What is the exchange rate of 1 USD to VND today?

The State Bank of Vietnam's USD exchange rate is 24,036 VND.

The current USD exchange rate at Vietcombank is 24,395 VND - 24,765 VND (buying rate - selling rate).

The current Euro exchange rate is 25,979 VND - 27,405 VND (buying rate - selling rate).

The current exchange rate for the Japanese Yen is 161.55 VND - 170.99 VND (buying rate - selling rate).

The current exchange rate for the British Pound is 30,439 VND - 31,734 VND (buying rate - selling rate).

The exchange rate for the Chinese Yuan today is 3,360 VND - 3,503 VND (buying rate - selling rate).

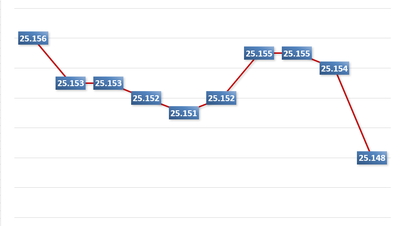

Today's USD exchange rate

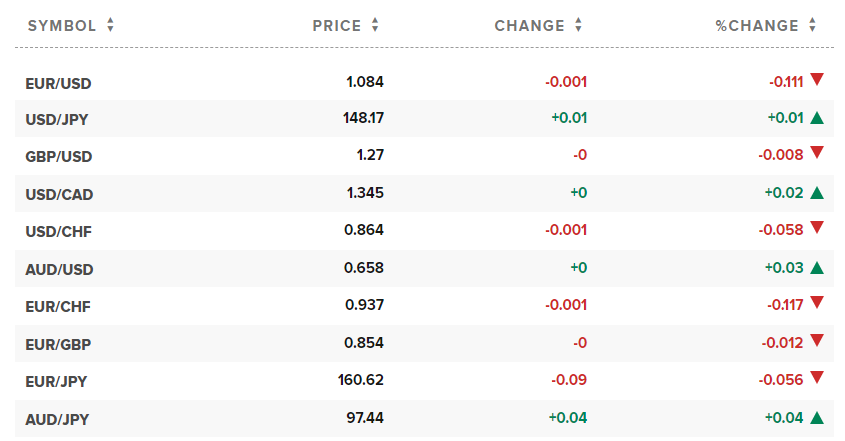

The US Dollar Index (DXY), which measures the fluctuations of the US dollar against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recorded a level of 103.41 points.

The US dollar started the week with a slight increase. Markets are scrutinizing US economic data ahead of this week's Federal Reserve policy meeting. Escalating geopolitical tensions in the Middle East are also contributing to risk aversion.

The USD Index edged up 0.01% to 103.55 on Monday. The DXY is expected to rise 2% in January as the market reduces expectations of an early US interest rate cut.

In December, the Fed surprised the market with a dovish stance and projected a 75-basis-point interest rate cut in 2024. However, since then, strong economic data and responses from other central banks have led the market to adjust expectations. The CME FedWatch tool shows that the market now assesses a 48% probability that the Fed will cut interest rates in March. This probability was 86% last month.

Marc Chandler, a market expert at Bannockburn Forex, said: “The market recognizes that the tightening cycle is over. The correction trend will continue in the coming weeks.”

Data released over the weekend showed that prices in the US rose at a moderate pace in December 2023. This kept annual inflation below 3% for the third consecutive month, fueling expectations of potential interest rate cuts this year.

The focus this week is the Federal Reserve's two-day policy meeting, beginning on Tuesday. The Fed is expected to keep interest rates unchanged, with all eyes on comments from Chairman Jerome Powell.

Paul Mackel, HSBC's foreign exchange research specialist, commented: "This week's meeting will be very simple… There is little reason for the Federal Open Market Committee (FOMC) to change policy. The focus will be on Powell's attitude."

Besides the Fed, investors are also monitoring a range of economic data, including the US payroll report. This data will help assess the strength of the US labor market.

The Euro fell 0.05% to 1.0847 against the US dollar. The British pound was at 1.2703 GBP/USD, up 0.04%.

The yen rose 0.01% to 148.14 JPY/USD. The Asian currency recorded its weakest monthly performance since June 2022.

The market is currently on high alert due to increasing geopolitical risks in the Middle East. This could help the Yen regain its position as a safe haven asset.

Elsewhere, the AUD/USD exchange rate is at 0.659, while the NZD/USD rate is 0.610.

Source

Comment (0)