World currency exchange rates

The US dollar gained in the last trading session, while the euro weakened slightly after the European Central Bank (ECB) cut interest rates for the seventh time in a year.

The greenback has largely steadied this week and traded in a narrow range against the common European currency, following sharp declines last week on concerns about the economic impact of tariffs and investors moving funds abroad.

“Our medium-term outlook remains fairly bearish on the dollar, so we see this as a minor bounce,” said Eric Theoret, FX strategist at Scotiabank.

Traders are closely watching discussions between the administration of US President Donald Trump and trading partners.

On April 17, President Donald Trump said he hopes to reach a trade deal with China.

The US leader and close ally Italian Prime Minister Giorgia Meloni have expressed optimism about resolving trade tensions that have strained US-European relations, ahead of talks at the White House.

Mr. Trump also hailed great progress in tariff talks with Japan on April 16.

The ECB has cut interest rates to their lowest level since late 2022, in a bid to support the struggling eurozone economy, which is being hit hard by US tariffs.

Meanwhile, US Federal Reserve Chairman Jerome Powell said on April 16 that the Fed would wait for more data on the direction of the economy before changing interest rates, but warned that President Donald Trump's tariff policies risked pushing inflation and employment further away from the central bank's targets.

On April 17, Mr. Trump called on the US Central Bank to cut interest rates.

Data released on April 17 showed the number of Americans filing new claims for unemployment benefits fell last week, suggesting labor market conditions remained stable in April.

The euro fell 0.41% on the day to $1.1351, hovering below a three-year high of $1.1473 hit late last week. Against the Japanese yen, the dollar rose 0.51% to 142.54. It had earlier hit 141.60, its lowest since Sept. 18.

Against the Swiss franc, the greenback gained 0.97% to 0.821.

Meanwhile, the AUD rose 0.24% to 0.6385, after new data showed Australian employment recovered in March.

The pound rose 0.1% to $1.3253, after hitting $1.3292 on April 16, its highest since October 2, 2024.

Domestic foreign exchange rates

In the domestic market, at the beginning of the trading session on April 18, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD decreased by 6 VND, currently at 23,893 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,699 VND - 26,087 VND.

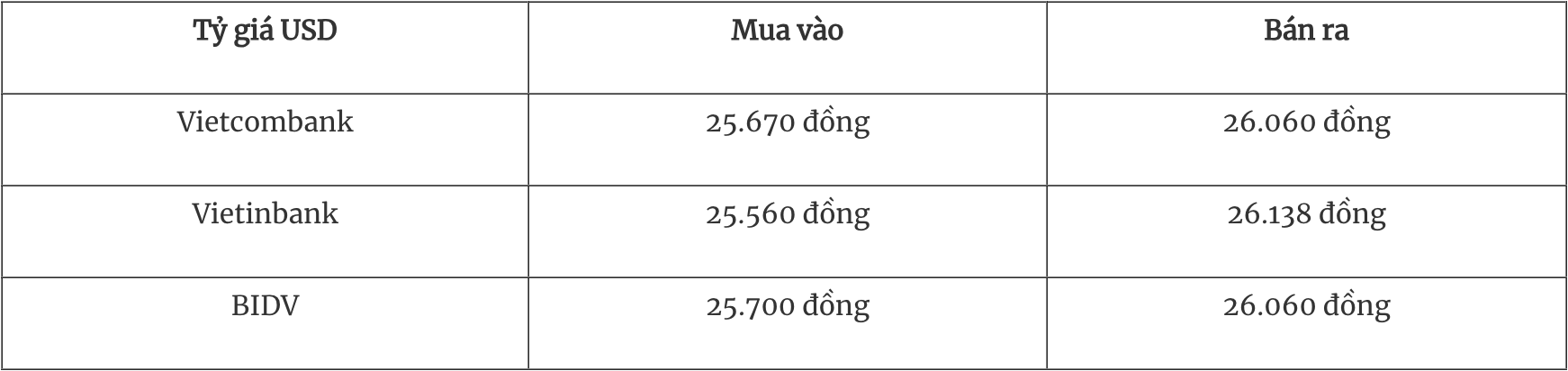

USD exchange rates at some commercial banks are as follows:

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 26,868 VND - 29,696 VND.

