- Update the latest gold price details today, April 11, 2025 in the domestic market

- Update gold price today April 11, 2025 latest on the world market

- Gold price forecast for tomorrow, April 12, 2025, domestic gold price continues its 3-day streak of breaking the peak

Update the latest gold price details today, April 11, 2025 in the domestic market

Gold price today, April 11, 2025, closed at 6:30 p.m., exploding with a strong increase across the market, bringing a brilliant trading day for investors. From SJC, PNJ, DOJI to big brands such as Mi Hong, Phu Quy, Bao Tin Minh Chau, domestic gold prices skyrocketed, creating an attractive investment fever. Let's explore the details of gold price today, April 11, 2025 so as not to miss the golden opportunity that is wide open!

In Hanoi , the SJC gold price listed by Saigon Jewelry Company closed at 6:30 p.m. at VND102.2 million/tael (buy) and VND105.2 million/tael (sell), up VND1,600,000 and VND1,600,000 respectively compared to the previous session. This strong upward trend was also recorded in Ho Chi Minh City and Da Nang through the PNJ price list, with SJC gold reaching a similar level, showing that the heat of the market is spreading across all regions. DOJI Group also contributed to the excitement of the gold picture when AVPL/SJC prices in Hanoi, Ho Chi Minh City and Da Nang increased simultaneously, reaching VND102.2 - 105.2 million/tael (up VND1,600,000 - 1,600,000), affirming a sustainable upward trend nationwide.

Not only gold bars, jewelry gold and plain rings also joined the price increase fever. At PNJ, the price of 999.9 jewelry gold closed at 6:30 p.m. at VND100.8 million/tael (buy, up VND900,000) and VND103.3 million/tael (sell, up VND900,000). PNJ 999.9 plain rings increased by VND900,000 to VND100.8 million/tael, while SJC 99.99% gold rings at SJC edged up to VND101.3 - 104.4 million/tael (up VND1,300,000 - 1,600,000). In particular, 9999 raw gold at DOJI Hanoi impressed with an increase of 500,000 VND for buying (100.5 million VND/tael) and 1,100,000 VND for selling (103.4 million VND/tael), demonstrating the strong attraction of gold today.

Other brands are also not out of the price increase spiral. Mi Hong recorded a sharp increase in SJC gold price to 102.8 - 104.8 million VND/tael (an increase of 1,100,000 - 1,800,000 VND), while Phu Quy pushed the price up to 102.0 - 105.2 million VND/tael (an increase of 2,000,000 - 1,600,000 VND). Vietinbank Gold attracted attention with its selling price reaching 105.2 million VND/tael (an increase of 1,600,000 VND), while Bao Tin Minh Chau maintained its upward momentum at 102.2 - 105.2 million VND/tael (an increase of 1,600,000 - 1,600,000 VND). For PNJ jewelry gold, from 18K gold (increased by VND 680,000, VND 75.13 - 77.63 million/tael) to 14K gold (increased by VND 530,000, VND 58.08 - 60.58 million/tael), all reflect an unprecedentedly vibrant gold market.

With the gold price today, April 11, 2025, increasing sharply from several hundred thousand to 2 million VND/tael depending on the brand, the market is opening up great opportunities for those who want to take profits or invest long-term. However, this impressive increase also makes many people wonder whether the price will continue to climb or will adjust in the coming sessions. Investors need to closely monitor fluctuations so as not to miss the decisive moment, making the most of the opportunities that the gold price brings.

In general, at the close of the session at 6:30 p.m. on April 11, 2025, today's gold price showed a strong upward trend covering the entire market. SJC gold price in Hanoi and other areas jumped to 102.2 - 105.2 million VND/tael (up 1,600,000 - 1,600,000 VND), while 9999 raw gold at DOJI increased impressively to 100.5 - 103.4 million VND/tael (up 500,000 - 1,100,000 VND). This is a clear signal that the gold market is entering its peak, bringing great opportunities for astute investors. Today's gold price on April 11, 2025 is truly the center of attention in the context of dramatic growth!

As of 6:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.7 - 104.3 million VND/tael (buy - sell); Bao Tin Minh Chau listed the price of gold rings at 100.9 - 104.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 800,000 VND/tael for selling.

