On December 12, 2024, Vietnam Report announced the Top 10 Prestigious Animal Feed Companies in 2024. The ceremony to honor typical enterprises organized by Vietnam Report and VietNamNet Newspaper will take place in January 2025 in Hanoi .

The ranking is built on objective and scientific principles with 3 main criteria: Financial capacity shown in the most recent financial report; Media reputation assessed by Media Coding method; Survey of research subjects and stakeholders.

Current status of Vietnam's Animal Feed Industry: Trend of decreasing production

Vietnam is one of the countries with a strong livestock industry in Asia. According to Alltech's 2024 Agri- Food Outlook Report, Vietnam ranks 8th in the world in terms of animal feed production.

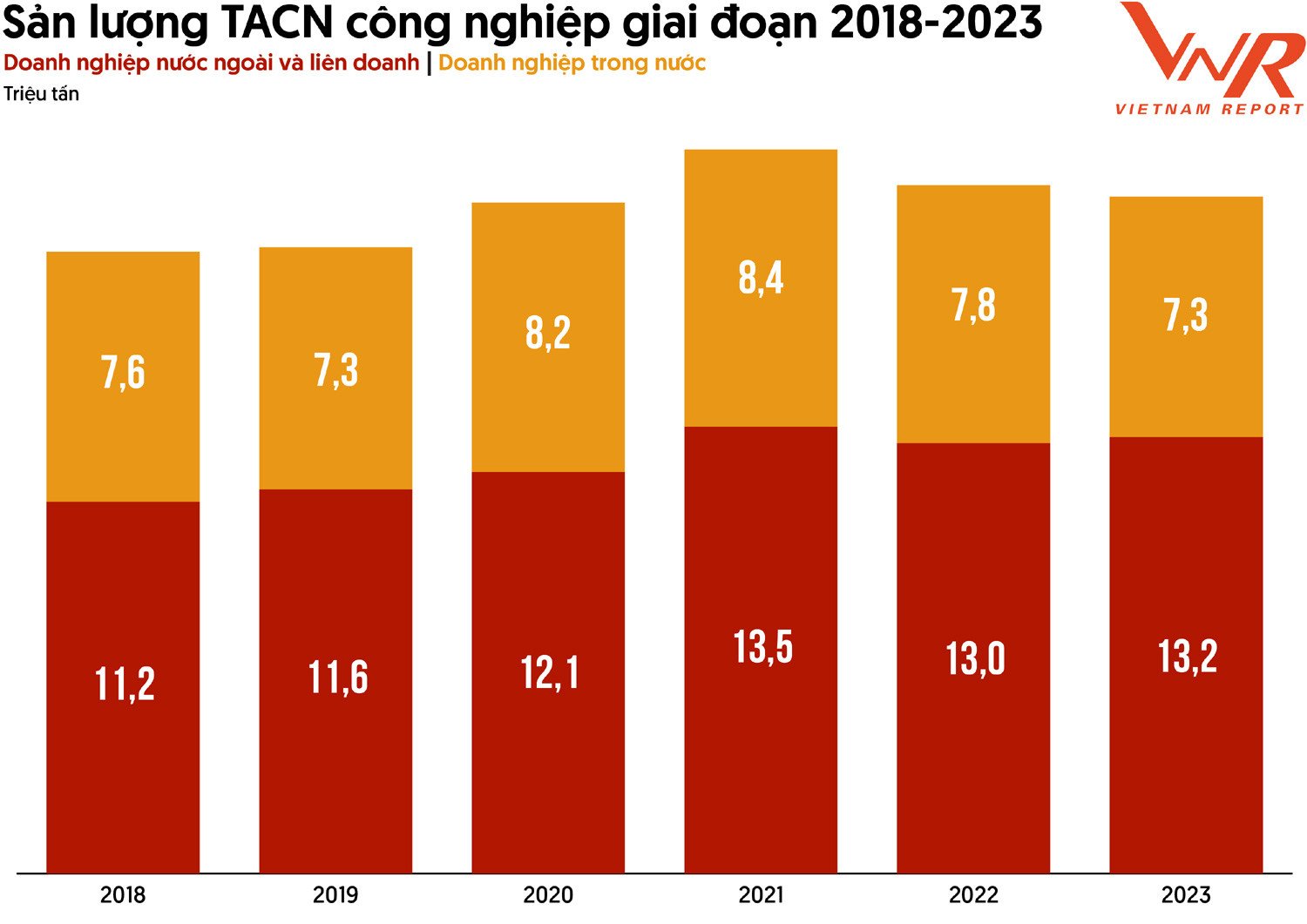

During the 2019-2021 period, the Vietnamese animal feed industry grew steadily in terms of output and peaked in 2021 at 21.9 million tons. However, a downward trend in output began to appear afterwards, partly due to advances in farming technology.

According to the Department of Animal Husbandry, the number of animal feed factories in the period of 2019 - 2023 is relatively stable, from 260 - 270 factories. In particular, the Red River Delta and the Southeast are the main areas of concentration of large factories thanks to the convenient transportation system and high demand for livestock.