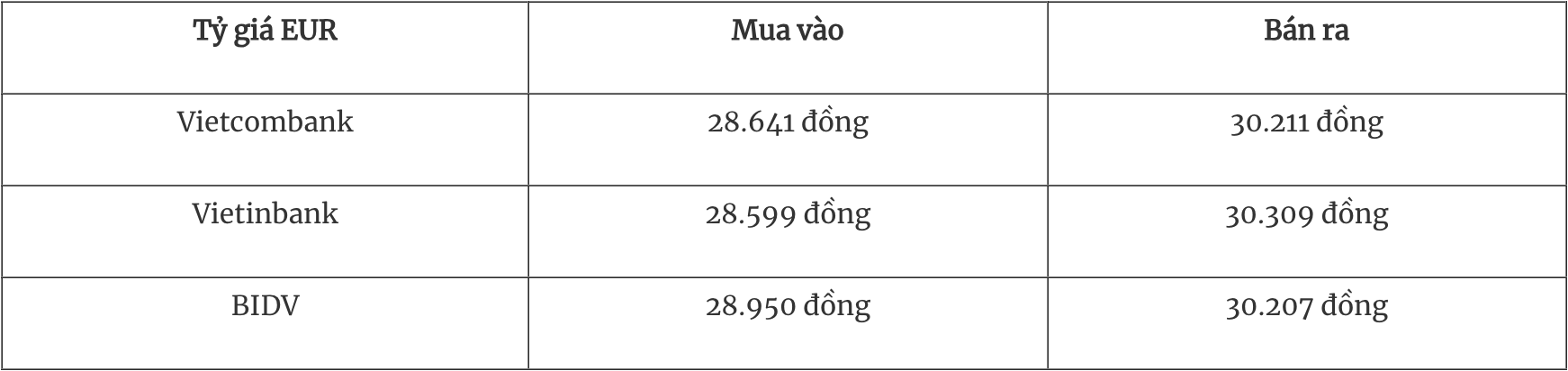

EUR exchange rates at some commercial banks are as follows:

* The Japanese Yen exchange rate at the State Bank's exchange office has increased slightly, currently at: 166 VND - 183 VND.

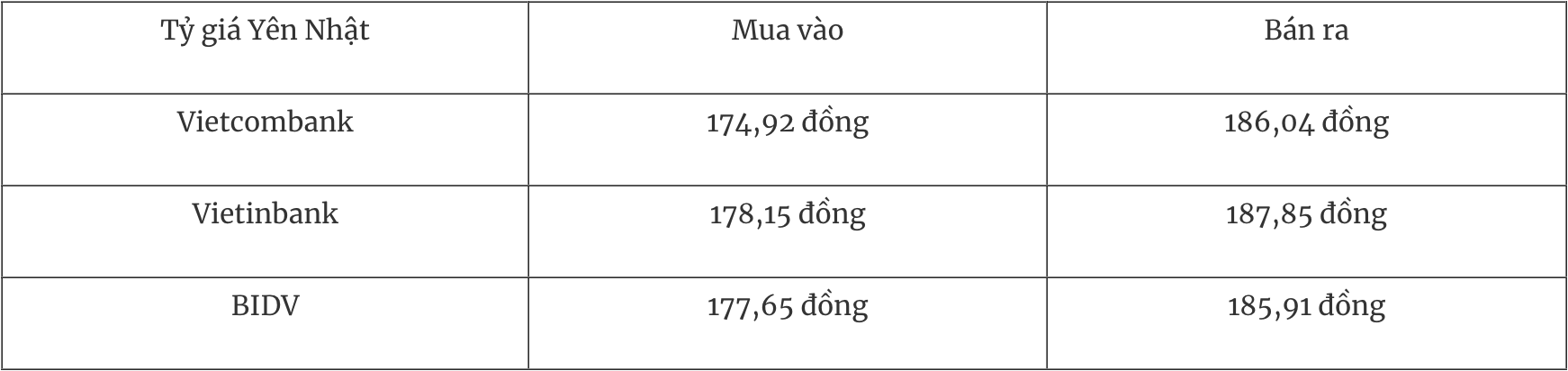

The YEN exchange rate at some commercial banks is as follows:

Source: https://baodaknong.vn/ty-gia-ngoai-te-hom-nay-18-4-dong-usd-the-gioi-nhich-nhe-249790.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)