USD exchange rate today (June 22): Early morning of June 22, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 9 VND, currently at 23,727 VND.

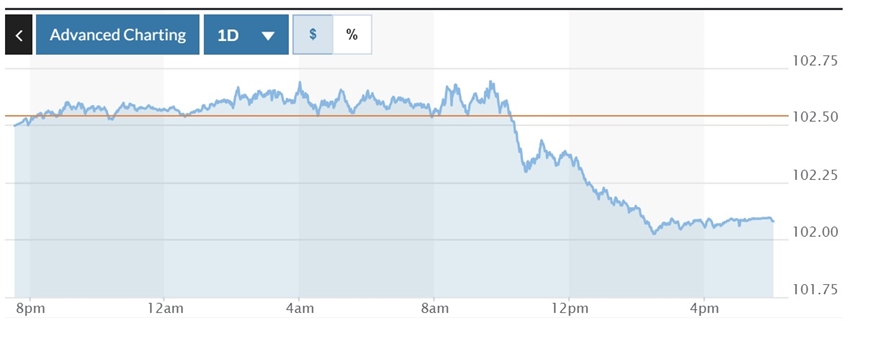

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.46% to 102.08.

USD exchange rate in the world today

The US dollar fell against other currencies in the last trading session, after comments by US Federal Reserve Chairman Jerome Powell on the central bank's fight against inflation fell short of market expectations.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch. |

Accordingly, Mr. Powell shared at a hearing before the US House Finance Committee that the fight against inflation is still "a long way ahead", and although recent interest rate hikes have been paused, borrowing costs may need to rise further.

He also stressed that while inflation remains far from the Fed's target, the Fed may still need to raise interest rates at a more moderate pace.

Last week, the Fed left interest rates unchanged at its June meeting but signaled that borrowing costs could rise as much as 50 basis points by the end of the year. Investors generally expect the Fed to raise rates again at its July meeting.

“The July consumer price index and non-farm payrolls will be the big events that will influence the Fed’s interest rate decision in July,” said Michael Brown, market strategist at TraderX.

In contrast, the euro rose 0.62% against the dollar, currently at $1.0985. Meanwhile, the dollar rose 0.3% to 141.805 yen, after Bank of Japan Governor Kazuo Ueda on June 21 reiterated the central bank's dovish stance to maintain its extremely "loose" monetary policy.

The pound swung between gains and losses after data showed UK inflation rose faster than expected in May. The pound was up 0.09% at $1.2774 by the end of the session, after sliding to a near one-week low of $1.2691 earlier in the session.

|

| USD exchange rate today (June 22): USD plunges after Fed hearing. Illustration photo: Reuters. |

Domestic USD exchange rate today

In the domestic market, at the end of the trading session on June 21, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 7 VND, currently at: 23,727 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,400 VND - 24,863 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 23,340 VND | 23,680 VND |

Vietinbank | 23,300 VND | 23,720 VND |

BIDV | 23,360 VND | 23,660 VND |

* The Euro exchange rate at the State Bank's buying and selling exchange center decreased slightly to: 24,602 VND - 27,192 VND.

Euro exchange rates at commercial banks are as follows:

Euro exchange rate | Buy | Sell |

Vietcombank | 25,275 VND | 26,423 VND |

Vietinbank | 24,976 VND | 26,266 VND |

BIDV | 25,260 VND | 26,400 VND |

MINH ANH

Source

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

Comment (0)