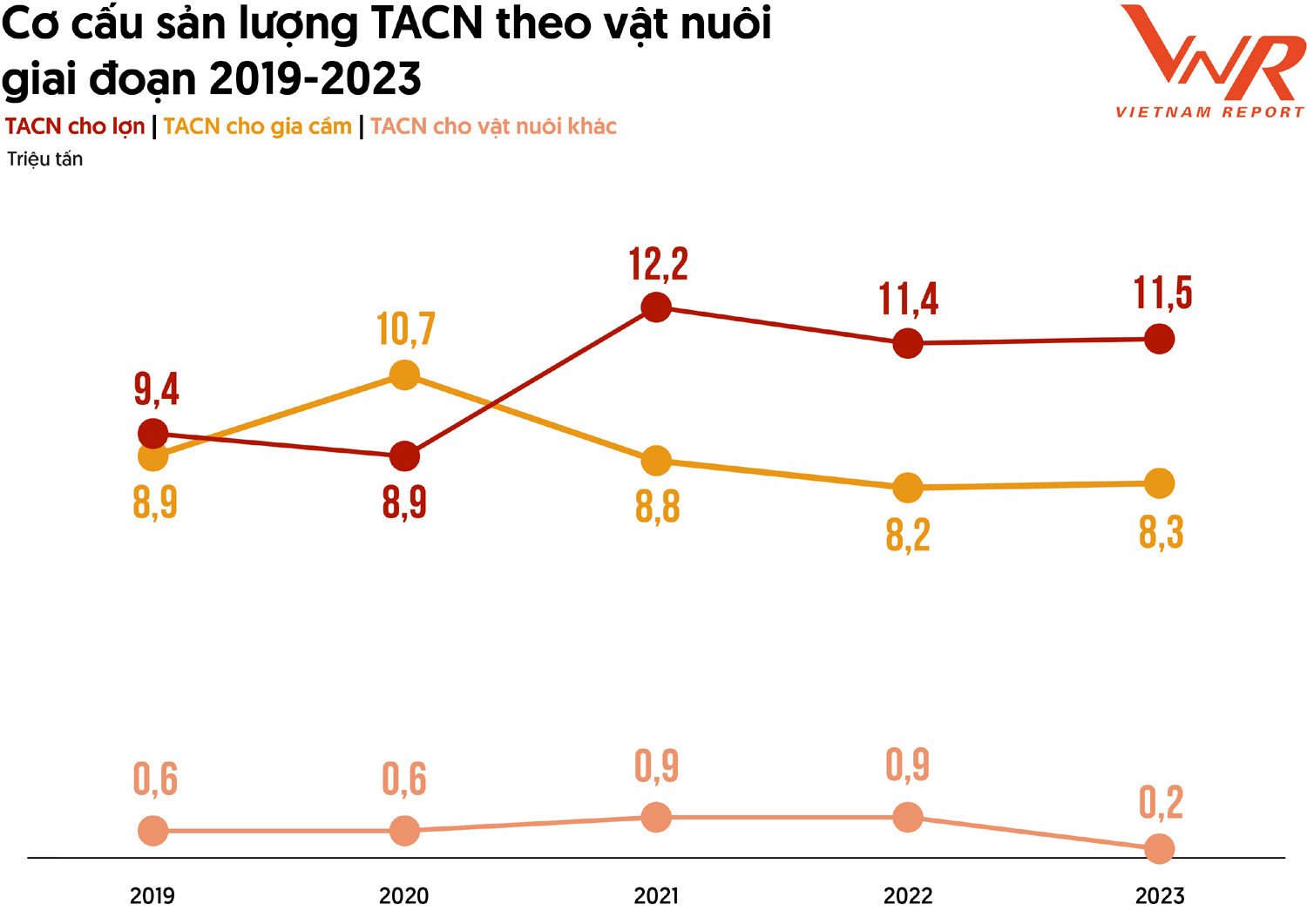

Feed production by product group over the past 5 years has also seen significant fluctuations. Specifically, pig feed production grew strongly in the period 2019 - 2021 due to the recovery of the industry after African swine fever, but then slowed down when the herd rebuilding process was gradually completed and demand stabilized. Meanwhile, poultry feed production decreased sharply and feed for other livestock remained low.

