The USD Index (DXY), which measures the greenback's performance against six major currencies, fell 0.87% to 99.23 this week.

USD exchange rate in the world last week

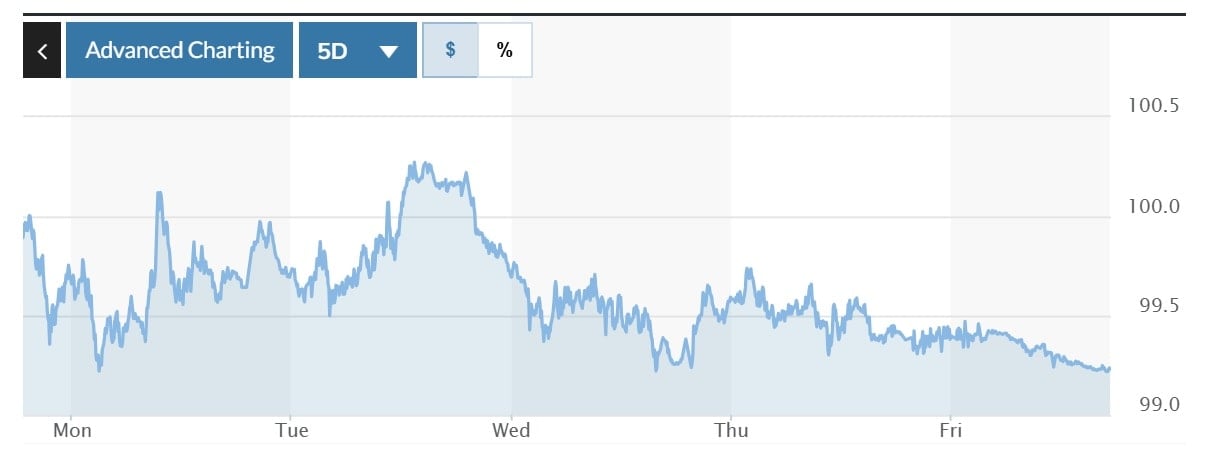

The dollar fell 0.46% to 99.64 on Monday, near a three-year low against the euro and the yen after President Donald Trump’s tariffs. The dollar has been inversely correlated with U.S. Treasury yields, falling last week even as yields rose. That has fueled speculation that investors are moving money out of the country because of concerns about the impact of trade tariffs.

|

| Chart of DXY Index fluctuations over the past week. Photo: Marketwatch |

The greenback recovered slightly on April 16, rising 0.46% to 100.10, showing signs of a cautious recovery after a sharp sell-off that sent the DXY index down more than 3% last week. However, investors remained cautious amid concerns about the impact of the US President’s trade tariffs on the US economy . The rapid changes in the tariff announcement sent investors looking for safe-haven assets, pushing Treasury yields up sharply last week and reducing the greenback’s appeal.

However, on April 17, the DXY index fell 0.94% to 99.28 as traders waited to see whether President Donald Trump's administration would reach new trade agreements with its partners. Meanwhile, US Federal Reserve Chairman Jerome Powell said that US economic growth appeared to be slowing, with consumer spending rising modestly, and a massive import spree to avoid tariffs could affect estimates of gross domestic product and consumer sentiment. Mr. Powell also said he hoped the US Central Bank would intervene to control market volatility.

The dollar rose just 0.02% to 99.40 on April 18 as traders closely watched discussions between the Trump administration and its trading partners. President Donald Trump said earlier he hoped to reach a trade deal with China and hailed progress in tariff talks with Japan. “Our medium-term outlook remains quite bearish on the dollar, so we see this as a small recovery,” said Eric Theoret, a foreign exchange strategist at Scotiabank.

The greenback ended the week down 0.15% to 99.23 despite hawkish comments from Fed Chairman Jerome Powell and solid labor data. Powell warned that persistent inflation amid a recession could lead to stagflation, providing temporary support for the dollar. Traders are pricing in a total of 86 basis points of Fed cuts by the end of 2025, with the first move expected in July, according to CME's FedWatch tool, putting downward pressure on the dollar despite Powell's more cautious stance.

|

| USD exchange rate today April 20: USD continues to sink in red. Illustration photo: Reuters |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on April 20, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD decreased by 25 VND this week, currently at 24,898 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,704 VND - 26,092 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

25,730 VND | 26,120 VND | |

Vietinbank | 25,620 VND | 26,130 VND |

BIDV | 25,760 VND | 26,120 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 26,905 VND - 29,738 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 28,736 VND | 30,310 VND |

Vietinbank | 28,670 VND | 30,380 VND |

BIDV | 29,038 VND | 30,301 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office has increased slightly, currently at: 166 VND - 184 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 175.83 VND | 187.00 VND |

Vietinbank | 178.09 VND | 187.79 VND |

BIDV | 178.5 VND | 186.81 VND |

MINH ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-20-4-dong-usd-tiep-tuc-chim-trong-sac-do-249972.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)