On March 7, 2025, Vietnam Report Joint Stock Company (Vietnam Report) in collaboration with VietNamNet Newspaper announced the FAST500 Ranking - Top 500 Fastest Growing Enterprises in Vietnam in 2025.

The FAST500 ranking has entered its 15th year on the journey of searching, recognizing and honoring the worthy achievements of businesses with good business efficiency, based on key criteria such as: compound growth rate (CAGR) in revenue, total assets, equity, pre-tax profit, media reputation, etc.

List of Top 10 FAST500 Rankings in 2025

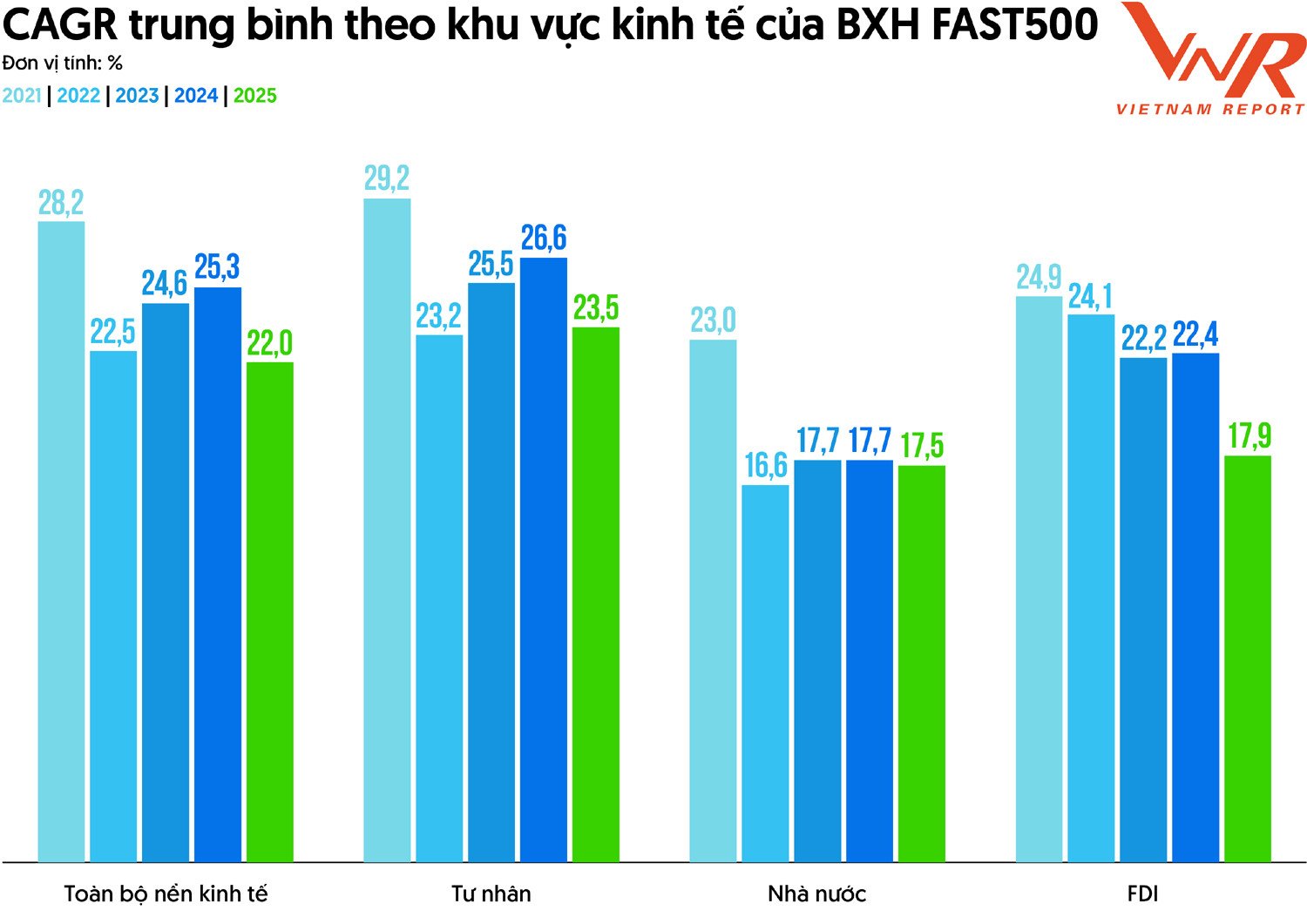

The average CAGR of FAST500 enterprises in the 2020-2023 period has slowed down somewhat, down 3.29% compared to the previous year, partly reflecting the general downward pressure of enterprises in the context of a gloomy business market. In terms of economic sector, the private sector continues to lead with an average CAGR of 23.5%, followed by the foreign direct investment (FDI) sector at 17.5%, and finally the state sector at 17.5%. Despite having the lowest average CAGR, the state sector has maintained stability over the past 3 years.

