According to experts, Vietnam is emerging as a promising financial investment destination, attracting the attention of international investors. However, to turn this potential into reality, Vietnam needs to meet investors’ increasing expectations regarding the legal environment, infrastructure and service quality.

“Human” attraction and support from the Government

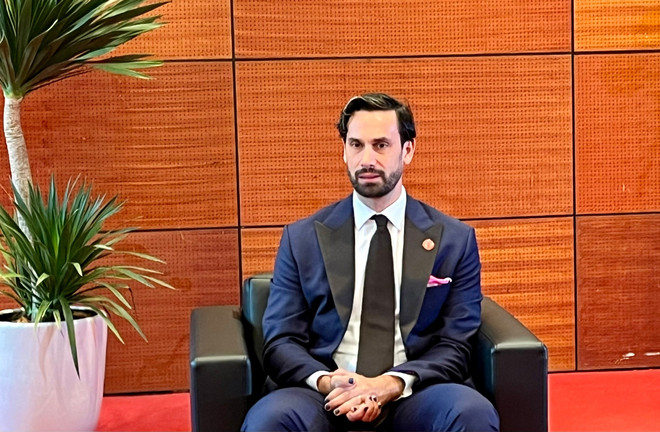

“Vietnam has all the ingredients to become an attractive investment destination,” said Vinnie Lauria, founder of Golden Gate Ventures, an investment fund that has been involved in Vietnam for the past decade.

Mr. Vinnie Lauria assessed that Vietnam has a very interesting business environment and market. It comes from a “human” factor when considering education level, talent and aspiration to build large and innovative enterprises. To date, Golden Gate Ventures has made nearly 20 investments in Vietnam. In the coming time, the fund will continue to accelerate the pace with the goal of one-third of new investments going to Vietnam.

Besides, he also emphasized the dynamism of the Vietnamese startup community with a large number of young entrepreneurs, especially women, which is also a big plus.

“The strong development of the business community will attract more international investors to Vietnam,” said Mr. Vinnie Lauria.

For Vietnam’s financial center to truly compete with other centers in the region, investors expect the completion of three key factors: the legal environment, infrastructure and service quality in Vietnam.

Regarding the legal environment, Mr. Lauria emphasized the importance of facilitating cross-border transactions and suggested allowing Vietnamese businessmen to own shares in foreign companies (for example, a company in Singapore) to facilitate capital mobilization.

“I think anything that makes it easier to transact across borders will help Vietnam’s innovation ecosystem, whether it’s investment or talent (coming and going),” Lauria shared.

Mr. Chad Ovel, representative of Mekong Capital (a fund that has invested in Vietnam for 25 years) also shared his views on the need to streamline and simplify procedures so that foreign investors can easily invest in startups, especially small investments. In addition, although Vietnam has made significant progress in infrastructure, there is still much room for improvement, especially in areas such as transportation, telecommunications and energy.

Regarding service quality, Mr. Ovel highly appreciated the high-quality human resources in the field of innovation and digital transformation in Vietnam. However, he also emphasized the need for a more dynamic financial market, including a separate stock market for startups and technology companies.

In addition to the opportunities, investors also frankly pointed out the barriers and challenges that Vietnam needs to overcome to attract more investment capital. One of the issues mentioned is that many Vietnamese startups choose to establish companies abroad.

Mr. Ovel pointed out the current situation where a technology company can start its company in Singapore instead of Vietnam because registering in this island nation makes it easier to attract venture capital. Meanwhile, the process of registering a foreign investor in a business in Vietnam can take more time and the procedures are more complicated.

Therefore, he recommended that Vietnam continue to support the education system, celebrate success and find ways to support Vietnamese companies to go global. He also proposed building a "sandbox" environment so that companies can test new products and processes without having to go through a complicated approval process.

Expect more "unicorns" in Vietnam

Hiren Krishnani, Head of Southeast Asia at Nasdaq, stressed the importance of building a strong corporate governance structure, recruiting the right board, and telling the company’s story in a way that investors can understand. He also recommended that Vietnamese companies attend more conferences in the US, not just the top-tier conferences but also the second- or third-tier conferences, to meet with investors to gather feedback and build relationships.

Although specific investment plans have not been disclosed, investors have expressed optimism about the potential of the Vietnamese market. Mr. Lauria said Golden Gate Ventures is considering various investment opportunities, including in the fields of medical technology and education.

Meanwhile, Mr. Krishnamani affirmed that Nasdaq is fully committed to the Vietnamese market and hopes to see many Vietnamese "unicorns" (startups worth more than 1 billion USD) listed on Nasdaq.

From objective assessments, international experts believe that Vietnam's financial center possesses "plus points" in terms of young, dynamic human resources as well as support from the Government. To truly become a competitive financial center in the region, Vietnam needs to make more efforts to improve the legal environment, infrastructure and service quality.

According to experts, resolving the remaining barriers will be an important "driving force" for Vietnam to realize its goal of becoming a leading regional financial center, attracting investment capital, promoting innovation and contributing to the country's economic development./.

Source: https://www.vietnamplus.vn/trung-tam-tai-chinh-viet-nam-diem-den-hap-dan-va-cac-luc-day-can-thiet-post1034534.vnp

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Video] 24-hour news on May 9, 2025: General Secretary To Lam officially visits the Russian Federation and attends the 80th anniversary of Victory Day in the Great Patriotic War](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5eaa6504a96747708f2cb7b1a7471fb9)

Comment (0)