The latest gold price update table today, April 11, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 102.2 | ▲1600 | 105.2 | ▲1600 |

| DOJI Group | 102.2 | ▲1600 | 105.2 | ▲1600 |

| Red Eyelashes | 102.8 | ▲1100 | 104.8 | ▲1800 |

| PNJ | 100.8 | ▲900 | 104.3 | ▲1400 |

| Vietinbank Gold | 105.2 | ▲1600 | ||

| Bao Tin Minh Chau | 102.2 | ▲1600 | 105.2 | ▲1600 |

| Phu Quy | 102.0 | ▲2000 | 105.2 | ▲1600 |

| 1. DOJI - Updated: April 11, 2025 18:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 102,200 ▲1600 | 105,200 ▲1600 |

| AVPL/SJC HCM | 102,200 ▲1600 | 105,200 ▲1600 |

| AVPL/SJC DN | 102,200 ▲1600 | 102,200 ▲1600 |

| Raw material 9999 - HN | 100,500 ▲500 | 103,400 ▲1100 |

| Raw material 999 - HN | 100,400 ▲500 | 103,300 ▲1100 |

| 2. PNJ - Updated: April 11, 2025 18:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| HCMC - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Hanoi - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Hanoi - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Da Nang - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Da Nang - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Western Region - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Western Region - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - PNJ | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Southeast | PNJ | 100,800 ▲900K |

| Jewelry gold price - SJC | 102,200 ▲1600K | 105,200 ▲1600K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 100,800 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 100,800 ▲900K | 104,300 ▲1400K |

| Jewelry gold price - Jewelry gold 999.9 | 100,800 ▲900K | 103,300 ▲900K |

| Jewelry gold price - Jewelry gold 999 | 100,700 ▲900K | 103,200 ▲900K |

| Jewelry gold price - Jewelry gold 9920 | 100,070 ▲890K | 102,570 ▲890K |

| Jewelry gold price - Jewelry gold 99 | 99,870 ▲890K | 102,370 ▲890K |

| Jewelry gold price - 750 gold (18K) | 75,130 ▲680K | 77,630 ▲680K |

| Jewelry gold price - 585 gold (14K) | 58,080 ▲530K | 60,580 ▲530K |

| Jewelry gold price - 416 gold (10K) | 40,620 ▲370K | 43,120 ▲370K |

| Jewelry gold price - 916 gold (22K) | 92,220 ▲820K | 94,720 ▲820K |

| Jewelry gold price - 610 gold (14.6K) | 60,660 ▲550K | 63,160 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 64,800 ▲590K | 67,300 ▲590K |

| Jewelry gold price - 680 gold (16.3K) | 67,890 ▲610K | 70,390 ▲610K |

| Jewelry gold price - 375 gold (9K) | 36,390 ▲340K | 38,890 ▲340K |

| Jewelry gold price - 333 gold (8K) | 31,740 ▲300K | 34,240 ▲300K |

| 3. SJC - Updated: 11/04/2025 18:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 102,200 ▲1600 | 105,200 ▲1600 |

| SJC gold 5 chi | 102,200 ▲1600 | 105,220 ▲1600 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 102,200 ▲1600 | 105,230 ▲1600 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 101,300 ▲1300 | 104,400 ▲1600 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 101,300 ▲1300 | 104,500 ▲1600 |

| Jewelry 99.99% | 101,300 ▲1300 | 103,900 ▲1400 |

| Jewelry 99% | 99,071 ▲586 | 102,871 ▲1386 |

| Jewelry 68% | 67,009 ▲152 | 70,809 ▲952 |

| Jewelry 41.7% | 39,680 ▼216 | 43,480 ▲583 |

Update gold price today April 11, 2025 latest on the world market

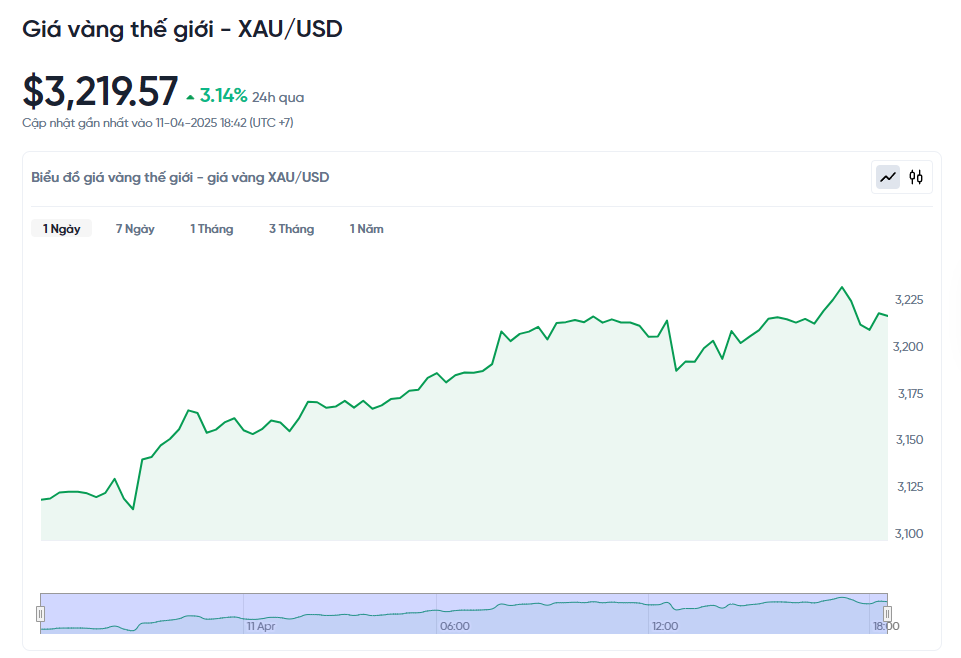

At the time of trading at 6:42 p.m. on April 11, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,219.57 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 101.86 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (102.2-105.2 million VND/tael), the SJC gold price is currently about 3.33 million VND/tael higher than the international gold price.