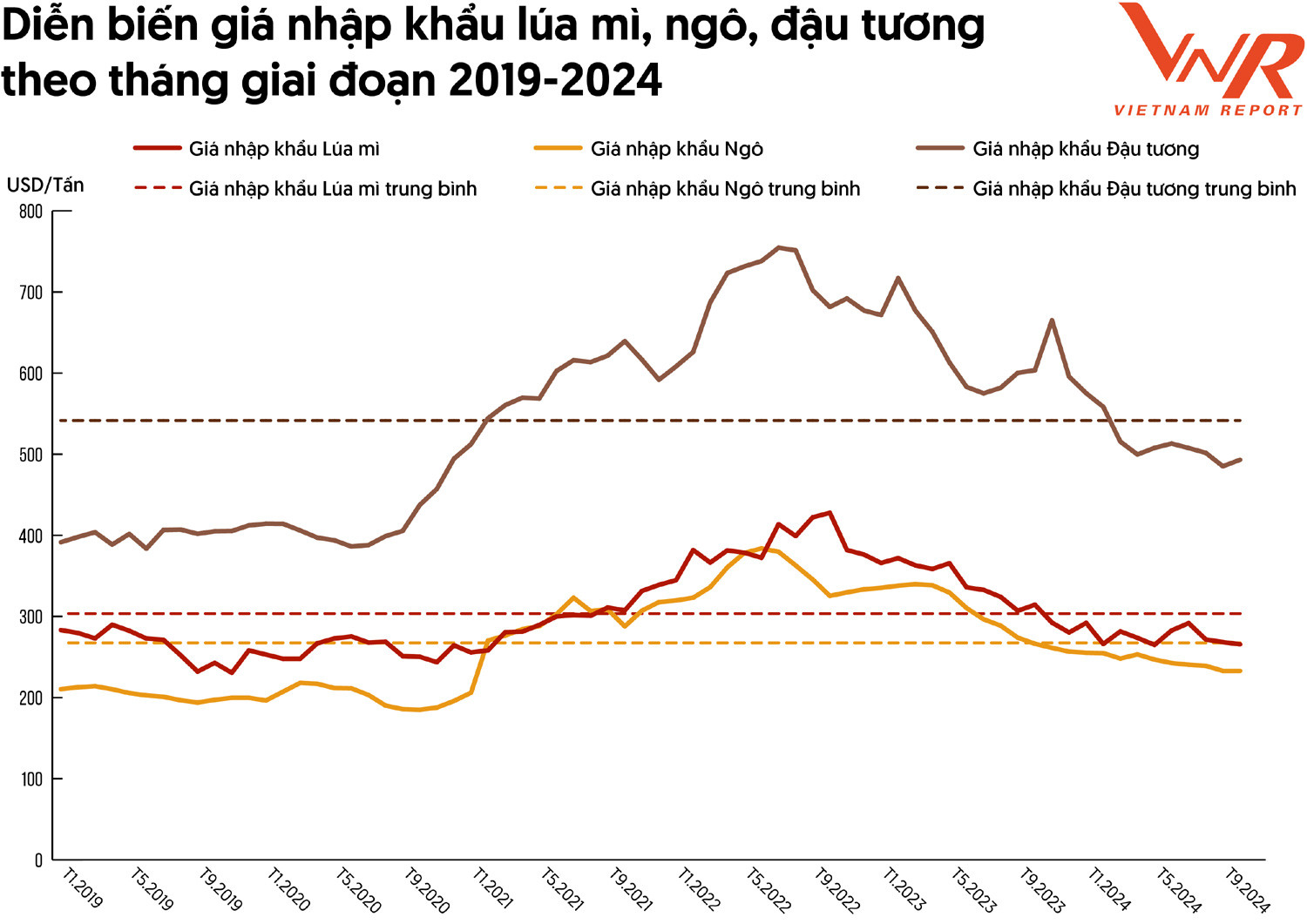

Preliminary statistics from the General Department of Customs show that in the first 10 months of 2024, the export value of animal feed and raw materials is estimated at 850 million USD, down 16.0% and the import value of this group of goods reached more than 4.02 billion USD, down 5.8% over the same period last year. Since the beginning of the year, the price of imported raw materials for animal feed production such as wheat, corn, and soybeans has decreased by 8-14%, causing animal feed prices to be adjusted down up to 4 times. The main reason is due to bumper crops and favorable conditions in importing countries.

Currently, animal feed enterprises still face many challenges. According to a survey by Vietnam Report, the main factors affecting production in the past year are: Impact of climate change, natural disasters, epidemics; Pressure from increasing exchange rates; Competition between enterprises in the same industry; Increasing prices of input materials; Fluctuations in the energy market...

Outlook 2025: Positive Forecasts

In the Livestock and Poultry 2025 report of the United States Department of Agriculture (USDA), Vietnam's pork output is expected to increase by 3%, reaching 3.8 million tons in 2025. Industrial feed output is expected to reach 24 - 25 million tons in 2025 and 30 - 32 million tons in 2030, according to the Animal Feed Processing Industry Development Project to 2030.

Vietnam Report's survey also showed positive signs in 2025 when 57.1% of businesses were optimistic about the industry's growth prospects, 28.6% predicted no change and 14.3% worried about more difficulties.

According to businesses, to take advantage of growth opportunities and overcome potential challenges, a number of solutions need to be prioritized, such as: Researching organic animal feed products that meet biosafety quality standards; Finding and diversifying raw material suppliers at competitive prices; Investing in machinery and automated animal feed production lines that meet international standards; Implementing a sustainable development strategy and protecting the environment.

According to Vietnam Report's survey, businesses also recommended policies focusing on: Improving statistics and market forecasting; Strengthening policies to protect domestic production; Planning and developing raw materials for animal feed production.

