Customers with expired identification documents and who have not updated their biometrics will have their payment or withdrawal transactions suspended.

According to regulations, from January 1, 2025, customers whose identity documents have expired will have their money transfer and withdrawal transactions stopped on all channels.

Individual customers and corporate cardholders who have not registered for biometrics will also have all online transactions and ATM/CDM withdrawals stopped.

According to banks, from January 1, 2025, if the bank account has not been biometrically authenticated, customers will not be able to make transfers of any value; will not be able to link or make online payments from e-wallets/bank accounts; will not be able to deposit or withdraw money between e-wallets and bank accounts; will not be able to make touch payments via Apple Pay, Samsung Pay, Google Pay, Garmin Pay, etc.

For payment cards and debit cards, from January 1, 2025, customers will also not be able to continue using them if their identity documents or residence confirmation papers have expired or if their identity documents have not been updated to CCCD/ID card.

Previously, from October 1, customers could not open payment accounts and debit cards online without updating their biometrics.

For credit cards, from January 1, 2025, customers will not be able to make card transactions when their identity documents or residence confirmation papers expire.

Previously, from October 1, customers could not open a credit card online, could not renew a credit card, and could not activate a credit card when their identity documents/residence certificates expired.

To help ensure maximum customer benefits, banks recommend that customers update their identification information and biometric data by accessing the banking application and updating biometric data; or updating personal information and biometric data at all bank branches/transaction offices nationwide.

To successfully update biometrics, customers only need to prepare a valid 12-digit chip-embedded ID card or an ID card issued from July 1 according to the new standards of the Ministry of Public Security and a mobile device that supports NFC. In case the device does not support NFC, customers need to go to the transaction points of the bank where the account is opened.

To prevent scammers from taking advantage of this to steal information and money from customers' accounts, banks confirm that when assisting customers in updating data, employees will never send login request links, provide user names, passwords, ID card numbers, OTP codes or any other personal information.

Therefore, customers need to be more vigilant against counterfeit and fraudulent forms. Customers should also not buy/use external NFC devices at home to avoid information security risks for personal devices.

| According to the State Bank of Vietnam, after two months of implementing Decision 2345 of the State Bank of Vietnam on mandatory biometric authentication for money transfer transactions of over VND10 million/transaction and over VND20 million/day, the number of fraud cases after July 1st was only 700, down 50% compared to the average of the previous 7 months. The number of accounts involved in fraud was only 682, down 72% compared to the average number of the first 7 months of the year. |

Source: https://vietnamnet.vn/tu-1-1-2025-nguoi-dung-tai-khoan-ngan-hang-can-luu-y-gi-2335098.html

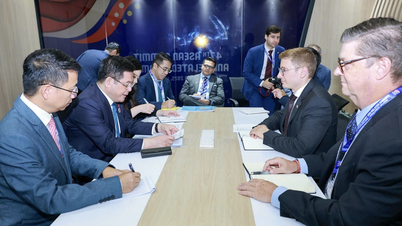

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

Comment (0)