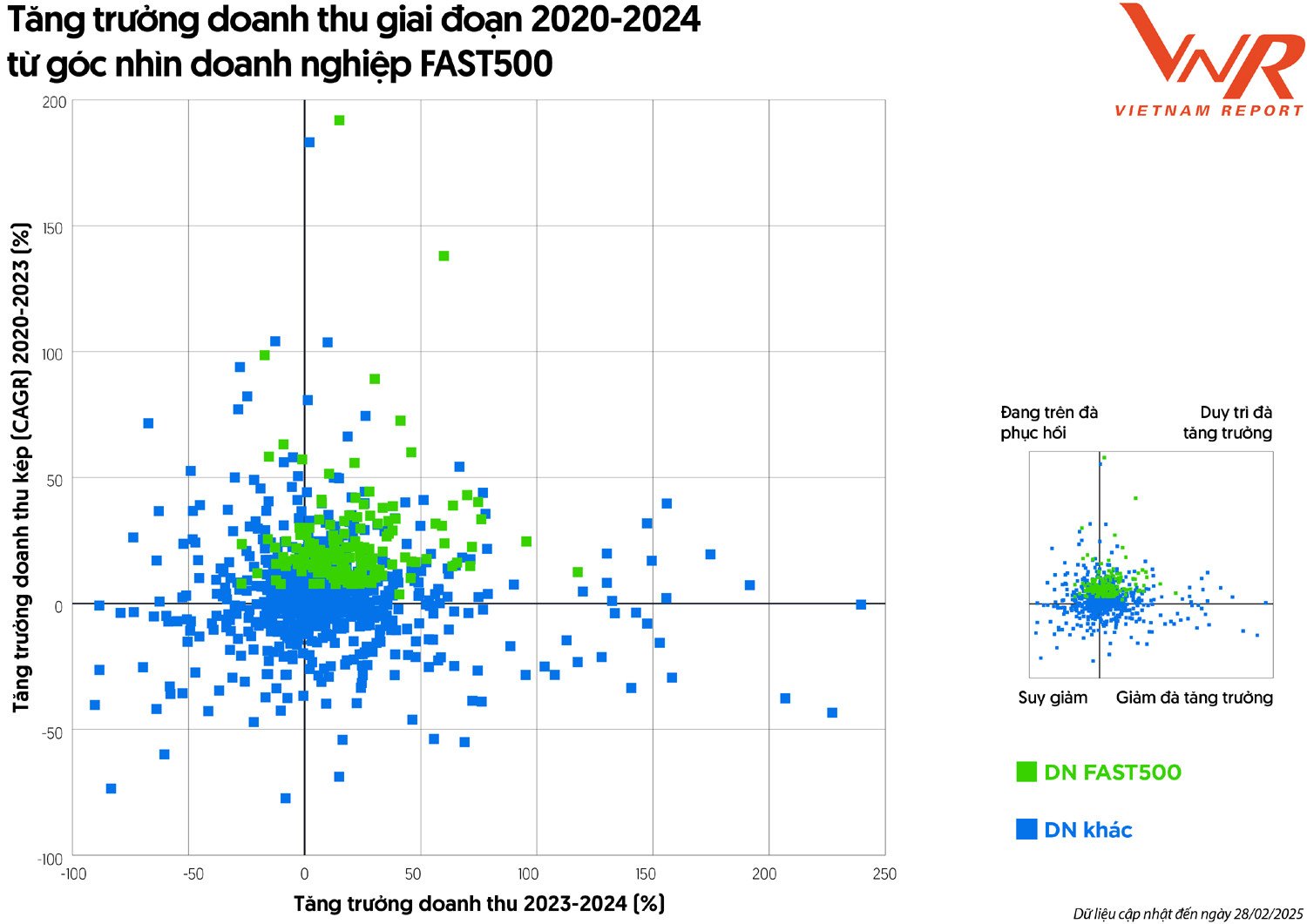

FAST500 enterprises have demonstrated impressive resilience in the face of a series of fluctuations since 2020. According to Vietnam Report statistics (updated financial data in 2024), FAST500 enterprises not only maintained a stable revenue growth rate in the 2020-2023 period but also continued to have positive growth in 2024, while the remaining group had a wide dispersion, with many data points falling into the decline or slowing growth zone. This affirms the outstanding growth capacity, adaptability, and maintenance of sustainable development momentum through the financial foundation and methodical business strategy of FAST500 enterprises.

The difference in distribution between FAST500 enterprises and the rest of the economy emphasizes the value of the Ranking as an important indicator of financial health and growth potential of enterprises. In 2025, the FAST500 community is expected to maintain stable development momentum, affirming its role as a driving force for economic growth and shaping development trends as the country enters a new era.

