| Coffee export prices increase across the board, Robusta reaches peak levelCoffee export prices increase for 4 consecutive weeks, reaching highest price level |

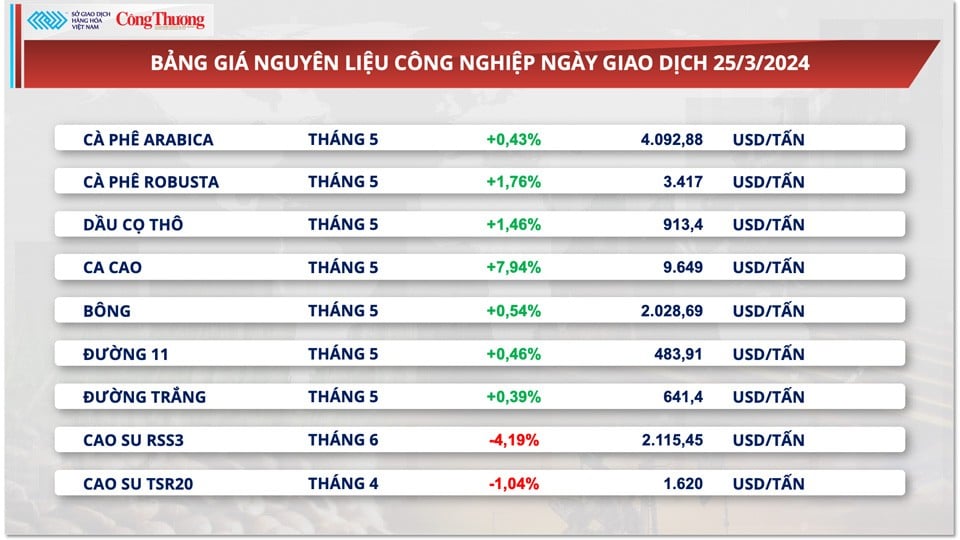

At the end of the trading session on March 25, the prices of the two coffee products increased again by 1.76% for Robusta and 0.43% for Arabica, respectively. The weakening USD/BRL exchange rate overwhelmed the recovery speed of inventory data on the ICE-US Exchange, thereby promoting the increase in Arabica coffee prices.

Specifically, the Dollar Index decreased by 0.19% in yesterday's session, putting pressure on the USD and pulling the USD/BRL exchange rate down by nearly 0.6%. The narrowing exchange rate gap has curbed the demand for coffee sales by Brazilian farmers.

|

| The prices of two coffee products increased again by 1.76% for Robusta and 0.43% for Arabica, respectively. |

Robusta prices have surged as supply shortage risks continue to loom over the market, according to the Vietnam Commodity Exchange (MXV). Unseasonal rains are forecast to return to Vietnam’s main coffee growing areas by mid-week. However, this is unlikely to ease negative sentiment about the 24/25 crop supply outlook in the world’s largest Robusta exporter due to unusual weather conditions.

Many coffee industry experts have assessed that the quality of Vietnamese Robusta coffee beans has increased dramatically. From being considered a low-quality source, Vietnamese Robusta coffee, which used to cost only 1/3 of the price, has now increased to more than 80% of the price of Arabica coffee.

To date, roasters around the world have incorporated Robusta coffee into their recipes. In the popular roasted coffees around the world, the proportion of Robusta has increased from 20-30% in the past to 40-50%. As for instant coffee, Robusta dominates thanks to its caffeine content and many other characteristics.

Over the years, coffee processing factories around the world have increasingly used Vietnam's Robusta raw materials. The current sharp increase in coffee prices is due to a nearly 20% decrease in Robusta production - partly due to the impact of climate change and the strong impact of the El Nino phenomenon.

Vice President of the Vietnam Coffee and Cocoa Association Thai Nhu Hiep commented that the coffee market is in a period of price fever, focusing on Robusta - the type of coffee that Vietnam is the number 1 global supplier of.

The current sharp increase in coffee prices is due to a nearly 20% drop in Robusta production, partly due to the impact of climate change and the strong impact of the El Nino phenomenon.

|

| Coffee exports, mainly Robusta coffee, in the first half of March reached 199,719 tons, up 119.47% |

Vietnam Customs reported preliminary data showing that coffee exports, mainly Robusta, in the first half of March reached 199,719 tonnes (about 3.32 million bags), up 119.47% year-on-year. The high export volume has rebutted speculation that Vietnamese farmers are hoarding their crops, unwilling to sell at current prices.

According to Reuters, low supply and high demand have caused the price of Robusta coffee beans in the domestic market in Vietnam to soon reach a record high of VND100,000/kg.

According to the Import-Export Department ( Ministry of Industry and Trade ), coffee exports from Vietnam to Indonesia recorded a triple-digit growth rate in the first two months of the year. Specifically, Vietnam exported more than 21,300 tons of coffee to Indonesia, earning 71.37 million USD, equivalent to an increase of 215% in volume and 235% in value compared to the same period.

Indonesia is also a major coffee producer in the region, but in recent years its output has been affected by a number of extreme weather events.

The US Department of Agriculture (USDA) forecasts that the country’s coffee production will decrease by 2.2 million bags in the 2023-24 crop year compared to the previous crop year, to 9.7 million bags. This is mainly due to a decrease of 2.1 million bags in Robusta production to 8.4 million bags.

Excessive rains during the coffee cherry development stage have reduced production in the lowlands of South Sumatra and Java, which account for about 75% of Indonesia’s Robusta area. Arabica production is also forecast to decline slightly to 1.3 million bags. With this forecast, Indonesia’s green coffee exports are expected to fall by 2.7 million bags to just 5 million bags in 2023-24.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)