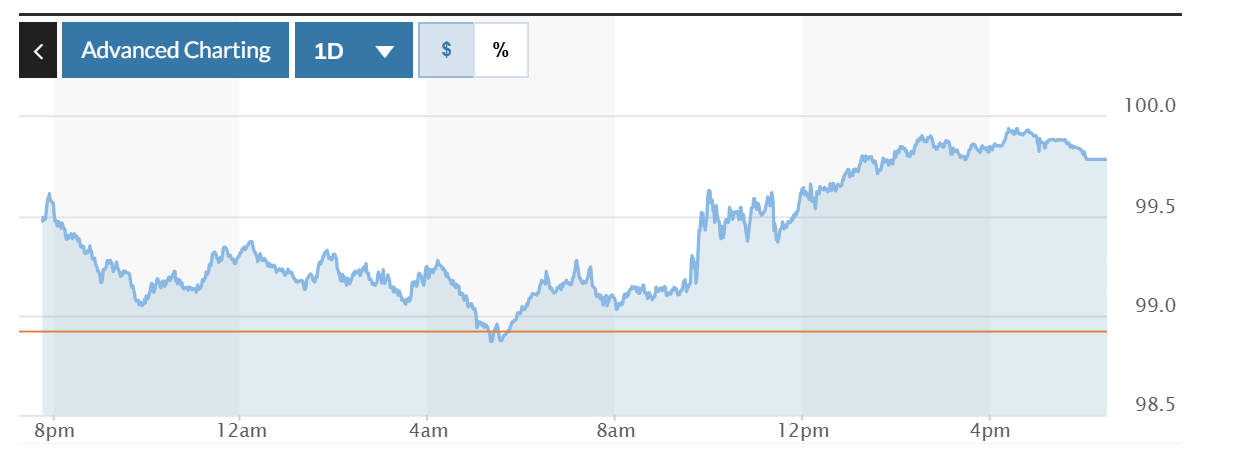

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.86% to 99.78.

USD exchange rate today in the world

The US dollar recovered against major currencies in the last trading session on expectations that trade tensions will ease and as US President Donald Trump withdrew his threat to fire the head of the US Federal Reserve.

The Trump administration will consider lowering tariffs on Chinese imports pending negotiations with Beijing, adding that any action would not be taken unilaterally. Hopes that the trade war would ease boosted the greenback against the euro and the Swiss franc.

US Treasury Secretary Scott Bessent has suggested that trade tensions between the US and China could ease and that any trade deal with China could result in significant tariff cuts.

Investors were quick to return to the dollar, which has hovered near three-year lows in recent weeks and whose safe-haven status has been questioned due to President Donald Trump's trade policies and their potential impact on the US economy .

The DXY index rose sharply in early Asian trading but later stabilized as market sentiment remained fragile. The index closed up 0.86% at 99.78.

Markets this week are also grappling with the prospect of Fed Chairman Jerome Powell being fired after Trump repeatedly criticized him for not cutting interest rates since the president took office in January.

“I have no intention of firing him,” the US leader told reporters in the Oval Office. “I would like to see him be a little more aggressive about the idea of lowering interest rates.”

This is an encouraging sign for the market, said Lee Hardman, senior currency analyst at MUFG.

In contrast, the euro fell 0.86% to $1.132, down from $1.15 earlier this week, its highest in about three and a half years.

Surveys on April 23 showed business growth in the euro zone is stagnating and Germany's private sector is shrinking this month, hit by a slump in the services sector and trade-related uncertainty.

Meanwhile, the US dollar rose 1.27% against the Japanese yen to 143.435.

Despite the recovery, the greenback remains anchored near multi-year lows against the euro and Swiss franc and a seven-month low against the Japanese yen.

After imposing a base import tariff of 10% and much higher on dozens of countries earlier this month, Mr. Trump abruptly postponed the higher tariffs for 90 days to allow countries to negotiate.

White House press secretary Karoline Leavitt said on April 22 that 18 countries have made proposals so far, with Trump's trade negotiating team meeting with 34 countries this week to discuss tariff policy.

USD exchange rate today in the country

In the domestic market, at the beginning of the trading session on April 24, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 20 VND, currently at 23,897 VND.

* The reference exchange rate at the State Bank's transaction office has slightly decreased, currently at: 23,703 VND - 26,091 VND.

USD exchange rate at commercial banks buy and sell as follows:

USD exchange rate | Buy | Sell |

25,751 VND | 26,141 VND | |

Vietinbank | 25,780 VND | 26,141 VND |

BIDV | 25,781 VND | 26,141 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 26,940 VND - 29,776 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 28,944 VND | 30,530 VND |

Vietinbank | 29,159 VND | 30,567 VND |

BIDV | 29,138 VND | 30,408 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 166 VND - 184 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 177.18 VND | 188.44 VND |

Vietinbank | 180.50 VND | 189.23 VND |

BIDV | 179.31 VND | 187.65 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-24-4-dong-usd-phu-sac-xanh-tro-lai-5045030.html

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)