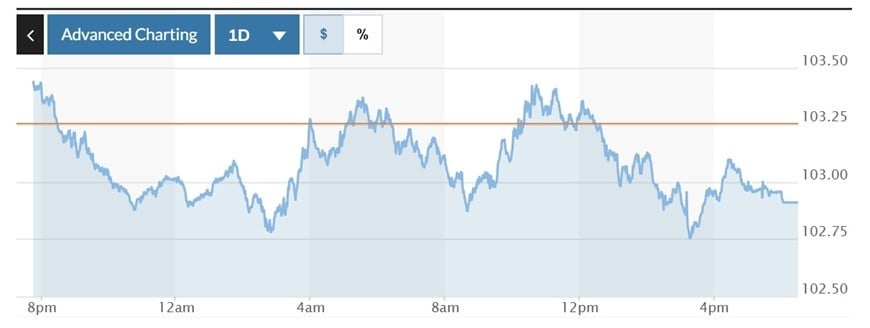

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.35% to 102.91.

USD exchange rate today in the world

The US dollar fell while the euro rose in the last trading session, as investors focused on trade disputes following US President Donald Trump's tariff policies.

The euro rose 0.52 percent to $1.0958 after falling in the previous two sessions, after the European Commission proposed imposing 25 percent retaliatory tariffs on a range of US imports. The move is seen as a direct response to tariffs imposed by President Donald Trump on EU steel and aluminum. The new tariffs will be applied in two phases. Some items will be taxed from May 16, while others will be taxed from December 1. The list of taxed items is diverse, including diamonds, eggs, dental floss, sausages, poultry, almonds and soybeans.

However, the Japanese yen and Swiss franc continued to benefit from safe-haven demand, as investors remained concerned about the possibility of a global recession.

Meanwhile, markets are bracing for a trade war between the US and China. US Trade Representative Jamieson Greer told US senators that the Trump administration will not back down on its trade strategy anytime soon.

The Chinese yuan hit its lowest level since it began trading in 2010, at 7.3815 yuan per dollar. The currency closed the session down 1.05% against the greenback, at 7.423 yuan per dollar.

The dollar fell 1 percent to 146.30 yen against the Japanese yen and fell 1.48 percent to 0.84780 franc against the Swiss franc.

The greenback has underperformed against other currencies, in part due to concerns about a recession in the face of tariffs, said Marvin Loh, senior global market strategist at State Street in Boston.

The DXY index fell 0.35% to 102.91.

The index has fallen about 0.7% since US President Donald Trump announced the tariffs on April 2, prompting investors to weigh the impact of the series of policies on the US economy.

The greenback's decline may be partly due to a recovery in stock markets in some parts of Asia, said Juan Perez, head of trading at Monex USA.

USD exchange rate today in the country

In the domestic market, at the beginning of the trading session on April 9, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 12 VND, currently at 23,898 VND.

* The reference exchange rate at the State Bank's transaction office remains unchanged, currently at: 23,704 VND - 26,080 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

25,750 VND | 26,140 VND | |

Vietinbank | 25,790 VND | 26,142 VND |

BIDV | 25,775 VND | 26,135 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 25,897 VND - 28,623 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 27,697 VND | 29,215 VND |

Vietinbank | 27,967 VND | 29,167 VND |

BIDV | 27,928 VND | 29,177 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 160 VND - 177 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 170.36 VND | 181.18 VND |

Vietinbank | 172.99 VND | 180.99 VND |

BIDV | 172.87 VND | 180.87 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-9-4-dong-usd-giam-dong-thai-ve-thue-quan-5043508.html

![[Photo] Special flag-raising ceremony to celebrate the 135th birthday of President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/1c5ec80249cc4ef3a5226e366e7e58f1)

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)