One-third of Tri Viet's assets are being invested in MWG shares and have temporarily recorded large profits. The company is also among the few businesses planning to buy back its own shares.

Tri Viet plans to buy back 8 million treasury shares, betting big on MWG shares

One-third of Tri Viet's assets are being invested in MWG shares and have temporarily recorded large profits. The company is also among the few businesses planning to buy back its own shares.

|

| Tri Viet is among the few businesses that have bought back its own shares in recent years. |

Rare businesses buy treasury stocks

The Board of Directors of Tri Viet Asset Management Group Joint Stock Company (code TVC - HNX floor) has implemented the repurchase of 8 million shares of the company itself, equivalent to more than 6.7% of the charter capital of this enterprise.

The transaction is expected to be executed through order matching and/or negotiation in 2024 after the State Securities Commission has notified it of the receipt of full documents reporting the share buyback and the company has made information disclosure as prescribed. The transaction period shall not exceed 30 days from the date of commencement of execution.

The maximum share repurchase price is VND 14,600/share, 1.4 times higher than the closing price on November 1, 2024 (VND 10,100/share).

According to current regulations in the Securities Law and the Enterprise Law issued in 2019 and both effective from January 1, 2021, organizations when repurchasing shares from shareholders will have to carry out procedures to reduce charter capital corresponding to the total value calculated by the par value of the shares repurchased by the company within 10 days from the date of completion of payment for the share repurchase.

This is also the reason why the number of treasury stock buyback transactions is no longer chosen by many businesses. Since the beginning of the year, 4 businesses have bought back from resigned employees. Vinhomes and Tri Viet are two rare organizations that buy back treasury stocks from the market. Vinhomes' deal is expected to record a historic transaction value (over VND 13,000 billion). From October 23, 2024 to November 3, Vinhomes is estimated to have disbursed over VND 3,000 billion to buy back 76.86 million VHM shares, equivalent to 20.77% of the registered treasury shares.

With 8 million treasury shares expected to be bought back, Tri Viet estimates that it will spend a maximum of nearly 11.7 billion VND. Compared to the original plan, Tri Viet's treasury share purchase plan has changed.

Previously, on June 20, 2024, the Board of Directors of the company approved the adjustment of some contents in the share repurchase plan to reduce charter capital, including increasing the number to 8 million shares, the maximum price to 14,600 VND/share. Accordingly, the total number of shares registered for repurchase was adjusted to 8 million shares, instead of registering to repurchase the first phase of 5 million shares as originally planned. In addition, the maximum repurchase price was also adjusted from 9,968 VND/share to 14,600 VND/share. Thus, instead of repurchasing at below par value, the maximum repurchase price that Tri Viet accepts is up to 46% higher.

At the 2024 Annual General Meeting of Shareholders, Ms. Nguyen Thi Hang, Chairwoman of the Board of Directors of the company, said that the long-term major policy of the board of directors is to buy back shares to reduce capital and this can be considered a form of "dividend". According to Ms. Hang, it is even possible to create a surplus of equity if buying below book value. The company's leaders also mentioned the possibility of buying back shares every 6 months.

Invest 1/3 of assets in MWG stocks, temporary big profit

Tri Viet suffered a heavy loss of VND 887 billion in 2022. In addition to the unfavorable financial investment segment when recording revenue and expenses of VND 72 billion and VND 473 billion, respectively, the company also set aside hundreds of billions of dong for bad debt provisions.

Although it returned to profit in 2023, in order to optimize the company's profits, the Board of Directors approved not to set aside funds and pay dividends in 2023. In 2022, Tri Viet also did not pay dividends. The most recent time, this enterprise paid the first interim dividend in 2021 at a rate of 8% in August 2021. Meanwhile, according to the original plan, the maximum dividend in 2021 was not to exceed 20% of charter capital. On March 30, 2022, the Board of Directors approved the plan to pay the second interim cash dividend in 2021 at a rate of 10%, but has not yet implemented it due to "considering the distribution at the appropriate time, because otherwise it may lead to negative equity".

In the third quarter of 2024, the company achieved more than VND 85 billion in revenue, an increase of 613% over the same period last year. However, this period the company no longer had a refund like the same period last year, so its after-tax profit decreased by 21% to VND 127 billion. Accumulated for 9 months, revenue reached VND 175 billion, an increase of 483% over the same period. After-tax profit reached VND 286 billion, an increase of 18%.

According to Chairwoman of the Board of Directors Nguyen Thi Hang, the company has focused on core investment activities, anticipated and made good use of market fluctuations, and built an investment portfolio in line with its strategy and plan. The company also closed a portion of the portfolio in line with its year-end operations, taking advantage of cash dividends from the stocks in the portfolio.

As of September 30, Tri Viet's asset size was approximately VND2,500 billion, an increase of VND520 billion compared to the beginning of the year. Capital was increased mainly thanks to retained earnings and increased margin loans at securities companies, using financial leverage in investing in the market.

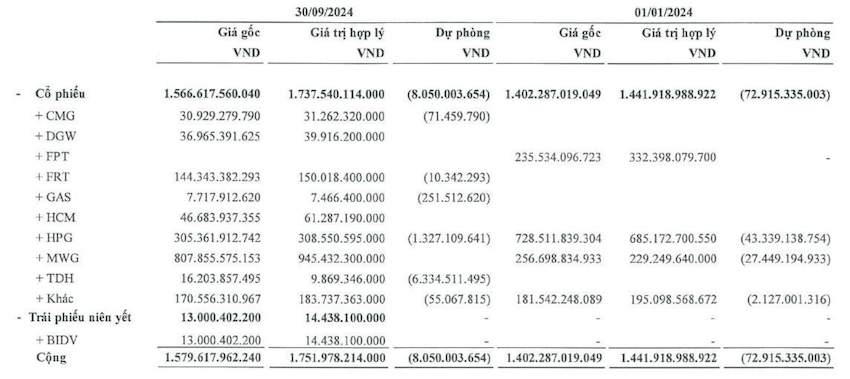

|

| Value of securities traded at Tri Viet. |

By the end of the third quarter, Tri Viet's investment portfolio value exceeded VND1,520 billion. Of which, MWG shares accounted for the largest proportion with the original investment price equal to nearly 1/3 of total assets. Tri Viet spent VND807 billion to buy MWG shares and is temporarily earning nearly VND140 billion. On the other hand, this company reduced the value of its holdings of Hoa Phat's HPG shares from VND728 billion to VND305 billion. This is also the stock that Tri Viet sold the most in the year in the portfolio.

Source: https://baodautu.vn/tri-viet-du-tinh-mua-lai-8-trieu-co-phieu-quy-cuoc-lon-vao-co-phieu-mwg-d229074.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)