Communication activities of animal feed enterprises

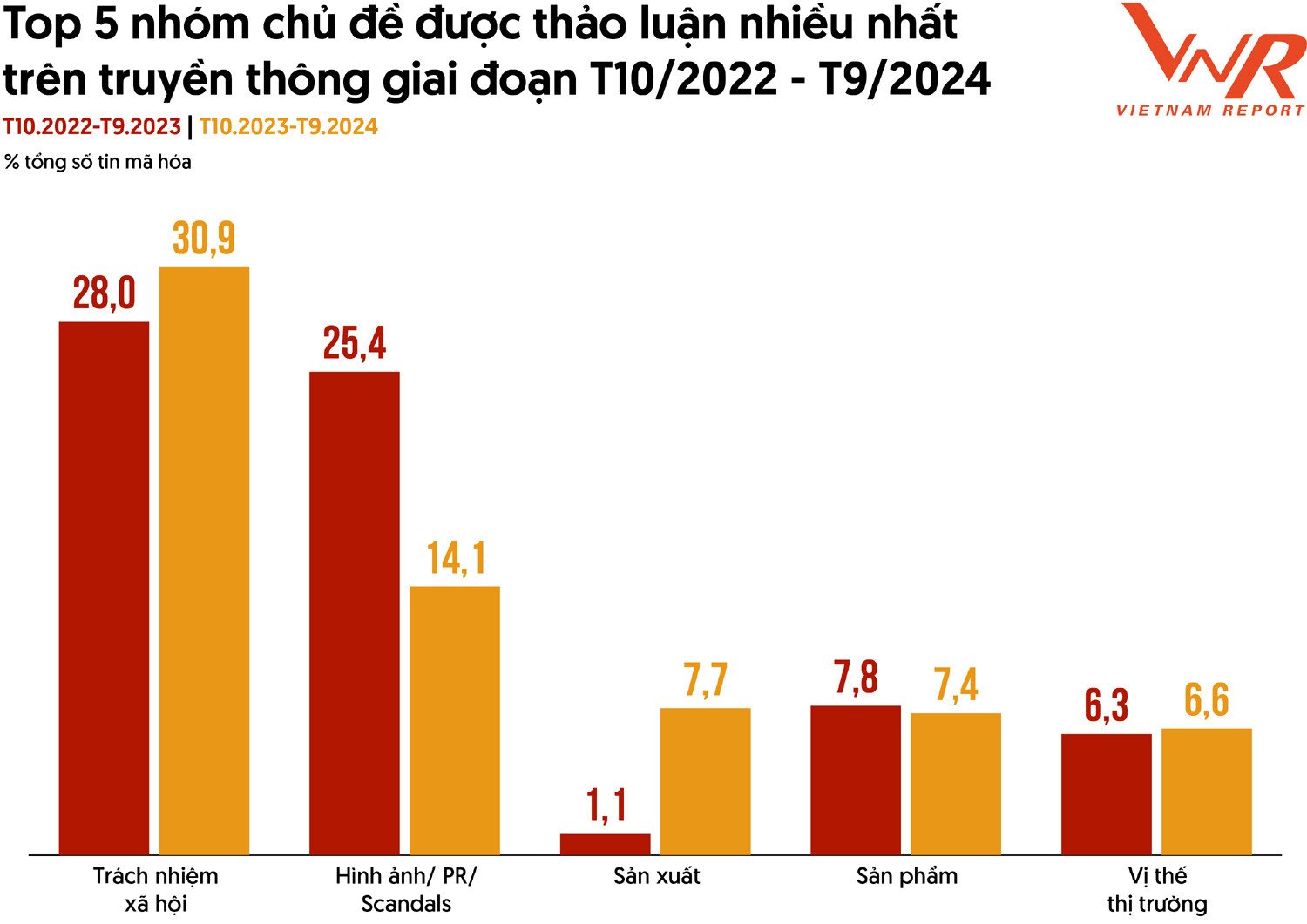

Media Coding data from October 2023 to September 2024 yielded the 5 most discussed topic groups: (1) Social Responsibility; (2) Image/PR/Scandals; (3) Production; (4) Product; and (5) Market Position.

Feed companies have recorded a clear shift in communication focus. The topic of Social Responsibility is increasingly prioritized, while Image/PR/Scandals has decreased sharply but is still discussed a lot. Information related to Production has increased significantly, showing the investment of businesses in expanding scale and improving production efficiency.

Regarding information quality, enterprises are considered “safe” when the difference between positive and negative information compared to the total amount of encoded information is 10%, the “best” threshold is over 20%. Accordingly, 75.6% of enterprises in the study reached the threshold of over 20%. Although this ratio tends to decrease compared to previous years, it is still high, showing that animal feed enterprises continue to aim to build a reputable image with the community.

(Source: Vietnam Report)

Source: https://vietnamnet.vn/top-10-cong-ty-thuc-an-chan-nuoi-uy-tin-nam-2024-2351603.html

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)