Optimistic Psychology: Stretch - Accelerate

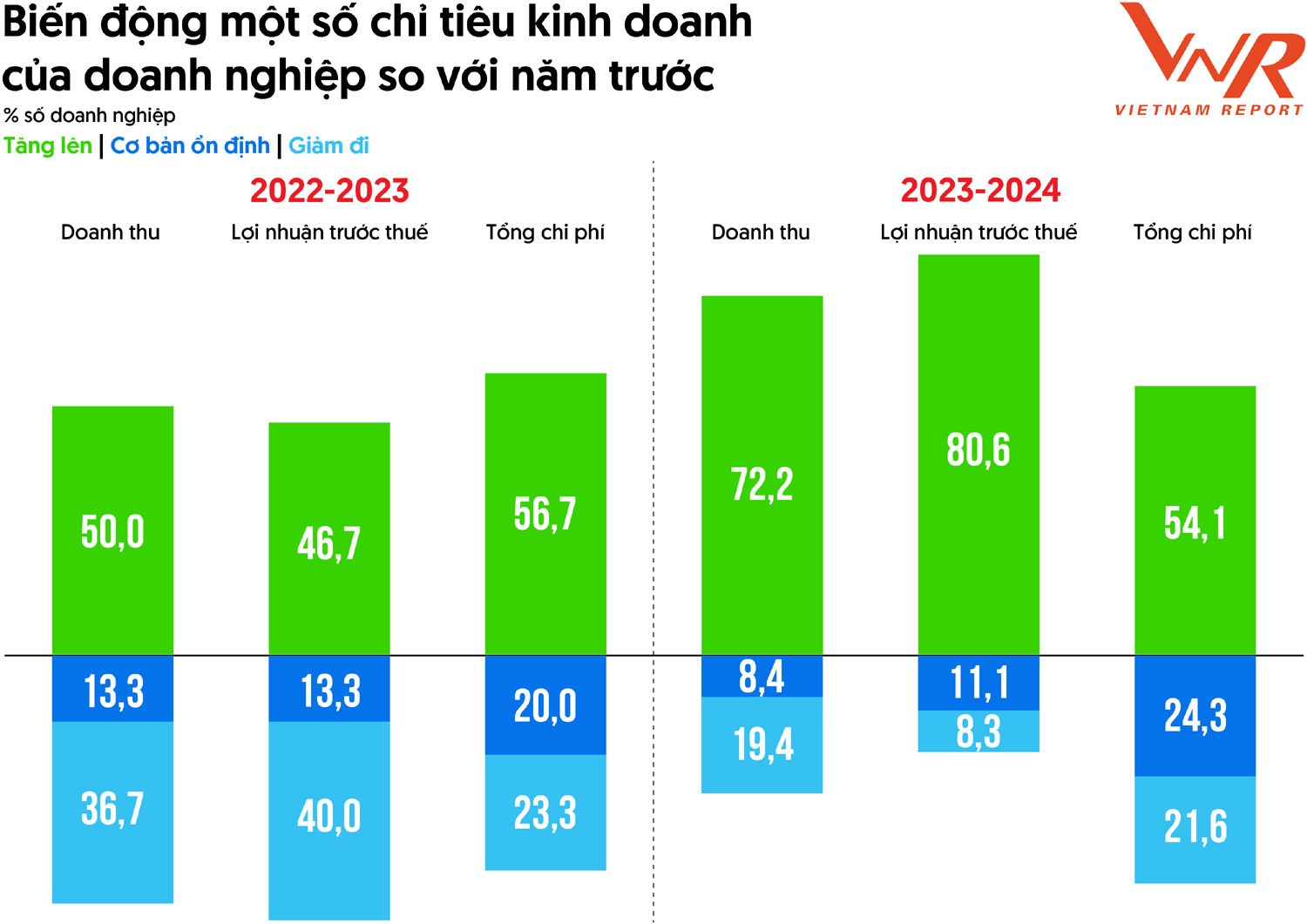

Recovery remained the main story of the Vietnamese economy last year. According to a survey by Vietnam Report, with the low base effect, the majority of enterprises saw revenue and profit growth compared to the previous year, while the proportion of enterprises with declining business results narrowed significantly and the number of enterprises recording increased costs was also lower than in the previous period.

In addition to many positive assessments from international organizations, most businesses also expect Vietnam to achieve impressive economic growth in 2025. Accordingly, the GDP growth scenario of 7.0-7.5% is considered the most feasible (23.6%), followed by 7.5-8.0% (21.4%) and 6.5-7.0% (19.3%). The leading industry groups in terms of growth potential include: Information Technology/Telecommunications (69.4%), Transportation/Logistics (41.7%), Electricity/Energy (38.9%), Real Estate/Construction/Building Materials (33.3%), Pharmaceuticals/ Healthcare (33.3%).

Breakthrough Reform - Efficient Streamlining - Comprehensive Digitalization

As an important milestone as Vietnam enters the final year of implementing the Socio-Economic Development Plan for the 2021-2025 period, this year is expected to witness strong absorption of the reform policies that have been implemented, creating momentum to promote economic growth, enhance competitiveness, and continue to build the foundation for long-term strategic goals. Enterprises also identify digital transformation, administrative reform, infrastructure development, low interest rates, and especially an improved legal environment as solid support foundations for growth momentum in 2025.

The Government ’s efforts to streamline the apparatus, reform synchronously and digitize administrative procedures not only help improve the efficiency of state management but also create strong momentum for the development of the business community. “Opening the way” policies are opportunities for businesses to improve operational efficiency, develop new products and reach customers through digital channels, especially in the context of the digital economy expected to account for a larger proportion of GDP.

