Increase retirement age according to roadmap

According to Article 169 of the 2019 Labor Code, employees who ensure the conditions on social insurance payment period as prescribed by the law on social insurance are entitled to pension when they reach retirement age.

Accordingly, the retirement age of workers in normal working conditions will be adjusted according to the roadmap until male workers reach 62 years old in 2028 and female workers reach 60 years old in 2035.

From 2021, the retirement age of workers in normal working conditions is 60 years and 3 months for male workers; 55 years and 4 months for female workers. After that, it will increase by 3 months for male workers and 4 months for female workers each year.

Thus, in 2025, the retirement age under normal working conditions is as follows: male workers 61 years and 3 months, female workers 56 years and 8 months.

Workers with reduced working capacity; working in particularly arduous, toxic, or dangerous occupations or jobs; working in areas with particularly difficult socio -economic conditions may retire at a lower age, but not more than 5 years older than the prescribed age at the time of retirement, except in cases where the law provides otherwise.

Workers with high professional and technical qualifications and some special cases may retire at a higher age but not more than 5 years older than the prescribed age at the time of retirement, unless otherwise provided by law.

A labor and salary expert said that adjusting the retirement age is a strategic human resource decision with a long-term vision. Adjusting the retirement age to increase by 3 months each year for male workers until they reach 62 years old and by 4 months for female workers until they reach 60 years old is to avoid shocking the labor market and avoid a sudden increase in unemployment, which could cause social instability.

Pay social insurance for 15 years to receive pension

From July 1, 2025, when the Social Insurance Law 2024 takes effect, when retiring, employees who have paid compulsory social insurance for at least 15 years (current law stipulates 20 years) will be entitled to pension if they meet the conditions specified in Article 65 of the Social Insurance Law such as: reaching retirement age, being at least 10 years younger than the prescribed age and having worked in underground coal mining for at least 15 years according to Government regulations; being infected with HIV/AIDS due to occupational accidents while performing assigned tasks...

Although according to the Social Insurance Law 2024, employees are allowed to reduce their social insurance participation time to receive retirement benefits, the highest pension rate remains at the old level of 75%.

According to Article 66 of the Social Insurance Law 2024 on monthly pension levels, the monthly benefit level of eligible retirees is calculated as follows:

For female workers, the pension rate for 15 years of social insurance contributions is equivalent to 45% of the salary used as the basis for social insurance contributions. Then, for each additional year of social insurance contributions, an additional 2% is calculated, with a maximum of 75%.

For male workers, the pension is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

In the case of male workers who have paid social insurance for 15 years but less than 20 years, the monthly pension is equal to 40% of the average salary used as the basis for social insurance payment corresponding to 15 years of social insurance payment, then for each additional year of payment, 1% is added. In the case of early retirement due to reduced working capacity, each year of retirement before the prescribed age is reduced by 2%.

In case of early retirement of less than 6 months, the pension percentage will not be reduced; from 6 months to less than 12 months, the pension will be reduced by 1%.

Labor expert Nguyen Thi Lan Huong - former Director of the Institute of Labor and Social Sciences ( Ministry of Labor, Invalids and Social Affairs ) said that reducing the time of paying social insurance from 20 years to 15 years to receive pension does not mean that retirement salary is low. This is only the minimum condition for those who enter the labor market late (age 35-45) to have the opportunity to enjoy pension policy. For those who participate in social insurance for a long time, nothing will change, when they reach retirement age, the benefit level will be high.

Furthermore, pensions are adjusted according to the annual consumer price index, pensioners can participate in free health insurance, so when they get old and sick, the burden on relatives and society will be reduced.

The Social Insurance Law 2024 stipulates 3 forms of receiving pension from July 1, 2025 for employees participating in compulsory social insurance: Through the beneficiary's bank account; directly from the social insurance agency or a service organization authorized by the social insurance agency; through the employer.

For voluntary social insurance participants, there are two ways to receive pension: Through the beneficiary's account opened at a commercial bank or foreign bank branch established and operating in Vietnam; directly from the social insurance agency or a service organization authorized by the social insurance agency.

Source: https://vietnamnet.vn/tuoi-nghi-huu-va-ty-le-huong-luong-huu-cua-nam-nu-moi-nhat-2330647.html

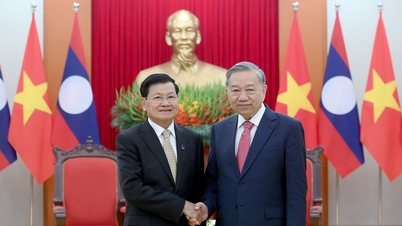

![[Photo] General Secretary To Lam meets with General Secretary and President of Laos Thongloun Sisoulith](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761380913135_a1-bnd-4751-1374-7632-jpg.webp)

![[Photo] President Luong Cuong and United Nations Secretary-General Antonio Guterres chaired the signing ceremony of the Hanoi Convention.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761370409249_ndo_br_1-1794-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761390212729_dsc-1484-jpg.webp)

![[Photo] President Luong Cuong receives heads of delegations attending the signing ceremony of the Hanoi Convention](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761377309951_ndo_br_1-7006-jpg.webp)

Comment (0)