On April 11, 2025, the international gold price is climbing strongly, reaching a new record as many people seek gold to preserve their assets against economic uncertainties. The trade tension between the US and China is getting more intense as the two countries impose tariffs on each other, making investors worried about the future of the global economy. This has turned gold into a safe haven, attracting great attention in the market.

Currently, an ounce of international gold is trading at $3,216.05, up more than 22% since the beginning of 2025. This increase reflects the strong appeal of gold amid economic turmoil. Large investors, such as financial institutions, often trade gold through international banks. The price of gold is determined by supply and demand at the time of purchase, like a dynamic exchange where prices are constantly changing.

London plays a leading role in the global gold market, thanks to the London Bullion Market Association, which sets trading standards and facilitates easy connectivity between banks and businesses. In addition, regions such as China, India, the Middle East and the US are also bustling gold markets, contributing to shaping global prices.

In addition to buying gold directly, many people choose to participate in the gold market through futures contracts, where they commit to buying or selling gold at a fixed price at a future date. For example, you can order gold today but take delivery in a few months. The COMEX in New York is the world’s largest gold futures exchange, while China and Japan also have prominent exchanges such as the Shanghai Futures Exchange and the Tokyo Futures Exchange.

Another option is to invest in a gold exchange-traded fund (ETF), where you buy securities that represent gold without having to hold the physical gold. In 2025, gold ETFs attracted an additional $3.4 billion, showing the growing popularity of investing in gold without having to worry about storage.

For retail buyers, gold bars or coins are a popular approach, sold in stores or online. This is a simple, convenient way to own physical gold that anyone can participate in.

The reason why gold is getting hotter is because large investment funds are pouring capital into this market. Moreover, economic developments such as inflation or international conflicts make many people choose gold to reduce risks. Rapidly changing market sentiment, from optimism to anxiety, can push gold prices up or down unexpectedly.

Gold prices are also affected by the US dollar. When the dollar depreciates, gold becomes more attractive to users of other currencies, causing demand to surge. Conversely, a stronger dollar often causes gold prices to stagnate. Therefore, gold is an effective tool to protect assets when exchange rates fluctuate.

In the current context, gold is increasingly sought after as the world faces the threat of a trade war. The US, under President Trump, has raised import tariffs on Chinese goods to the equivalent of 145%. China responded by raising tariffs on US goods from 84% to 125%. These moves have shaken financial markets, raising fears of economic recession and inflation. In such circumstances, gold has emerged as a reliable haven, providing peace of mind for those who want to protect their assets.

Gold price forecast for tomorrow, April 12, 2025, domestic gold price continues its 3-day streak of breaking the peak

Tomorrow, the price of gold on April 12, 2025 is expected to continue to increase, bringing opportunities for those interested in buying gold. Today, at 5:00 p.m. on April 11, the world gold price reached a very high level, about 3,216 USD per ounce - that is, about 101.4 million VND per tael if calculated in Vietnamese currency. Compared to yesterday, the world gold price has increased by nearly 90 USD, a fairly large number, showing that gold is being sought after by many people.

The reason why gold prices are rising so much is because of the instability in the world. The US and China are in a trade war, which is making people nervous and looking for gold as a safe place to keep their money. In addition, a major institution in the US, called the Fed, is likely to cut interest rates – this weakens the US dollar, and when the dollar is weak, gold prices usually increase. Experts also say that many major banks around the world are buying gold for their reserves, which is also pushing gold prices higher.

Forecast for tomorrow, if the world situation remains unstable, the price of gold could rise to $3,600, or even $4,000 per ounce – that is, about VND113 to 126 million per tael. But if the US and China reach an agreement, or the dollar strengthens, the price of gold could drop a bit. In Vietnam, domestic gold prices often follow world prices, so SJC gold – the most popular type of gold – could increase tomorrow morning, April 12. This means that if you are thinking of buying gold, tomorrow could be a notable day, but you should also keep an eye out to see if the price drops.

In summary, the price of gold on April 12, 2025 is expected to increase, thanks to factors such as global instability and a weak dollar. This is an opportunity for those who want to buy gold to store, but you should be careful because the price may change if the world situation eases. Keep a close watch to make the right decision!

Source: https://baoquangnam.vn/tin-tuc-du-bao-gia-vang-ngay-mai-12-4-2025-gia-vang-trong-nuoc-tiep-tuc-chuoi-3-ngay-pha-dinh-3152566.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Podcast] - War Scars](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/18/9a131452559b41c9be4dc3798d0a4da0)

Comment (0)