Difficult problems in digital transformation of BFSI industry

According to a report from Precedence Research (2023), the GenAI market size in the finance and banking industry is expected to reach more than 12 billion USD by 2032 globally. In Vietnam, the digital transformation wave in the BFSI industry is also taking place strongly.

"Many financial, banking and insurance businesses in Vietnam are currently facing a "race" of digital transformation to optimize costs, processes, ensure data security and increase customer experience, thereby creating a competitive advantage in the market," Dr. Dao Duc Minh, General Director of VinBigdata shared at the A:Invent - Innovative Finance in GenAI Era event held in Ho Chi Minh City on September 12.

However, Dr. Dao Duc Minh also emphasized that current digitalization mostly stops at single tasks such as customer care and sales, and has not really been implemented according to a comprehensive and overall strategy.

On the other hand, implementation costs are also one of the major barriers for businesses. The digital transformation process requires a huge investment cost, not only in terms of technology, but also in infrastructure and human training. Therefore, many BFSI businesses are not ready to "go all in".

“To address the challenges and provide a comprehensive digital transformation strategy for the BFSI industry, it is essential to research and develop a comprehensive set of solutions, apply GenAI, support multi-tasking, and comply with industry-specific rules and standards,” said Dr. Dao Duc Minh.

Applying GenAI to solve problems

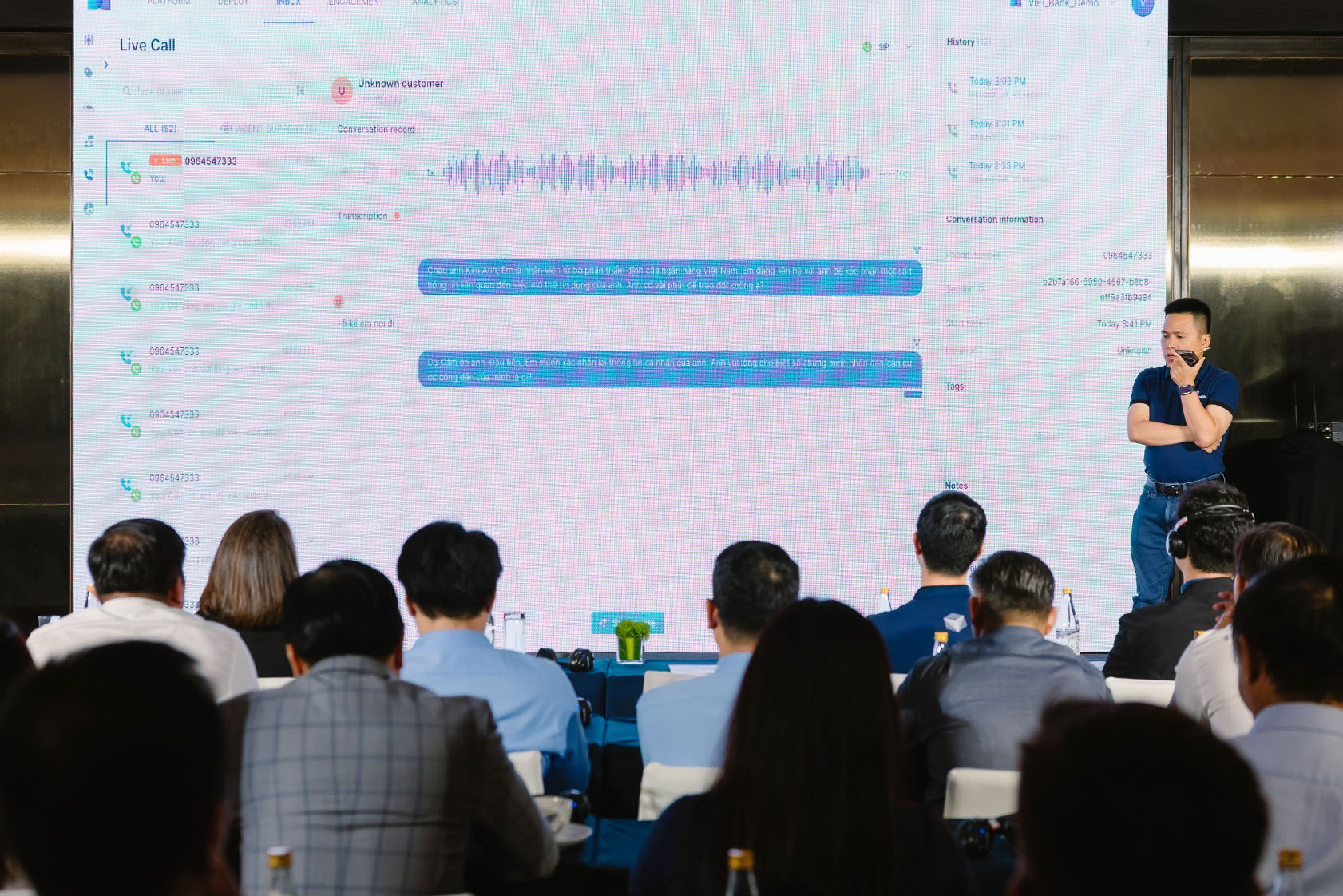

The ViFi solution set introduced by VinBigdata (Vingroup) through the recent event “A:Invent - Innovative Finance in GenAI Era” is considered a new step forward in applying GenAI in the BFSI industry. The solution set is flexibly developed and customized, including Financial Virtual Assistant, Banking Virtual Assistant, Insurance Virtual Assistant, and Internal Virtual Assistant.

“Our goal is not only to provide “instant noodle” AI products to solve a few single tasks, instead, VinBigdata wants to package a set of solutions specifically for the BFSI industry, where we will accompany BFSI businesses in an overall strategy from internal operations to marketing and sales, helping businesses create a difference and build long-term competitiveness", emphasized Dr. Nguyen Kim Anh - Product Director of VinBigdata.

In particular, the Finance and Banking Virtual Assistant will be flexibly integrated into customer channel systems such as websites, mobile applications, social networking platforms and call centers.

