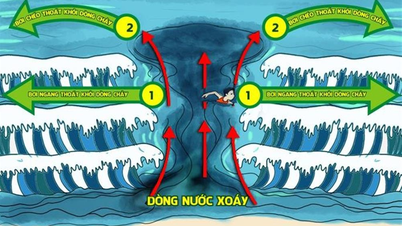

Illustration photo. Photo: Internet

USD exchange rate developments in the international market

The Dollar Index (DXY), a tool that reflects the strength of the greenback against six major currencies including EUR, JPY, GBP, CAD, SEK and CHF, closed at 98.48 points, down 0.75 points compared to April 21, 2025.

President Trump has continued to attack Federal Reserve Chairman Jerome Powell on social media, calling him a “big loser” and demanding immediate interest rate cuts, Reuters reported. The dollar has thus fallen to its lowest level since March 2022 against many other major currencies. Against the Swiss franc, the dollar is at a decade low, while the euro has surpassed $1.15.

In addition, the USD/JPY exchange rate also fell to a seven-month low, with CFTC data revealing that net long positions in the yen hit a record high in the week ending April 15.

White House economic adviser Kevin Hassett said Friday that the president and his team are still exploring the possibility of firing Powell, a day after Trump said Powell’s removal “can’t come fast enough” amid calls for the Fed to lower interest rates.

Trading volumes on global markets were light as most exchanges in Europe, Australia and Hong Kong were closed for the Easter holiday. Most global financial markets were closed on Friday.

“If the central bank’s dual mandate — maintaining price stability and promoting full employment — is diluted by a new set of goals defined by the White House, policymakers may find themselves unable to tighten policy aggressively in the face of a sudden surge in prices,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

The pound rose to $1.34, its highest since September, while the Australian dollar climbed to $0.6430, a four-month high. The New Zealand dollar reclaimed $0.6000 for the first time in more than five months.

The onshore yuan also edged up to a two-week high before cooling slightly. In the offshore market, the currency hit a one-week high of 7.2911 USD.

Domestic USD exchange rate fluctuates slightly following global trends

In the domestic market, in the early session on April 22, the central exchange rate between VND and USD announced by the State Bank increased by 9 VND, to 23,907 VND.

The reference exchange rate at the State Bank of Vietnam also increased slightly, currently listed at 23,712 VND for buying and 26,102 VND for selling.

At Vietcombank , the USD exchange rate is listed at 25,670 VND for buying and 26,060 VND for selling, down 60 VND in both directions compared to the previous session.

ABBank is currently the unit buying USD cash at the lowest price, at: 1 USD = 24,900 VND.

VIB Bank is buying USD transfers at the lowest price: 1 USD = 25,400 VND.

HSBC Bank holds the highest USD cash buying position, recording the level: 1 USD = 25,828 VND.

Also at HSBC, the highest USD transfer buying rate is still at: 1 USD = 25,828 VND.

On the selling side, VIB bank is the unit selling USD cash at the lowest price: 1 USD = 25,760 VND.

At the same price of 25,760 VND, VIB bank also sells USD via bank transfer at the lowest price.

Meanwhile, UOB bank is offering USD cash at the highest rate: 1 USD = 26,150 VND.

SCB Bank is leading the highest transfer selling rate, currently: 1 USD = 26,110 VND.

The EUR exchange rate at the State Bank of Vietnam also recorded a slight increase, currently at the buying - selling level: 27,148 VND - 30,006 VND.

The exchange rate of the Japanese Yen at the State Bank of Vietnam also increased slightly, with the listed buying and selling rates being: 168 VND - 185 VND.

Source: https://doanhnghiepvn.vn/kinh-te/ty-gia-ngoai-te-ngay-22-4-usd-giam-manh-xuong-muc-thap-nhat-trong-3-nam-giua-loat-bien-dong-lon/20250422080235929

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)