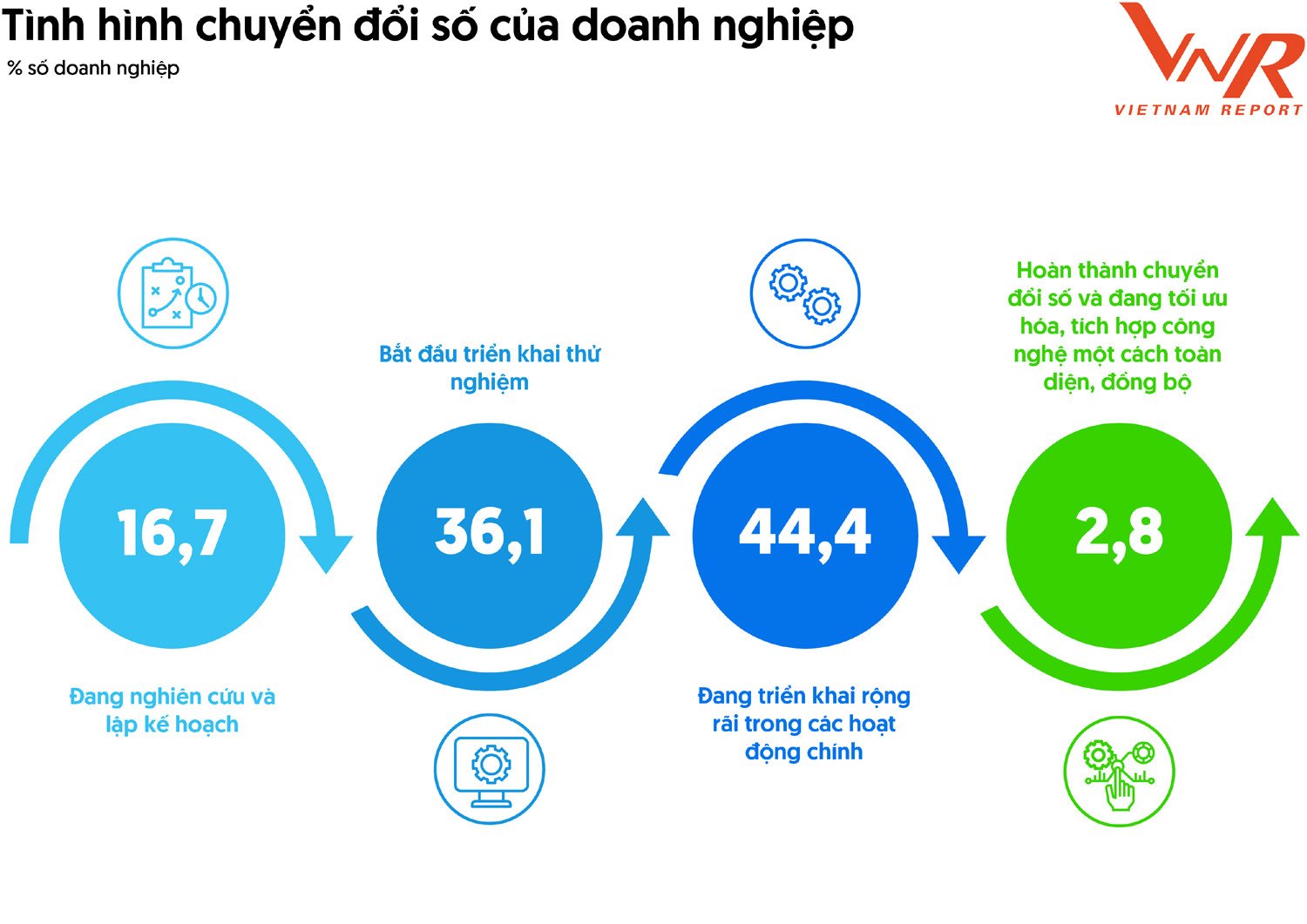

According to a survey by Vietnam Report, the majority of businesses have recognized the positive trend in digital transformation and have begun to take action: 44.4% of businesses have entered the actual implementation phase, applying digital transformation to core operations; 36.1% of businesses are in the experimental implementation phase to find suitable solutions. However, only 2.8% of businesses have reached the highest level of completing digital transformation and are optimizing.

Overall, the digital transformation picture is taking place strongly but unevenly. Businesses have made significant progress, but still need to continue investing, testing and perfecting to achieve optimal digital transformation.

Detailed information about the list and rankings of businesses is posted at: www.fast500.vn.

Thuy Nga

Source: https://vietnamnet.vn/top-500-doanh-nghiep-tang-truong-nhanh-nhat-viet-nam-nam-2025-2378358.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)