adjustments?

Dr. Can Van Luc : I think that the drastic actions and policies of the Government are very appropriate and timely, and are highly appreciated by ministries, branches, localities and businesses, including US businesses. Our problem is how to implement them.

We have been doing four things. First, the Government has directed the use of all channels for exchange, negotiation, dialogue, and persuasion.

Second, we have proactively reduced tax rates for many goods and services imported from the United States.

Third, we have also proactively imported more goods and services from the United States through the signing of Memorandums of Understanding and a number of contracts... These contracts need to be realized soon and implemented in accordance with the commitments and the set roadmap.

I think the Prime Minister's establishment of a Working Group to enhance cooperation and proactively adapt to the US's economic and trade policy adjustments is a very appropriate approach in the current context. We need a fast-response, interdisciplinary, and interconnected unit directly led by the Government leader to quickly and promptly resolve issues, especially when there is not much time left for negotiations and exchanges.

He repeatedly emphasized the need to "calmly respond" to the US's decision to impose tariffs. So in this context, what should "calmly" be understood as in the actual steps taken by the Government and businesses?

Dr. Can Van Luc : First of all, I think it is necessary to closely monitor the situation and developments, especially new moves from the US Government on issues related to tariffs and other related issues.

Besides, it is necessary to observe the actions of other countries, especially large countries, countries with large trade balances and large trade surpluses with the United States.

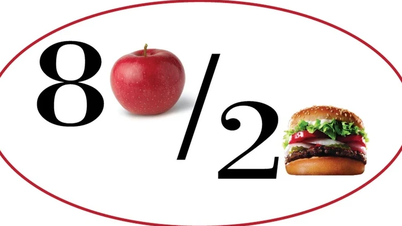

In addition, the Government and businesses need to develop appropriate response scenarios. It could be in the direction of a certain level of tariffs that the US will impose on Vietnam, such as 25-30% instead of 46% so that we can have solutions and responses.

In this regard, we must be extremely calm in the direction of not being subjective but also not being too pessimistic, because this is a global story and poses risks and challenges to the world, not just Vietnam. The country that is calmer, more proactive, and more clever will successfully overcome this great shock, that is, minimize the negative impact and at the same time be able to take advantage of certain opportunities in the current context.

Experts all affirm that Vietnam still has room for negotiation. In your opinion, which factor will be most convincing to the US side in this process?

Dr. Can Van Luc : I think Vietnam still has room to negotiate, but there is not much time left. From April 5, the US will begin to impose an additional tax of 10% on all imported goods and by April 9, they will consider an additional tax rate of up to 50% with about 59 countries, including Vietnam.

To take advantage of the room for negotiation, I think Vietnam needs to focus on some key points.

First, we must continue to persistently clarify to the US side that the economic, trade and investment relations between the US and Vietnam are mutually supportive and complementary.

Second, the US side has just announced the problems related to 14 areas in the US Trade Barriers Report on April 1. Therefore, Vietnam needs to pay attention and have very specific solutions to overcome and resolve these concerns and recommendations. If we resolve them promptly, it will also show that we have goodwill and are very serious about accepting and resolving the problems appropriately.

Third, in the formula for calculating the US tax rate, there are currently two very important functions: The common function for the whole world is 4 and another function related to the elasticity coefficient that the US is taking according to the level of trade protection of other countries. Vietnam is in the group with a coefficient of 0.25 - a relatively low coefficient, meaning that we still have many trade barriers that need to be removed. I think that Vietnam needs to prove to the US how open we have been on trade issues, and for the obstacles and barriers, we are determined to have a roadmap and specific solutions to remove them in the coming time, ensuring effectiveness.

Accordingly, we can propose that the US side raise this coefficient, for example from 0.25 to 0.5. Immediately, the tax rate can be significantly reduced, perhaps from 46% to a level of about 30%. That is also an approach based on data, science, with a specific calculation formula that the US side often follows.

We also need to realize the memorandums of understanding and contracts signed on importing equipment and goods from the US in the recent past and have to specify them into contracts as well as have very specific transactions in the coming time.

Fourth, we also need to guide and require businesses and localities to clarify the origin of goods, and of related investment programs and projects so that when working with the US side, we can prove to them that goods exported from Vietnam to the US sometimes come from US investment, not simply from other countries or from Vietnam alone.

You just mentioned transparency of data and production information. In your opinion, is Vietnam well prepared in terms of data and mechanisms to prove origin?

Dr. Can Van Luc : I think that in recent times, we have made progress, have prepared and have more transparent information, but clearly there are still shortcomings. This is a point that we need to quickly overcome in the coming time so that we can negotiate with the US side.

For example, we currently receive investment from Singapore, but sometimes that capital comes from US businesses. We have to prove this to them to show that the level of US business cooperation and investment in Vietnam is not just the current figure of 12 billion USD but could be higher.

Regarding the tax story, we need to continue reviewing to be able to reduce tariffs on goods exported from the United States to Vietnam, which is also a way for us to show goodwill and also a way to have appropriate reciprocal tax rates for the United States.

Thank you very much!

Source: https://baolangson.vn/ung-pho-viec-ap-thue-moi-tu-hoa-ky-binh-tinh-chu-dong-khon-kheo-thi-se-vuot-qua-thu-thach-5043179.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)