With diverse features such as sales consulting support; providing information about products and promotions; customer care support and troubleshooting, Virtual Assistant can act as a financial consultant, providing full information and supporting customers 24/7.

Insurance Virtual Assistant focuses on the ability to provide personalized advice, process records and authenticate voice and facial biometric information quickly and accurately with new generation eKYC technology, Voice Recording,... thereby supporting advice on suitable product packages for customers.

In addition to business activities, operational processes will also be significantly reduced through the Internal Virtual Assistant, supporting staff in performing a variety of tasks, from recruiting, answering questions about company rules and regulations, to supporting reporting and handling technical incidents.

“ViFi is trained on the GenAI model completely owned by VinBigdata without depending on any foreign unit, at the same time VinBigdata also strictly complies with international standards such as NIST, iBeta, GDPR, PCI DSS, ISO 2700. This helps ensure data safety, security, and enhances data management and control. This is also something that BFSI enterprises are particularly interested in,” emphasized Dr. Nguyen Kim Anh - VinBigdata Product Director.

On the other hand, the solution set is also the key to solving the bottleneck in terms of deployment costs. ViFi is trained on a multi-field database system of up to 3,500 Terabytes and a powerful infrastructure system with dozens of server clusters, helping businesses optimize costs.

Prior to the launch of the ViFi solution, VinBigdata's generative AI applications have been deployed for a number of large enterprises in the BFSI industry in Vietnam. Typically, AI Bot for ACB Bank, with the ability to support the automation of customer care processes, helping to speed up task processing and improve customer experience.

In addition, AI Voice Recording is also deployed for FWD insurance company to help increase accuracy in authenticating customer profiles through voice biometrics.

ViFi - A comprehensive AI solution for the BFSI industry is a product developed by VinBigdata, launched and deployed from September 12, 2024. Trained on core technologies completely researched and mastered by VinBigdata, ViFi is expected to be a comprehensive solution to help BFSI businesses make breakthroughs in business and enhance customer experience. Learn more about the ViFi solution: https://www.youtube.com/watch?v=VwTL2Zqujy0&feature=youtu.be |

The Dinh

Source: https://vietnamnet.vn/ung-dung-genai-giup-doanh-nghiep-tai-chinh-ngan-hang-viet-di-tat-don-dau-2322022.html

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)